Abstract

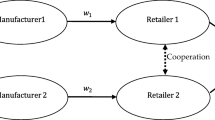

This study explores two competing manufacturers’ green investment decisions with different market sizes in selling price- and green-level-differentiated substitutable green products through a retailer. Five game structures are considered in examining the impacts of power structures on the optimal price and green level decisions and the corresponding equilibrium decisions. A two-way revenue-sharing contract is proposed from the perspective of improving the performance of each member. Numerical experiments are conducted to illustrate the results and gain managerial insights for green product manufacturing and selling in a competitive market. The results demonstrate that the two competing manufacturers need to cooperate rather than compete if cross-price elasticity or the difference between market potentials is too high. In this scenario, the equilibrium outcome can outperform the overall green supply chain’s performance compared to those achieved under the Bertrand or Nash game. The retailer also receives benefits. Due to a higher variation in market size and price sensitivity, the retailer may receive higher profits under the manufacturer’s leadership and vice versa. Therefore, the results contradict the common consensus. Although greening levels remain higher if the retailer dominates or the members have equal power, every member can receive suboptimal profits in these scenarios. It is found that a two-way revenue-sharing contract mechanism based on product market sizes can improve the overall green supply chain’s performance and allocate profit surplus arbitrarily.

Similar content being viewed by others

References

Agi MA, Yan X (2019) Greening products in a supply chain under market segmentation and different channel power structures. Int J Prod Econ 223:107523

Aslani A, Heydari J (2019) Transshipment contract for coordination of a green dual-channel supply chain under channel disruption. J Clean Prod 223:596–609

Bian J, Zhao X, Liu Y (2020) Single vs. cross distribution channels with manufacturers’ dynamic tacit collusion. Int J Prod Econ 220:107456

Cachon GP, Kök AG (2010) Competing manufacturers in a retail supply chain: on contractual form and coordination. Manag Sci 56(3):571–589

Cachon GP, Lariviere MA (2005) Supply chain coordination with revenue-sharing contracts: strengths and limitations. Manag Sci 51(1):30–44

Cai G, Dai Y, Zhou SX (2012) Exclusive channels and revenue sharing in a complementary goods market. Mark Sci 31(1):172–187

Chaabane A, Ramudhin A, Paquet M (2011) Designing supply chains with sustainability considerations. Prod Plan Control 22(8):727–741

Chakraborty T, Chauhan SS, Vidyarthi N (2015) Coordination and competition in a common retailer channel: wholesale price versus revenue-sharing mechanisms. Int J Prod Econ 166:103–118

Chakraborty T, Chauhan SS, Ouhimmou M (2019) Cost-sharing mechanism for product quality improvement in a supply chain under competition. Int J Prod Econ 208:566–587

Chen X, Wang X, Zhou M (2019) Firms’ green R&D cooperation behaviour in a supply chain: technological spillover, power and coordination. Int J Prod Econ 218:118–134

Chen X, Luo Z, Wang X (2019a) Compete or cooperate: intensity, dynamics, and optimal strategies. Omega 86:76–86

Cho SH (2014) Horizontal mergers in multitier decentralized supply chains. Manag Sci 60(2):356–379

Choi SC (1991) Price competition in a channel structure with a common retailer. Mark Sci 10(4):271–296

Choi SC (1996) Price competition in a duopoly common retailer channel. J Retail 72(2):117–134

De Giovanni P (2014) Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Ann Oper Res 220(1):135–157

Descrier (2019) Samsung vs Apple: Competition or collaboration? https://descrier.co.uk/business/samsung-vs-apple-competition-or-collaboration/)

Dey K, Saha S (2018) Influence of procurement decisions in two-period green supply chain. J Clean Prod 190:388–402

Dey K, Roy S, Saha S (2019) The impact of strategic inventory and procurement strategies on green product design in a two-period supply chain. Int J Prod Res 57(7):1915–1948

Du P, Yang X, Xu L, Tan Y, Li H (2020) Green design strategies of competing manufacturers in a sustainable supply chain. J Clean Prod 265:121853

El-Ansary Adel I, Stern Louis W (1972) Power measurement in the distribution channel. J Mark Res 9(1):47–52

Fatehi S, Wagner MR (2019) Crowdfunding via revenue-sharing contracts. Manuf Serv Oper Manag 21(4):875–893

