Abstract

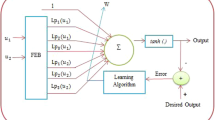

Deriving relevant features from historic financial data and forecasting it accurately and impartially is an emerging and predominant field of research in the vast domain of finance. Mutual fund is a structured investment instrument in economic market and the measuring instrument required to price it is called as Net Asset Value (NAV). For NAV prediction, Artificial Neural Network has been immensely utilized in the past due to its adaptive learning, robustness and great ability to identify and handle hidden nonlinear patterns. In this study, a Chebyshev Polynomial Neural Network (CPNN) has been proposed for one day ahead prediction of three different NAV data set belonging to three leading Indian financial houses. The controlling parameters of the network are estimated by a computationally intelligent meta-heuristic algorithm known as Flower Pollination Algorithm (FPA). It is a nature inspired algorithm, motivated by the pollination process of flowering plants with very few control parameters and rapid convergence rate. The efficacy of the proposed forecasting model is also examined by a comparative analysis of training of CPNN with other optimizing algorithms like Differential Evolution and Particle Swarm Optimization (PSO) on the same set of data collected over the same period of time. The convergence plots obtained during the training of the models and the different error metrics values calculated during their testing phase of the study showcase that the proposed CPNN-FPA model clearly outperforms the other two experimented predictive models.

Similar content being viewed by others

References

Majhi R, Panda G, Sahoo G (2009) Development and performance evaluation of FLANN based model for forecasting of stock markets. Expert Syst Appl 36(3):6800–6808

Hann TH, Steurer E (1996) Much ado about nothing? Exchange rate forecasting: neural networks vs. linear models using monthly and weekly data. Neurocomputing 10(4):323–339

De Oliveira JF, Ludermir TB (2016) A hybrid evolutionary decomposition system for time series forecasting. Neurocomputing 180:27–34

Babu CN, Reddy BE (2014) A moving-average filter based hybrid ARIMA–ANN model for forecasting time series data. Appl Soft Comput 23:27–38

Kaita T, Tomita S, Yamanaka J (2002) On a higher-order neural network for distortion invariant pattern recognition. Pattern Recogn Lett 23(8):977–984

Ghosh J, Shin Y (1992) Efficient higher-order neural networks for classification and function approximation. Int J Neural Syst 3(04):323–350

Giles CL, Maxwell T (1987) Learning, invariance, and generalization in high-order neural networks. Appl Opt 26(23):4972–4978

Nocedal J, Wright S (2006) Numerical optimization. Springer Science & Business Media

Lee TT, Jeng JT (1998) The Chebyshev-polynomials-based unified model neural networks for function approximation. IEEE Trans Syst Man Cybern Part B (Cybernetics) 28(6):925–935

Yang XS (2012) Flower pollination algorithm for global optimization. In: International conference on unconventional computing and natural computation. Springer: Berlin, Heidelberg, pp. 240–249

Chen H, Xiao K, Sun J, Wu S (2017) A double-layer neural network framework for high-frequency forecasting. ACM Trans Manag Inform Syst (TMIS) 7(4):1–17

Zhong X, Enke D (2017) Forecasting daily stock market return using dimensionality reduction. Exp Syst Appl 67:126–139

Mohanty S, Dash R (2021) Application of computational intelligence techniques in the domain of net asset value prediction: a survey. In: Intelligent and cloud computing (pp. 573-580). Springer, Singapore

Chiang WC, Urban TL, Baldridge GW (1996) A neural network approach to mutual fund net asset value forecasting. Omega 24(2):205–215

Indro DC, Jiang CX, Patuwo BE, Zhang GP (1999) Predicting mutual fund performance using artificial neural networks. Omega 27(3):373–380

Priyadarshini E, Babu AC (2012) A comparative analysis for forecasting the NAV’s of Indian mutual fund using multiple regression analysis and artificial neural networks. Int J Trade Econ Financ 3(5):347–350

Ray P, Vina V (2004) Neural network models for forecasting mutual fund net asset value. In: 8th capital markets conference, Indian Institute of Capital Markets Paper. https://dx.doi.org/https://doi.org/10.2139/ssrn.872269

Anish CM, Majhi B (2015) Net asset value prediction using FLANN model. Int J Sci Res 4(2):2222–2227

Anish CM, Majhi B (2015) An ensemble model for net asset value prediction. In: 2015 IEEE power, communication and information technology conference (PCITC) 392–396

Narula A, Jha CB, Panda G (2015) Development and performance evaluation of three novel prediction models for mutual fund NAV prediction. Ann Res J Symb Centre Manag Stud Pune 3:227–238

Anish CM, Majhi B (2016) Prediction of mutual fund net asset value using low complexity feedback neural network. In: 2016 IEEE international conference on current trends in advanced computing (ICCTAC) 1–5

Siddiqui MU, Abbas A, AbdurRehman SM, Jawed A, Rafi M (2018) Comparison of garch model and artificial neural network for mutual fund's growth prediction. In: 2018 international conference on computing, mathematics and engineering technologies (iCoMET), 1–7

Hota S, Satapathy P, Pati SP, Mishra D (2018) Net asset value prediction using extreme learning machine with dolphin swarm algorithm. In: 2018 2nd international conference on data science and business analytics (ICDSBA) 13–18

Anish CM, Majhi B, Majhi R (2016) Development and evaluation of novel forecasting adaptive ensemble model. The J Fin Data Sci 2(3):188–201

