Abstract

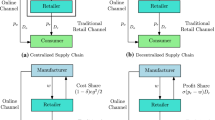

Due to growing public awareness about environment-friendly (green) products, green improvement has become an important factor in supply chain management. This paper deals with a two-echelon sustainable supply chain where both the manufacturer and the retailer are environmentally conscious. Market demand is assumed to be dependent on the selling price and green activities of both the channel members, while the carbon emissions are affected by the greening level of the product. In a make-to-order setting, this paper develops four models, viz. centralized, decentralized, retailer-led revenue sharing and bargaining revenue sharing under the cap-and-trade policy, and compares the optimal outcomes analytically. Numerical examples are taken to investigate the influence of some key model-parameters on optimal decisions. Our results demonstrate that besides improving the greening level of the product, the retailer-led revenue sharing can achieve a win-win situation for both the manufacturer and the retailer. Although the bargaining revenue sharing results in lower profit for the retailer, through promoting the greening level of the product effectively and diminishing the selling price it appears favorable for consumers, the manufacturer and the entire supply chain. Sensitivity analysis illustrates that a higher value of carbon trading cost encourages the manufacturer in improving the greening level and so, reducing the carbon emissions.

Similar content being viewed by others

Notes

For the rest of the paper, the manufacturer and the retailer will be treated as ‘he’ and ‘she’ respectively.

References

Bai Q, Xu J, Zhang Y (2018) Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Comput Ind Eng 119:131–145

Basiri Z, Heydari J (2017) A mathematical model for green supply chain coordination with substitutable products. J Clean Prod 145:232–249

Benjaafar S, Li Y, Daskin M (2013) Carbon footprint and the management of supply chains: insights from simple models. IEEE Trans Auto Sci Eng 10(1):99–116

Cachon GP (2003) Supply chain coordination with contracts. In: Graves SC, de Kok AG (eds) Handbooks in Operations Research and Management Science: Supply Chain Management: Design, Coordination and Operation. Elsevier, Amsterdam, The Netherlands, pp 229–340

Chang X, Xia H, Zhu H, Fan T, Zhao H (2015) Production decisions in a hybrid manufacturing-remanufacturing system with carbon cap and trade mechanism. Int J Prod Econ 162:160–173

Chen X, Hao G (2015) Sustainable pricing and production policies for two competing firms with carbon emissions tax. Int J Prod Res 53(21):6408–6420

Dobos I (2005) The effects of emission trading on production and inventories in the Arrowe-Karlin model. Int J Prod Econ 93:301–308

Dong C, Shen B, Chow PS, Yang L, Ng CT (2016) Sustainability investment under cap-and-trade regulation. Ann Oper Res 240:509–531

Dong C, Liu Q, Shen B (2019) To be or not to be green? Strategic investment for green product development in a supply chain. Transp Res Part E Logist Transp Rev 131:193–227

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Giri BC, Bardhan S (2012) Supply chain coordination for a deteriorating item with stock and price dependent demand under revenue sharing contract. Int Transac Oper Res 19(5):753–768

Giri BC, Mondal C, Maiti T (2018) Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J Clean Prod 190:822–837

He P, Dou G, Zhang W (2017) Optimal production planning and cap setting under cap-and-trade regulation. J Oper Res Soc 68(9):1094–1105

Heydari H, Govindan K, Basiri Z (2020) Balancing price and green quality in presence of consumer environmental awareness: a green supply chain coordination approach. Int J Prod Res 59(7):1957–1975

Hong Z, Wang H, Yu Y (2018) Green product pricing with non-green product reference. Trans Res Part E Logist Trans Rev 115:1–15

Hong Z, Guo X (2019) Green product supply chain contracts considering environmental responsibilities. Omega 83:155–166

Hsueh CF (2014) Improving corporate social responsibility in a supply chain through a new revenue sharing contract. Int J Prod Econ 151:214–222