Ferrell W, Ellis K, Kaminsky P, Rainwater C (2020) Horizontal collaboration: opportunities for improved logistics planning. Int J Prod Res 58(14):4267–4284

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135(2):568–583

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Giri RN, Mondal SK, Maiti M (2019) Government intervention on a competing supply chain with two green manufacturers and a retailer. Comput Ind Eng 128:104–121

Gu D, Yao Z, Zhou W, Bai R (2019) When is upstream collusion profitable? RAND J Econ 50(2):326–341

Ha AY, Shang W, Wang Y (2017) Manufacturer rebate competition in a supply chain with a common retailer. Prod Oper Manag 26(11):2122–2136

Hong Z, Guo X (2019) Green product supply chain contracts considering environmental responsibilities. Omega 83:155–166

Hong Z, Wang H, Yu Y (2018) Green product pricing with non-green product reference. Transp Res Part E: Logist Transp Rev 115:1–15

Hou Y, Wei F, Li SX, Huang Z, Ashley A (2017) Coordination and performance analysis for a three-echelon supply chain with a revenue sharing contract. Int J Prod Res 55(1):202–227

Independent (2019) Apple and Sumsung team up to let iPhone talk to smart TVs. https://www.independent.co.uk/life-style/gadgets-and-tech/news/apple-iphone-samsung-smart-tv-phone-watch-airplay-2-latest-feature-update-a8715741.html

Jamali MB, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043

Lee E, Staelin R (1997) Vertical strategic interaction: implications for channel pricing strategy. Mark Sci 16(3):185–207

Li W, Chen J (2018) Pricing and quality competition in a brand-differentiated supply chain. Int J Prod Econ 202:97–108

Liu J, Ke H, Tian G (2020) Impact of emission reduction investments on decisions and profits in a supply chain with two competitive manufacturers. Comput Ind Eng 149:106784

Luo Z, Chen X, Chen J, Wang X (2017) Optimal pricing policies for differentiated brands under different supply chain power structures. Eur J Oper Res 259(2):437–451

Madani SR, Rasti-Barzoki M (2017) Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: a game-theoretic approach. Comput Ind Eng 105:287–298

Mondal C, Giri BC (2020) Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper Res Int J 1–36. https://doi.org/10.1007/s12351-020-00596-0

Moon I, Jeong YJ, Saha S (2020) Investment and coordination decisions in a supply chain of fresh. Oper Res Int J 20:2307–2331

Nielsen IE, Majumder S, Saha S (2019) Exploring the intervention of intermediary in a green supply chain. J Clean Prod 233:1525–1544

Nielsen IE, Majumder S, Sana SS, Saha S (2019) Comparative analysis of government incentives and game structures on single and two-period green supply chain. J Clean Prod 235:1371–1398

Pan K, Lai KK, Leung SC, Xiao D (2010) Revenue-sharing versus wholesale price mechanisms under different channel power structures. Eur J Oper Res 203(2):532–538

Piccolo S, Reisinger M (2011) Exclusive territories and manufacturers’ collusion. Manag Sci 57(7):1250–1266

Reisinger M, Thomes TP (2017) Manufacturer collusion: strategic implications of the channel structure. J Econ Manag Strategy 26(4):923–954

Rounti IS, Mavridoglou G, Kyriazopoulos P (2005) The impact of strategic alliances to resolve problems arising from globalization: the case of medium sized firms in Greece. Oper Res 5(2):327–348

Safarzadeh S, Rasti-Barzoki M (2019) A game theoretic approach for assessing residential energy-efficiency program considering rebound, consumer behavior, and government policies. Appl Energy 233–234:44–61

Saha S, Sarmah SP (2015) Supply chain coordination under ramp-type price and effort induced demand considering revenue sharing contract. Asia-Pacific J Oper Res 32(02):1550004

Saha S, Majumder S, Nielsen IE (2019) Is it a strategic move to subsidized consumers instead of the manufacturer? IEEE Access 7:169807–169824

Shang W, Ha AY, Tong S (2015) Information sharing in a supply chain with a common retailer. Manag Sci 62(1):245–263

Shen B, Cao Y, Xu X (2020) Product line design and quality differentiation for green and non-green products in a supply chain. Int J Prod Res 58(1):148–164

