Abstract

In order to reveal intrinsic fluctuation rules hidden in a stock market time series dataset with noise, a novel forecasting model combining Markov chain theory with fuzzy set theory is proposed in this study. A fuzzified one-step transition matrix of Markov Chain in the paper represents inherent rules of historical fluctuation. Comparing with existing models, the advantage of the proposed model is that transition matrix can express the relationship between history and current flexibly while the introduction of fuzzy theory can help to alleviate noises. Therefore, the proposed model could handle complex patterns during state transitions and the relatively simple forecasting algorithm could reduce the calculation cost. We apply the proposed method to forecast well-known stock indexes such as (Taiwan Stock Exchange Capitalization Weighted Stock Index) TAIEX, (Shanghai Stock Exchange Composite Index) SHSECI and so on. Experimental results demonstrate that our proposed method outperforms other traditional models.

Similar content being viewed by others

References

Kuo RJ, Lee LC, Lee CF (1996) Integration of artificial neural networks and fuzzy Delphi for stock market forecasting. In: IEEE international conference on system, man, and cybernetics, Beijing, China, vol 2, pp 1073–1078

Chen S-M (2002) Forecasting enrollments based on high-order fuzzy time series. J Cybern 33(1):1–16

Sharma N, Sharma P, Irwin D, Shenoy P (2012) Predicting solar generation from weather forecasts using machine learning. In: IEEE international conference on smart grid communications, Brussels, Belgium, pp 528–533

Cheng SH, Chen SM, Jian WS (2016) Fuzzy time series forecasting based on fuzzy logical relationships and similarity measures. Inf Sci 327:272–287

Brown RG (1964) Forecasting and prediction of discrete time series. J R Stat Soc Ser A (Gen) 127(2):292–293

Box GEP, Jenkins GM, Reinsel GC (1994) Time series analysis: forecasting and control (revised edition). J Mark Res 14(2):199–201

Tambi MK (2005) Forecasting exchange rate: a univariate out-of-sample approach (Box–Jenkins methodology). IUP J Bank Manag 1(6):60–74

Zadeh LA (1965) Fuzzy sets. Inf Control 8(3):338–353

Turksen IB (1986) Interval valued fuzzy sets based on normal forms. Fuzzy Sets Syst 20(2):191–210

Atanassov KT (1986) Intuitionistic fuzzy sets. Fuzzy Sets Syst 20(1):87–96

Torra V (2010) Hesitant fuzzy sets. Int J Intell Syst 25(6):529–539

Feng F, Pedrycz W (2015) On scalar products and decomposition theorems of fuzzy soft sets. J Multi-valued Log Soft Comput 25(1):45–80

Song Q, Chissom BS (1993) Fuzzy time series and its models. Fuzzy Sets Syst 54:269–277

Song Q, Chissom BS (1994) Forecasting enrollments with fuzzy time series: part II. Fuzzy Sets Syst 62(1):1–8

Chen BS, Peng SC, Wang KC (2000) Traffic modeling, prediction, and congestion control for high-speed networks: a fuzzy AR approach. IEEE Trans Fuzzy Syst 8(5):491–508

Khashei M, Bijari M, Ardali GAR (2009) Improvement of auto-regressive integrated moving average models using fuzzy logic and artificial neural networks (ANNs). Neurocomputing 72(4):956–967

Aladag CH, Yolcu U, Egrioglu E, Bas E (2014) Fuzzy lagged variable selection in fuzzy time series with genetic algorithms. Appl Soft Comput 22:465–473

Chen SM, Jian WS (2016) Fuzzy forecasting based on two-factors second-order fuzzy-trend logical relationship groups, similarity measures and PSO techniques. Inf Sci 391–392:65–79

Rubio A, Bermúdez José D, Vercher E (2017) Improving stock index forecasts by using a new weighted fuzzy-trend time series method. Expert Syst Appl 76:12–20

Mirzaei Talarposhti F, Javedani Sadaei H, Enayatifar R et al (2015) Stock market forecasting by using a hybrid model of exponential fuzzy time series. Int J Approx Reason 70:79–98

Mahmood T, Mujtaba G (2014) Venturini: a dynamic personalization in conversational recommender systems. Inf Syst E-Bus Manag 12(2):213–238

Gaeta M, Orciuoli F, Rarità Luigi et al (2017) Fitted Q-iteration and functional networks for ubiquitous recommender systems. Soft Comput 21(23):7067–7075

Silva EGDSE, Legey LFL, Silva EADSE (2010) Forecasting oil price trends using wavelets and hidden Markov models. Energy Econ 32(6):1507–1519

Carpinone A, Giorgio M, Langella R et al (2015) Markov chain modeling for very-short-term wind power forecasting. Electr Power Syst Res 122:152–158

Rahmat SN, Jayasuriya N, Bhuiyan MA (2017) Short-term droughts forecast using Markov chain model in Victoria, Australia. Theor Appl Climatol 129:1–13

Hassan MR (2009) A combination of hidden Markov model and fuzzy model for stock market forecasting. Neurocomputing 72(16–18):3439–3446

Sullivan J, Woodall WH (1994) A comparison of fuzzy forecasting and Markov modeling. Elsevier North-Holland Inc, New York

Yu HK (2005) Weighted fuzzy time series models for TAIEX forecasting. Physica A 349(3):609–624

Hsieh TJ, Hsiao HF, Yeh WC (2011) Forecasting stock markets using wavelet transforms and recurrent neural networks: an integrated system based on artificial bee colony algorithm. Appl Soft Comput J 11(2):2510–2525

Chang JR, Wei LY, Cheng CH (2011) A hybrid ANFIS model based on AR and volatility for TAIEX forecasting. Appl Soft Comput J 11(1):1388–1395

Cheng CH, Wei LY, Liu JW et al (2013) OWA-based ANFIS model for TAIEX forecasting. Econ Model 30(1):442–448

Chen SM, Manalu GM, Pan JS et al (2013) Fuzzy forecasting based on two-factors second-order fuzzy-trend logical relationship groups and particle swarm optimization techniques. IEEE Trans Cybern 43(3):1102–1117

Jia J, Zhao A, Guan S (2017) Forecasting based on high-order fuzzy-fluctuation trends and particle swarm optimization machine learning. Symmetry 9(7):124

Guan H, Guan S, Zhao A (2017) Forecasting model based on neutrosophic logical relationship and Jaccard similarity. Symmetry 9(9):191

Acknowledgements

The authors are indebted to anonymous reviewers for their very insightful comments and constructive suggestions, which help ameliorate the quality of this paper. This work was supported by major projects of the National Social Science Foundation of China under Grants with No. 19VHQ011.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

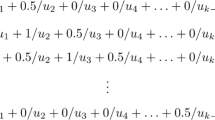

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Guan, H., Jie, H., Guan, S. et al. A novel fuzzy-Markov forecasting model for stock fluctuation time series. Evol. Intel. 13, 133–145 (2020). https://doi.org/10.1007/s12065-019-00328-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12065-019-00328-0