Hua G, Cheng TCE, Wang S (2011) Managing carbon footprints in inventory management. Int J Prod Econ 132(2):178–185

Jamali MB, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043

Ji J, Zhang Z, Yang L (2017) Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J Clean Prod 141:852–867

Ji T, Xu X, Yan X, Yu Y (2020) The production decisions and cap setting with wholesale price and revenue sharing contracts under cap-and-trade regulation. Int J Prod Res 58(1):128–147

Jolai H, Hafezalkotob A, Reza-Gharehbagh R (2021) Pricing and greening decisions of competitive forward and reverse supply chains under government financial intervention: Iranian motorcycle industry case study. Comput Ind Eng 157:107329

Li T, Zhang R, Zhao S, Liu B (2019) Low carbon strategy analysis under revenue-sharing and cost-sharing contracts. J Clean Prod 212:1462–1477

Li X, Shi D, Li Y, Zhen X (2019) Impact of carbon regulations on the supply chain with carbon reduction effort. IEEE Trans Syst Man Cybern Syst 49(6):1218–1227

Li G, Wu H, Sethi SP, Zhang X (2021) Contracting green product supply chains considering marketing efforts in the circular economy era. Int J Prod Econ 248:108041

Liu G, Yang H, Dai R (2020) Which contract is more effective in improving product greenness under different power structures: revenue sharing or cost sharing? Comput Ind Eng 148:106701

Meng Q, Li M, Liu W, Li Z, Zhang J (2021) Pricing policies of dual-channel green supply chain: considering government subsidies and consumers’ dual preferences. Sustain Prod Consump 26:1021–1030

Mondal C, Giri BC (2020a) Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper Res Int J. https://doi.org/10.1007/s12351-020-00596-0

Mondal C, Giri BC (2020b) Pricing and used product collection strategies in a two-period closed-loop supply chain under greening level and effort dependent demand. J Clean Prod 265:121335

Nash J Jr (1950) The bargaining problem. Econometrica 18(2):155–162

Panda S, Modak NM, Cárdenas-Barrón LE (2017) Coordinating a socially responsible closed-loop supply chain with product recycling. Int J Prod Econ 188:11–21

Pang Q, Li M, Yang T, Shen Y (2018) Supply chain coordination with carbon trading price and consumers’ environmental awareness dependent demand. Math Prob Eng 8749251:1–11

Paulraj A, Blome C (2017) Plurality in environmental supply chain mechanisms: differential effects on triple bottom line outcomes. Int J Oper Prod Manage 37(8):1010–1030

Qi Q, Wang J, Bai Q (2017) Pricing decision of a two-echelon supply chain with one supplier and two retailers under a carbon cap regulation. J Clean Prod 151:286–302

Qian X, Chan FTS, Zhang J, Yin M, Zhang Q (2020) Channel coordination of a two-echelon sustainable supply chain with a fair-minded retailer under cap-and-trade regulation. J Clean Prod 244:118715

Raj A, Biswas I, Srivastava SK (2018) Designing supply contracts for the sustainable supply chain using game theory. J Clean Prod 185:275–284

Rezayat RR, Yaghoubi S, Fander A (2020) A hierarchical revenue-sharing contract in electronic waste closed-loop supply chain. Waste Manage 115:121–135

Song H, Gao X (2018) Green supply chain game model and analysis under revenue-sharing contract. J Clean Prod 170:183–192

Swami S, Shah J (2013) Channel coordination in green supply chain management. J Oper Res Soc 64(3):336–351

Tong W, Mu D, Zhao F, Mendis GP, Sutherland JW (2019) The impact of cap-and-trade mechanism and consumers’ environmental preferences on a retailer-led supply chain. Resour Conserv Recycle 142:88–100

Taleizadeh AA, Niaki STA, Alizadeh-Basban N (2021) Cost-sharing contract in a closed-loop supply chain considering carbon abatement, quality improvement effort, and pricing strategy. Rairo-Oper Res 55:S2181–S2219