Sinayi M, Rasti-Barzoki M (2018) A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J Clean Prod 196:1443–1458

Sudhir K (2001) Competitive pricing behavior in the auto market: a structural analysis. Mark Sci 20(1):42–60

Taleizadeh AA, Babaei MS, Niaki STA, Noori-daryan M (2020) Bundle pricing and inventory decisions on complementary products. Oper Res 20(2):517–541

The Nielsen Company (2015) The sustainability imperative. New insights on consumer expectations. www.nielsen.com/eu/en/insights/reports/

Thorstenson A, Ramani V (2020) Coordination in a supply chain with two manufacturers, two substitute products, and one retailer. Int J Syst Sci: Oper Logist 7(2):105–120

Tseng ML, Wang R, Chiu AS, Geng Y, Lin YH (2013) Improving performance of green innovation practices under uncertainty. J Clean Prod 40:71–82

Wei J, Zhao J, Li Y (2013) Pricing decisions for complementary products with firms’ different market powers. Eur J Oper Res 224(3):507–519

Xia L, He L (2014) Game theoretic analysis of carbon emission reduction and sales promotion in dyadic supply chain in presence of consumers’ low-carbon awareness. Discrete Dyn Nat Soc 2014:13

Yang D, Xiao T (2017) Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J Clean Prod 149:1174–1187

Ye F, Lin Q, Li Y (2020) Coordination for contract farming supply chain with stochastic yield and demand under CVaR criterion. Oper Res 20(1):369–397

Yuan M, Ma SH, Guan X, Chen YJ (2020) Channel configuration in a complementary market under different power structures. Nav Res Logist. https://doi.org/10.1002/nav.21939

Zhang X, Yousaf HAU (2020) Green supply chain coordination considering government intervention, green investment, and customer green preferences in the petroleum industry. J Clean Prod 246:118984

Zhao J, Tang W, Zhao R, Wei J (2012) Pricing decisions for substitutable products with a common retailer in fuzzy environments. Eur J Oper Res 216(2):409–419

Zhao J, Wei J, Li Y (2014) Pricing decisions for substitutable products in a two-echelon supply chain with firms’ different channel powers. Int J Prod Econ 153:243–252

Zhao J, Wei J, Li Y (2018) Pricing decisions of complementary products in a two-level fuzzy supply chain. Int J Prod Res 56(5):1882–1903

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

A Optimal decision in scenario MB

The optimal solution for the retailer’s optimization problem defined in Eq. (1) is obtained by solving \(\frac{\partial \varPi _{r}^{MB}}{\partial p_1^{MB}}=0\) and \(\frac{\partial \varPi _{r}^{MB}}{\partial p_2^{MB}}=0 \), simultaneously. After simplification, market prices are obtained as

-

\(p_1^{MB}=\frac{a+w_1^{MB}(1- \beta ^2)+a k \beta +\gamma \theta _1^{MB}-\beta \delta \theta _1^{MB}+\beta \gamma \theta _2^{MB}-\delta \theta _2^{MB}}{2(1- \beta ^2)}\)

-

\(p_2^{MB}=\frac{w_2^{MB}(1- \beta ^2)+a (k+\beta )+\beta \gamma \theta _1^{MB}-\delta \theta _1^{MB}+\gamma \theta _2^{MB}-\beta \delta \theta _2^{MB}}{2(1- \beta ^2)}\)

From the above expressions, one can find that wholesale prices do not directly affect the other products’ market prices, but the GLs make. To verify concavity, we computed the Hessian matrix for the retailer’s profit(\(H_r^{MB}\)) as follows:

Therefore, the profit function for the retailer is concave. By substituting optimal responses in Eqs. (2) and (3), profit functions for manufacturers are obtained as follows:

-

\(\varPi _{m1}^{MB}=\frac{a w_1^{MB}-{w_1^{MB}}^2-2 \eta {\theta _1^{MB}}^2+w_1^{MB} (w_2^{MB} \beta +\gamma \theta _1^{MB}-\delta \theta _2^{MB}))}{2}\)

