Abstract

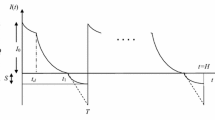

We develop an economic order quantity model for non-instantaneous deteriorating items with price dependent demand and trade credit. Our objective is to determine the optimal two-tiered pricing and ordering policies, where the two-tiered pricing means that the prices for the non-deteriorating period and the deteriorating period are different. We derive the expressions of the total profit under different situations and propose an algorithm to derive the optimal solutions. Through numerical analysis, we illustrate that the two-tiered pricing is better than one-tiered pricing. Some other managerial insights are also derived by the numerical examples.

Similar content being viewed by others

References

Abad PL, Jaggi CK (2003) A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83:115–122

Chang C-T, Teng J-T, Goyal SK (2010) Optimal replenishment policies for non-instantaneous deteriorating items with stock-dependent demand. Int J Prod Econ 123:62–68

Chang C-T, Cheng M-C, Ouyang L-Y (2015) Optimal pricing and ordering policies for non-instantaneously deteriorating items under order-size-dependent delay in payments. Appl Math Model 39:747–763

Chen LH, Kang FS (2010) Integrated inventory models considering the two-level trade credit policy and a price-negotiation scheme. Eur J Oper Res 205:47–58

Chung K-J (1998) A theorem on the determination of economic order quantity under conditions of permissible delay in payments. Comput Oper Res 25:49–52

Fitzpatrick A, Lien B (2013) The use of trade credit by businesses. Bulletin 9:39–46

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36:335–338

Hsieh T-P, Dye C-Y (2010) Optimal replenishment policy for perishable items with stock-dependent selling rate and capacity constraint. Comput Ind Eng 59:251–258

Liao JJ, Huang KN, Chung KJ (2012) Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. Int J Prod Econ 137:102–115

Maihami R, Kamalabadi IN (2012) Joint pricing and inventory control for non-instantaneous deteriorating items with partial backlogging and time and price dependent demand. Int J Prod Econ 136:116–122

Maihami R, Karimi B (2014) Optimizing the pricing and replenishment policy for non-instantaneous deteriorating items with stochastic demand and promotional efforts. Comput Oper Res 51:302–312

Ouyang L-Y, Wu K-S, Yang C-T (2006) A study on an inventory model for non-instantaneous deteriorating items with permissible delay in payments. Comput Ind Eng 51:637–651

Peterson MA, Rajan RG (1997) Trade credit: theories and evidence. Rev Financ Study 10:661–691

Seifert D, Seifert RW, Protopappa-Sieke M (2013) A review of trade credit literature: opportunities for research in operations. Eur J Oper Res 231:245–256

Sheen GJ, Tsao YC (2007) Channel coordination, trade credit and quantity discounts for freight cost. Transp Res Part E Logist Transp Rev 43(2):112–128

Teng J-T (2002) On the economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 53:915–918

Tirole J (2006) The theory of corporate finance. Princeton University Press, Princeton

Tsao Y-C (2010) Two-phase pricing and inventory management for deteriorating and fashion goods under trade credit. Math Meth Oper Res 72:107–127

Tsao YC (2013) Distribution center network design under trade credit. Appl Math Comput 222(1):356–364

Tsao YC (2015) A piecewise nonlinear optimization for a production-inventory model under maintenance, variable setup costs, and trade credits. Ann Oper Res 233(1):465–481

Tsao YC, Linh VT (2015) Supply chain networks design for deteriorating items under advance payment and backordering. Int J Inf Manage Sci 26(3):201–217

Tsao YC, Sheen GJ (2008) Dynamic pricing, promotion and replenishment policies for a deteriorating item under permissible delay in payments. Comput Oper Res 35:3562–3580

Wang WC, Teng JT, Lou KR (2014) Selle’s optimal credit period and cycle time in a supply chain for deteriorating items with maximum lifetime. Eur J Oper Res 232:315–321

Wang Y, Zhang J, Tang W (2015) Dynamic pricing for non-instantaneous deteriorating items. J Intell Manuf 26:629–640

Wu KS, Ouyang LY, Yang CT (2006) An optimal replenishment policy for non-instantaneous deteriorating items with stock dependent demand and partial backlogging. Int J Prod Econ 101:369–384

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tsao, YC., Zhang, Q., Fang, HP. et al. Two-tiered pricing and ordering for non-instantaneous deteriorating items under trade credit. Oper Res Int J 19, 833–852 (2019). https://doi.org/10.1007/s12351-017-0306-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-017-0306-9