Wang M, Zhao L, Herty M (2018) Modelling carbon trading and refrigerated logistics services within a fresh food supply chain under carbon cap-and-trade regulation. Int J Prod Res 56(12):4207–4225

Wang Y, Fan R, Shen L, Jin M (2020) Decisions and coordination of green e-commerce supply chain considering green manufacturer’s fairness concerns. Int J Prod Res. https://doi.org/10.1080/00207543.2020.1765040

Wang Z, Wu Q (2021) Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int J Prod Res 59(14):4359–4383

Xu J, Chen Y, Bai Q (2016) A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J Clean Prod 135:42–56

Xu X, Xu X, He P (2016) Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. J Clean Prod 112:4093–4106

Xu X, He P, Xu H, Zhang Q (2017a) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183:433–442

Xu X, Zhang W, He P, Xu XY (2017b) Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 66:248–257

Yang D, Xiao T, Huang J (2019) Dual-channel structure choice of an environmental responsibility supply chain with green investment. J Clean Prod 210:134–145

Zhang B, Liang Xu (2013) Multi-item production planning with carbon cap and trade mechanism. Int J Prod Econ 144:118–127

Zhang L, Zhou H, Liu Y, Lu R (2019) Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J Clean Prod 213:1063–1079

Zhang Q, Zhao Q, Zhao X, Tang L (2020) On the introduction of green product to a market with environmentally conscious consumers. Comput Ind Eng 139:106190106190

Zhang W, Xiao J, Cai L (2020) Joint emission reduction strategy in green supply chain under environmental regulation. Sustainability 12:3440. https://doi.org/10.3390/su12083440

Acknowledgements

The authors are sincerely thankful to the anonymous reviewers for their helpful comments and suggestions on the earlier version of the manuscript.

Funding

The Funding was provided by University Grants Commission (F.No. 16-9(June 2017)/2018(NET/CSIR)).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The profit function for the manufacturer is

The profit function for the retailer is

The profit function of the entire supply chain is

Proof of Proposition 1

Now,

,

,

,

,

,

,

.

The corresponding Hessian matrix is given by

=

Now, the leading principle minors are \(M_1 = - 2 \alpha < 0\), \(M_2 = 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2 > 0\), and

. Thus the Hessian matrix is negative definite. Using the first order conditions for optimality i.e.

and \(\frac{\partial \Pi ^{C}}{\partial \theta _r}=0\), the optimal decision variables can be obtained as given in Proposition 1. \(\square\)

Proof of Proposition 2

\(\frac{\partial \Pi _r^D}{\partial p} = D_0 + \alpha w - 2 \alpha p + \beta \theta _m + \gamma \theta _r\),

\(\frac{\partial ^2\Pi _r^{D}}{\partial p^2} = - 2 \alpha < 0\),

\(\frac{\partial \Pi _r^{D}}{\partial \theta _r} = \gamma p - \lambda _2 \theta _r - \gamma w\),

\(\frac{\partial ^2\Pi _r^{D}}{\partial \theta _r^2} = - \lambda _2 < 0\), \(\frac{\partial ^2\Pi _r^{D}}{\partial p \partial \theta _r} = \gamma\),

The corresponding Hessian matrix is given by

\(H=\left( \begin{array}{ccc} \frac{\partial ^2\Pi _r^{D}}{\partial p^2} &{} \frac{\partial ^2\Pi _r^{D}}{\partial p \partial \theta _r}\\ \frac{\partial ^2\Pi _r^{D}}{\partial \theta _r\partial p} &{} \frac{\partial ^2\Pi _r^{D}}{\partial \theta ^2_r} \end{array} \right)\)=\(\left( \begin{array}{ccccc} - 2 \alpha &{} \gamma \\ \gamma &{} - \lambda _2 \end{array} \right)\)