-

\(\varPi _{m2}^{MB}=\frac{(a k+\gamma {\theta _2^{MB}}) w_2^{MB}-w_2^{MB} (w_2^{MB}-w_1^{MB} \beta +\delta \theta _1^{MB}) -2 \eta {\theta _2^{MB}}^2}{2}\)

Therefore, optimal wholesale prices and GLs for the two manufacturers can be obtained by solving \(\frac{\partial \varPi _{m1}^{MB}}{\partial w_1^{MB}} = 0\); \(\frac{\partial \varPi _{m1}^{MB}}{\partial \theta _1^{MB}} = 0\); \(\frac{\partial \varPi _{m2}^{MB}}{\partial w_2^{MB}} = 0\);\(\frac{\partial \varPi _{m2}^{MB}}{\partial \theta _2^{MB}} = 0\), simultaneously. The simplified values of the solution are presented in Table 3.

Profit function for each manufacturer are also concave because the value of the determinant of the Hessian matrix(\(H_{mi}^{MB}\)) is obtained as follows:

Therefore, profit functions for each manufacturer are also concave if \(8\eta >\gamma ^2\). Moreover, from the simplified values of profit functions presented in Table 3, one can find that the condition is necessary for each manufacturer to receive non-negative profits.

B Optimal decision in scenario RB

First, the two manufacturers’ decisions are derived by substituting \(m_i^{RB}=p_i^{RB}-w_i^{RB}\) in Eqs. (2) and (3); these represent the per-unit profit margin for product i. Therefore, wholesale prices and GLs are obtained by solving \(\frac{\partial \varPi _{m1}^{RB}}{\partial w_1^{RB}}=0\); \(\frac{\partial \varPi _{m1}^{RB}}{\partial \theta _1^{RB}}=0 \); \(\frac{\partial \varPi _{m2}^{RB}}{\partial w_2^{RB}}=0\); and \(\frac{\partial \varPi _{m2}^{RB}}{\partial \theta _2^{RB}}=0\), simultaneously. After simplification, wholesale prices and GLs are obtained as follows:

-

\(w_1^{RB}=\frac{2 \eta ((a-m_1^{RB}+m_2^{RB} \beta ) (4 \eta -\gamma ^2)+(a k-m_2^{RB}+m_1^{RB} \beta ) (2 \beta \eta -\gamma \delta ))}{\varDelta _{rb}}\)

-

\(w_2^{RB}=\frac{2 \eta ((a k-m_2^{RB}+m_1^{RB} \beta )(4 \eta -\gamma ^2)+(a-m_1^{RB}+m_2^{RB} \beta ) (2 \beta \eta -\gamma \delta ))}{\varDelta _{rb}}\)

-

\(\theta _1^{RB}=\frac{\gamma ((a-m_1^{RB}+m_2^{RB} \beta ) (4 \eta -\gamma ^2)+(a k-m_2^{RB}+m_1^{RB} \beta ) (2 \beta \eta -\gamma \delta ))}{\varDelta _{rb}}\)

-

\(\theta _2^{RB}=\frac{\gamma ((a k-m_2^{RB}+m_1^{RB} \beta )(4 \eta -\gamma ^2)+(a-m_1^{RB}+m_2^{RB} \beta ) (2 \beta \eta -\gamma \delta ))}{\varDelta _{rb}}\)

To verify the concavity of the profit function for each manufacturer, we compute the value of the determinant of the Hessian matrix (\(H_{mi}^{RB}\)) as follows:

Therefore, the profit function for each manufacturer will be concave if \(4\eta >\gamma ^2\). Having the information about the two manufacturers’ decisions, the common retailer would use them to maximize her profit. Using \(w_1^{RB}\), \(w_2^{RB}\), \(\theta _1^{RB}\), and \(\theta _2^{RB}\), the profit function of the common retailer is obtained as follows:

Therefore, profit margins are obtained by solving \(\frac{\partial \varPi _{r}^{RB}}{\partial m_1^{RB}}=0\) and \(\frac{\partial \varPi _{r}^{RB}}{\partial m_2^{RB}}=0\), simultaneously. On simplification, \(m_1^{RB}=\frac{a(1+ k \beta )}{2(1- \beta ^2)}\) and \(m_2^{RB}=\frac{a (k+\beta )}{2(1- \beta ^2)}\) . Note that the value of the determinant of the Hessian matrix for the retailer’s profit function is obtained as:

Therefore, the profit function for the retailer in Scenario RB is concave.