Majhi B, Anish CM, Majhi R (2018) On development of novel hybrid and robust adaptive models for net asset value prediction. J King Saud Univ Comput Inform Sci. https://doi.org/10.1016/j.jksuci.2018.04.011

Rout M, Koudjonou KM, Satapathy SC (2021) Analysis of net asset value prediction using low complexity neural network with various expansion techniques. Evol Intell 14:643–655

Koudjonou KM, Rout M (2019) A stateless deep learning framework to predict net asset value. Neural Comput Appl 32:1–19

Pao Y (1989) Adaptive pattern recognition and neural networks

Dehuri S, Cho SB (2010) A comprehensive survey on functional link neural networks and an adaptive PSO–BP learning for CFLNN. Neural Comput Appl 19(2):187–205

Patra JC, Lim W, Meher PK, Ang EL (2006) Financial prediction of major indices using computational efficient artificial neural networks. In: The 2006 IEEE international joint conference on neural network proceedings, 2114–2120

Patra JC, Poh WB, Chaudhari NS, Das A (2005) Nonlinear channel equalization with QAM signal using Chebyshev artificial neural network. In: Proceedings. 2005 IEEE international joint conference on neural networks, 5:3214–3219

Patra JC, Kot AC (2002) Nonlinear dynamic system identification using Chebyshev functional link artificial neural networks. IEEE Trans Syst Man Cybern Part B (Cybernetics) 32(4):505–511

Yang XS (2010) Nature-inspired metaheuristic algorithms. Luniver press

Črepinšek M, Liu SH, Mernik M (2013) Exploration and exploitation in evolutionary algorithms: a survey. ACM Comput Surv (CSUR) 45(3):1–33

Yang XS (2020) Nature-inspired optimization algorithms: challenges and open problems. J Comput Sci 46:101–104

Sampson JR (1976) Adaptation in natural and artificial systems (John H. Holland)

Eberhart R, Kennedy J (1995) A new optimizer using particle swarm theory. In: MHS'95. Proceedings of the sixth international symposium on micro machine and human science, 39–43

Neshat M, Sepidnam G, Sargolzaei M, Toosi A (2012) Artificial fish swarm algorithm: a survey of the state-of-the-art, hybridization, combinatorial and indicative applications. Artif Intell Rev 42:965–997

Xing B, Gao WJ (2014) Innovative computational intelligence: a rough guide to 134 clever algorithms. Springer, New York, pp 22–28

Reddy PDP, Reddy VV, Manohar TG (2016) Application of flower pollination algorithm for optimal placement and sizing of distributed generation in distribution systems. J Electr Syst Inform Technol 3(1):14–22

Emary E, Zawbaa HM, Hassanien AE, Parv B (2017) Multi-objective retinal vessel localization using flower pollination search algorithm with pattern search. Adv Data Anal Classif 11(3):611–627

Binh HTT, Hanh NT, Dey N (2018) Improved cuckoo search and chaotic flower pollination optimization algorithm for maximizing area coverage in wireless sensor networks. Neural Comput Appl 30(7):2305–2317

Dubey HM, Pandit M, Panigrahi BK (2015) A biologically inspired modified flower pollination algorithm for solving economic dispatch problems in modern power systems. Cogn Comput 7(5):594–608

Metwalli M, Hezam I (2015) A modified flower pollination algorithm for fractional programming problems. Int J Intell Syst Appl Eng 3(3):116–123

Wang R, Zhou Y (2014) Flower pollination algorithm with dimension by dimension improvement. Math Probl Eng. https://doi.org/10.1155/2014/481791

Zhao C, Zhou Y (2016) A complex encoding flower pollination algorithm for global numerical optimization. In: international conference on intelligent computing, 667–678

Zhou Y, Zhang S, Luo Q, Wen C (2018) Using flower pollination algorithm and atomic potential function for shape matching. Neural Comput Appl 29(6):21–40

Rodrigues D, Yang XS, De Souza AN, Papa JP (2015) Binary flower pollination algorithm and its application to feature selection. In: Recent advances in swarm intelligence and evolutionary computation, 85–100.

Yang XS, Karamanoglu M, He X (2013) Multi-objective flower algorithm for optimization. Procedia Comput. Sci. 18:861–868

Chakraborty D, Saha S, Dutta O (2014). DE-FPA: a hybrid differential evolution-flower pollination algorithm for function minimization. In: 2014 international conference on high performance computing and applications (ICHPCA) 1–6

Abdelraouf O, Abdel-Baset M, Elhenawy I (2014) A new hybrid flower pollination algorithm for solving constrained global optimization problems. Int J Appl Op Res An Open Access J 4:1–13

Pavlyukevich I (2007) Lévy flights, non-local search and simulated annealing. J Comput Phys 226(2):1830–1844

Mantegna RN (1994) Fast, accurate algorithm for numerical simulation of Levy stable stochastic processes. Phys Rev E 49(5):4677–4683

Hota S, Pati SP, Satapathy P (2021) Forecasting of net asset value of indian mutual funds using firefly algorithm-based neural network model. Lecture Notes Netw Syst 151:217–224

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mohanty, S., Dash, R. A flower pollination algorithm based Chebyshev polynomial neural network for net asset value prediction. Evol. Intel. 16, 115–131 (2023). https://doi.org/10.1007/s12065-021-00645-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12065-021-00645-3