Abstract

The conformity of products is usually assessed on the basis of Gaussian distributions of the test results. For wire screen products, as an example, this assumption is only valid if the apertures are quite close to the nominal value and if the dispersion of the apertures is small compared to the tolerance band. In cases where these provisions are not given beta distributions are better distribution approaches. The application of a modified beta distribution leads to significantly lower producer’s and consumer’s risks allowing to expand safeguard limits without changing the levels of confidence. A financial model enables the user to create scenarios for such different input data as the effort for testing, the number of products in line with the production target, the prices of products and scrap prices as well as quality classifications of products. The pivots chosen for the model are the producer’s and consumer’s risks. For reasons of comparison the risks were determined both on the basis of normal and modified beta distributions. Product-specific conformity assessment procedures may have apparent financial benefits if the parameters of the model can be well defined.

Similar content being viewed by others

Notes

The term conformity is used for final products, whereas conformance refers to internal criteria. The term ‘conformity assessment’ in this contribution is used with reference to ISO/IEC 17000 [1].

In contrast to measurement tests are often not traceable to SI units.

A Type II error is a false negative error. The test result is ‘no’ but due to the uncertainty of the test the product conforms with the requirement (=producer’s risk).

A negative profit: a profit that would not have been realized if loss preventive measures had not been implemented yet. So the profit would still contribute to the company’s overall profit.

References

ISO/IEC 17000:2004. Conformity assessment—Vocabulary and general principles

ISO 9044:1999. Industrial woven wire cloth—Technical requirements and testing

ISO 14315:1997. Industrial wire screens—Technical requirements and testing

ISO 3310-1:2000. Test sieves technical requirements and testing—part 1: test sieves of metal wire cloth

ASTM E11-09. Woven wire test sieve cloth and test sieves

Hinrichs WH (2006) Linking conformity assessment and measurement uncertainty—an example. tm Technisches Messen 73(10):571–577

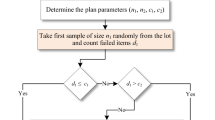

ISO 2859 series. Sampling procedures for inspection by attributes

ISO 3951 series. Sampling procedures for inspection by variables

Williams RH, Hawkins CF (1993) The economics of guardband placement. In: Proceedings of the 24th IEEE international test conference, Baltimore

Rossi GB, Crenna F (2006) A probabilistic approach to measurement-based decisions. Measurement 39:101–119

Pendrill LR (2008) Operating ‘cost’ characteristics in sampling by variable and attribute. Accredit Qual Assur 13:619–631

Rimpau C, Reinhart G (2010) Knowledge-based risk evaluation during the offer calculation of customised products. Prod Eng Res Develop 4:515–524

ASME B89.7.4.1-2005; Measurement uncertainty and conformance testing: risk analysis (Technical Report)

Joint Committee for Guides in Metrology 106, May 2009 Evaluation of measurement data—The role of measurement uncertainty in conformity assessment

Hinrichs WH (2010) The impact of measurement uncertainty on the producer’s and user’s risks, on classification and conformity assessment: an example based on tests on some construction products. Accredit Qual Assur 15:289–296

Acknowledgments

This project (15464/N) was sponsored by the German Federal Ministry of Economics and Technology (BMWi), managed by the German Federation of Industrial Research Associations (AiF) and supported by the German Wire Weavers Association (VDD), Düsseldorf.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hinrichs, W. Product-specific adaption of conformity assessment criteria and their financial consequences. Prod. Eng. Res. Devel. 5, 549–556 (2011). https://doi.org/10.1007/s11740-011-0329-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11740-011-0329-7