C Optimal decision in scenario MC

The optimal solution of the retailer’s optimization problem defined in Eq. (4) is obtained by solving \(\frac{\partial \varPi _{r}^{MC}}{\partial p_1^{MC}}=0\) and \(\frac{\partial \varPi _{r}^{MC}}{\partial p_2^{MC}}=0 \), simultaneously. After simplification, the retailer’s response is obtained as

-

\(p_1^{MC}=\frac{a+a k \beta +w_1^{MC}(1- \beta ^2)+(\gamma -\beta \delta ) \theta _1^{MC}+(\beta \gamma -\delta ) \theta _2^{MC}}{2(1- \beta ^2)}\)

-

\(p_2^{MC}=\frac{w_2^{MC}(1-\beta ^2)+a (k+\beta )+(\beta \gamma -\delta ) \theta _1^{MC}+\gamma \theta _2^{MC}-\beta \delta \theta _2^{MC}}{2(1- \beta ^2)}\).

The value of the determinant of the Hessian matrix (\(H_r^{MC}\)) for the retailer’s profit function is obtained as follows:

Therefore, the profit function for the retailer is concave. By substituting optimal responses in Eq. (5), the total profit function for two manufacturers is obtained as

By solving first-order conditions, \(\frac{\partial \varPi _{m}^{MC}}{\partial w_1^{MC}} = 0\);\(\frac{\partial \varPi _{m}^{MC}}{\partial \theta _1^{MC}} = 0\); \(\frac{\partial \varPi _{m}^{MC}}{\partial w_2^{MC}} = 0\);\(\frac{\partial \varPi _{m}^{MC}}{\partial \theta _2^{MC}} = 0\); simultaneously, we obtain responses for manufacturers, which are presented in Table 4. To verify concavity, the Hessian matrix for total profit function(\(H_m^{MC}\)) is computed as follows:

The values of leading principal minors for the matrix (\(H_m^{MC}\)) are obtained as \(|H_{m1}^{MC}|=-1\); \(|H_{m2}^{MC}|=\frac{8\eta -\gamma ^2}{4}>0\);\(|H_{m3}^{MC}|=\frac{-(8 (1 - \beta ^2) \eta -\gamma ^2 + 2 \beta \gamma \delta - \delta ^2 )}{4}<0\); and \(|H_{m4}^{MC}|=\frac{\varDelta _{mc}}{16}\), respectively. Therefore, the combined profit function for two manufacturers is also concave if \(\varDelta _{mc}>0\).

D Optimal decision in scenario RC

Similar to Scenario RB, we assume \(m_i^{RC}=p_i^{RC}-w_i^{RC}\) represents profit margin for product i and substitute in Eqs. (4) and (5). Therefore, wholesale prices and green-degrees are obtained by solving \(\frac{\partial \varPi _{m}^{RC}}{\partial w_1^{RC}}=0\); \(\frac{\partial \varPi _{m}^{RC}}{\partial \theta _1^{RC}}=0\); \(\frac{\partial \varPi _{m}^{RC}}{\partial w_2^{RC}}=0\), and \(\frac{\partial \varPi _{m}^{RC}}{\partial \theta _2^{RC}}=0\) simultaneously. After simplification, wholesale price and GLs are obtained as follows:

-

\(w_1^{RC}=\frac{2\eta }{\varDelta _{rc}}\left[ 2 (2 (a+a k \beta -m_1^{RC} (1-\beta ^2)) \eta -(a k-m_2^{RC}+m_1^{RC} \beta ) \gamma \delta )\right. \)

-

\(\left. - (a-m_1^{RC}+m_2^{RC} \beta ) (\gamma ^2+\delta ^2)\right] \)

-

\(w_2^{RC}=\frac{2\eta }{\varDelta _{rc}}\left[ 4(a (k+\beta )-m_2^{RC} (1-\beta ^2))+2(a-m_1^{RC}+m_2^{RC} \beta ) \gamma \delta \right. \)

-

\(\left. - (a k-m_2^{RC}+m_1^{RC} \beta ) (\gamma ^2+\delta ^2) \right] \)

-

\(\theta _1^{RC}=\frac{1}{\varDelta _{rc}}\left[ 4 (a (1+k \beta ) \gamma -a (k+\beta ) \delta -(1-\beta ^2) (m_1^{RC} \gamma -m_2^{RC} \delta )) \eta \right. \)

-

\(\left. -(\gamma ^2-\delta ^2) (m_2^{RC} \beta \gamma -m_1^{RC} \gamma \right. \)

-

\(\left. -m_2^{RC} \delta +m_1^{RC} \beta \delta +a (\gamma +k \delta ))\right] \)

-

\(\theta _2^{RC}=\frac{1}{\varDelta _{rc}}\left[ 4 (a (k+\beta ) \gamma -a (1+k \beta ) \delta -(1-\beta ^2) (m_2^{RC} \gamma -m_1^{RC} \delta )) \eta \right. \)

-

\(\left. -(\gamma ^2-\delta ^2) ((a k-m_2^{RC}+m_1^{RC} \beta ) \gamma +(a-m_1^{RC}+m_2^{RC} \beta ) \delta )\right] \)

To verify concavity, the Hessian matrix for combined profit function (\(H_m^{RC}\)) is computed as follows:

Therefore, the values of leading principal minors for the Hessian matrix for combined profit function (\(H_r^{RC}\)) are obtained as \(|H_{m1}^{RC}|=-2<0\), \(|H_{m2}^{RC}|=(4\eta -\gamma ^2)>0\), \(|H_{m3}^{RC}|=-2(8 (1 - \beta ^2) \eta -\gamma ^2 + 2 \beta \gamma \delta - \delta ^2)<0\), and \(|H_{m4}^{RC}|=\varDelta _{rc}\), respectively. Therefore, the total profit function for both manufacturers is also concave if \(\varDelta _{rc}>0\). By substituting the optimal response for two manufacturers, the profit function for the retailer is obtained as follows:

-

\(\varPi _{r}^{RC}=\frac{2\eta }{\varDelta _{rc}}\left[ 4 m_1^{RC} m_2^{RC} (\gamma \delta +\beta ^2 \gamma \delta -\beta (\gamma ^2+\delta ^2-2 \eta )-2 \beta ^3\eta )\right. \)

-

\(\left. +({m_1^{RC}}^2+{m_2^{RC}}^2) ((1+\beta ^2) \gamma ^2-4 \beta \gamma \delta +(1+\beta ^2) \delta ^2-4 (1-\beta ^2) \eta )+\right. \)

-

\(\left. -a (m_1^{RC} ((1-k \beta ) \gamma ^2+2 (k-\beta ) \gamma \delta +(1-k \beta ) \delta ^2-4 (1-\beta ^2) \eta )\right. \)

-

\(\left. +{m_2}^{RC} (\beta (\gamma ^2+\delta ^2)-2 \gamma \delta -k (\gamma ^2-2 \beta \gamma \delta +\delta ^2-4 (1-\beta ^2) \eta )))\right] \)

Therefore, the profit margins for each products for the retailer can be obtained by solving \(\frac{\partial \varPi _{r}^{RC}}{\partial m_1^{RC}} = 0\) and \(\frac{\partial \varPi _{r}^{RC}}{\partial m_2^{RC}} = 0\), and the corresponding solution is \(m_1^{RC}=\frac{a+a k \beta }{2-2 \beta ^2}\) and \(m_2^{RC}=\frac{a (k+\beta )}{2 (1-\beta ^2)}\). The profit function for the retailer is also concave because the value of the determinant of the Hessian matrix for the retailer profit function (\(H_r^{RC}\)) is

Therefore, the profit function for the retailer is also concave. By using back substitution, one can find the optimal decision as presented in Table 4.

Note that the optimal decision in Scenario VN is similar to that in Scenario RC, however, one needs to solve \(\frac{\partial \varPi _{m}^{VN}}{\partial w_1^{VN}}=0\); \(\frac{\partial \varPi _{m}^{VN}}{\partial \theta _1^{VN}}=0\); \(\frac{\partial \varPi _{m}^{VN}}{\partial w_2^{VN}}=0\), and \(\frac{\partial \varPi _{m}^{VN}}{\partial \theta _2^{VN}}=0\); \(\frac{\partial \varPi _{r}^{VN}}{\partial m_1^{VN}} = 0\) and \(\frac{\partial \varPi _{r}^{VN}}{\partial m_2^{VN}} = 0\), simultaneously. Note that the profit margins for per unit products for the retailer in Scenario VN are \(m_1^{VN}=\frac{2 a \eta (2 (3+4 k \beta +\beta ^2) \eta -\gamma (\gamma +k \beta \gamma +(k+\beta ) \delta ))}{(1-\beta ^2) \varDelta _{vn}}\) and \(m_1^{VN}=\frac{2 a \eta (2 (4 \beta +k (3+\beta ^2)) \eta -\gamma ((k+\beta ) \gamma +\delta +k \beta \delta ))}{(1-\beta ^2) \varDelta _{vn}}\), respectively. The corresponding optimal outcome is presented in Proposition 5.

E Proof of Propositions 1 and 2

See Tables 6 and 7 and Fig. 7.

We represent the difference between manufacturers’ and the retailer’s profits and GLs in Table 6.

After, simplification we obtain the relation. Similarly, we present the difference between manufacturers’ and retailer’s profit, in Table 7.

F Optimal decision under TRS contract

The optimal decision for the retailer optimization problem in Eq. (7) is obtained by solving the following first-order conditions, \(\frac{\partial \varPi _{r}^{TRS}}{\partial p_{1}^{TRS}} =0\) and \(\frac{\partial \varPi _{r}^{TRS}}{\partial p_{2}^{TRS}}=0\), respectively. On simplification, the retailer’s response to the market prices is obtained as follows:

-

\(p_1^{TRS}=\frac{1}{4 \rho _1 \rho _2-\beta ^2 (\rho _1+\rho _2)^2}[2 (w_1^{TRS}-w_2^{TRS} \beta +(a+\gamma \theta _1^{TRS}-\delta \theta _2^{TRS}) \rho _1) \rho _2+\beta (\rho _1^{TRS}+\rho _2^{TRS}) (w_2^{TRS}-w_1^{TRS} \beta +(a k-\delta \theta _1^{TRS}+\gamma \theta _2^{TRS}) \rho _2)]\)

-

\(p_2^{TRS}=\frac{1}{4 \rho _1 \rho _2-\beta ^2 (\rho _1+\rho _2)^2}[w_2^{TRS} (2-\beta ^2) \rho _1+w_1^{TRS} \beta (\rho _1-\rho _2)+w_2^{TRS} \beta ^2 \rho _1-\rho _1 (2 a k \rho _2-2 \delta \theta _1^{TRS} \rho _1+2 \gamma \theta _2^{TRS} \rho _1)+(\rho _1+\rho _2)(a \beta +\beta (\gamma \theta _1^{TRS}-\delta \theta _2^{TRS}) )]\)

Based on the retailer’s response, if two upstream manufacturers want to employ the centralized decision, then the optimal supply chain profits would be achieved if \(p_1^{TRS}=p_1^{c}\) and \(p_2^{TRS}=p_2^{c}\), respectively. On simplification, the GLs of two products are obtained as follows:

-

\(\theta _1^{TRS}=\frac{1}{(\gamma ^2-\delta ^2) \varDelta _c \rho _1 \rho _2}[w_1^{TRS} (\gamma ^4+\delta ^4+16 \beta \gamma \delta \eta -8 \delta ^2 \eta +16 (1-\beta ^2) \eta ^2-2 \gamma ^2 (\delta ^2+4 \eta )) (\beta \delta \rho _1-\gamma \rho _2)+w_2^{TRS} (\gamma ^4+\delta ^4+16 \beta \gamma \delta \eta -8 \delta ^2 \eta +16 (1-\beta ^2) \eta ^2-2 \gamma ^2 (\delta ^2+4 \eta )) (\beta \gamma \rho _2-\delta \rho _1)+a ((\gamma ^3+k \gamma ^2 \delta -k \delta (\delta ^2-4 \eta )-\gamma (\delta ^2+4 \eta )-(\gamma ^2-\delta ^2)) \rho _1 \rho _2-8 \beta ^2 \eta ^2 (\rho _1-\rho _2) (k \delta \rho _2-\gamma \rho _2)+2 \beta \eta (4 k \gamma \eta (\rho _1-\rho _2) \rho _2+4 \delta \eta \rho _1 (\rho _2-\rho _1)+\delta ^3 \rho _1 (\rho _1+\rho _2)+k \gamma ^3 \rho _2 (\rho _1+\rho _2)+k \gamma \delta ^2 (2 \rho _1^2-5 \rho _1 \rho _2+\rho _2^2)+\gamma ^2 \delta (\rho _1^2-5 \rho _1 \rho _2+2 \rho _2^2)))]\)

-

\(\theta _2^{TRS}=\frac{1}{(\gamma ^2-\delta ^2) \varDelta _c \rho _1 \rho _2}[(w_1^{TRS} (\gamma ^4+\delta ^4+16 \beta \gamma \delta \eta -8 \delta ^2 \eta +16 (1-\beta ^2) \eta ^2-2 \gamma ^2 (\delta ^2+4 \eta )) (\beta \gamma \rho _1-\delta \rho _1)-w_2^{TRS} (\gamma ^4+\delta ^4+16 \beta \gamma \delta \eta -8 \delta ^2 \eta +16 (1-\beta ^2) \eta ^2-2 \gamma ^2 (\delta ^2+4 \eta )) (\gamma \rho _1-\beta \delta \rho _2)+a ((\delta ^2-\gamma ^2) (k \gamma (\gamma ^2-\delta ^2-4 \eta )+\delta (\gamma ^2-\delta ^2+4 \eta )) \rho _1 \rho _2-8 \beta ^2 \eta ^2 (\rho _1-\rho _2) (k \gamma \rho _1-\delta \rho _2)+2 \beta \eta (4 k \delta \eta (\rho _1-\rho _2) \rho _2+4 \gamma \eta \rho _1 (\rho _2-\rho _1)+\gamma ^3 \rho _1 (\rho _1+\rho _2)+k \delta ^3 \rho _2 \delta ^2 (\rho _1^2-5 \rho _1 \rho _2+2 \rho _2^2)))]\).

Finally, optimal GSC profits will be achieved if \(\theta _1^{TRS}=\theta _1^{c}\) and \(\theta _2^{TRS}=\theta _2^{c}\), respectively. On simplification, wholesale prices are obtained as follows:

-

\(w_1^{TRS}=\frac{2 a \beta \eta (4 (1-\beta ^2) \eta -2 \gamma \delta -\beta (\gamma ^2+\delta ^2)+k (\gamma ^2-2 \beta \gamma \delta +\delta ^2)) (\rho _1-\rho _2)}{(1-\beta ^2) \varDelta _c}\)

-

\(w_2^{TRS}=\frac{2 a \beta \eta (4 (1-\beta ^2) \eta -(1-k \beta ) \gamma ^2+2 (k-\beta ) \gamma \delta +(1-k \beta ) \delta ^2) (\rho _1-\rho _2)}{(1-\beta ^2)\varDelta _c^2}\).

Finally, by using back substitution, one can obtain the profits as presented in Proposition 6. As expected, if \(k=1\) the difference between GLs in the centralized decision and in Scenarios MB or MC are \(\theta _1^{C}-\theta _1^{MC}=\theta _2^{C}-\theta _2^{MC}=\frac{4 a (1-\beta ) (\gamma -\delta ) \eta }{(\gamma -\delta )^4-12 (1-\beta ) (\gamma -\delta )^2 \eta +32 (1-\beta )^2 \eta ^2}>0\) and \(\theta _1^{C}-\theta _1^{MB}=\theta _2^{C}-\theta _2^{MB}=\frac{4 a (\gamma +(-2+\beta ) \delta ) \eta }{\varDelta _{1c}\varDelta _{1mb}}>0\), respectively. Therefore, if the GSC members adopt centralized GLs, consumers always receive products with higher GLs.

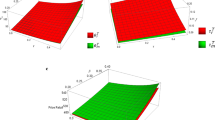

G Sensitivity analysis

A graphical representation of the sensitivity analysis is presented in the figure below:

Rights and permissions

About this article

Cite this article

Saha, S., Banaszak, Z., Bocewicz, G. et al. Pricing and quality competition for substitutable green products with a common retailer. Oper Res Int J 22, 3713–3746 (2022). https://doi.org/10.1007/s12351-021-00656-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00656-z