\(|H| = 2 \alpha \lambda _2 - \gamma ^2 > 0\). It is clear that the Hessian matrix corresponding to the retailer’s profit function is negative definite, and so \(\Pi _r^D\) is jointly concave in p and \(\theta _r\). Solving equations \(\frac{\partial \Pi _r^D}{\partial p}=0\), and \(\frac{\partial \Pi _r^D}{\partial \theta _r}=0\) simultaneously, we get

Substituting these values in the manufacturer’s profit function, we get the profit function of the manufacturer as follows:

Now,

\(\frac{\partial \Pi _m^{D}}{\partial w} = \frac{\alpha \lambda _2 [D_0 + \alpha (c + a c_e) - 2 \alpha w + (\beta - \alpha c_e b) \theta _m]}{2 \alpha \lambda _2 - \gamma ^2}\),

\(\frac{\partial ^2\Pi _m^{D}}{\partial w^2} = - \frac{2 \alpha ^2 \lambda _2}{2 \alpha \lambda _2 - \gamma ^2} < 0\),

\(\frac{\partial \Pi _m^{D}}{\partial \theta _m} = \frac{\alpha \lambda _2 [D_0 b c_e - \beta (c + a c_e) + w (\beta - \alpha c_e b)] - \lambda _1 (2 \lambda _2 - \gamma ^2) \theta _m}{2 \alpha \lambda _2 - \gamma ^2}\),

\(\frac{\partial ^2\Pi _m^{D}}{\partial \theta _m^2} = - \lambda _1 + \frac{2 \alpha \beta \lambda _2 c_e b}{2 \alpha \lambda _2 - \gamma ^2} < 0\), \(\frac{\partial ^2\Pi _m^{D}}{\partial w\partial \theta _m} = \frac{\alpha \lambda _2 (\beta - \alpha c_e b)}{2 \alpha \lambda _2 - \gamma ^2}\).

The Hessian matrix corresponding to the manufacturer’s profit function is given by

\(H=\left( \begin{array}{ccc} \frac{\partial ^2\Pi _m^{D}}{\partial w^2} &{} \frac{\partial ^2\Pi _m^{D}}{\partial w\partial \theta _m}\\ \frac{\partial ^2\Pi _m^{D}}{\partial \theta _m\partial w} &{} \frac{\partial ^2\Pi _m^{D}}{\partial \theta _m^2} \end{array} \right)\)=\(\left( \begin{array}{ccccc} - \frac{2 \alpha ^2 \lambda _2}{2 \alpha \lambda _2 - \gamma ^2} &{} \frac{\alpha \lambda _2 (\beta - \alpha c_e b)}{2 \alpha \lambda _2 - \gamma ^2}\\ \frac{\alpha \lambda _2 (\beta - \alpha c_e b)}{2 \alpha \lambda _2 - \gamma ^2} &{} - \lambda _1 + \frac{2 \alpha \beta \lambda _2 c_e b}{2 \alpha \lambda _2 - \gamma ^2} \end{array} \right)\)

Now, \(|H| = \frac{\alpha ^2 \lambda _2 [2 \lambda _1 (2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]}{(2 \alpha \lambda _2 - \gamma ^2)^2} > 0\), since \(2 \lambda _1 (2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2 = [\lambda _1 (\alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2] + [\lambda _1 (\alpha \lambda _2 - \gamma ^2)] + 2 \alpha \lambda _1 \lambda _2 > 0\). Therefore, the Hessian matrix corresponding to the manufacturer’s profit function is jointly concave in w and \(\theta _m\). Using the first order conditions for optimality i.e. \(\frac{\partial \Pi _m^{D}}{\partial w}=0,\) and \(\frac{\partial \Pi _m^{D}}{\partial \theta _m}=0\), we get the optimal decisions of the manufacturer, and substituting these values, we get the optimal decisions of the retailer as given in Proposition 2. \(\square\)

Proof of Proposition 3

.

\(\theta _m^C - \theta _m^D = \frac{\lambda _1 \lambda _2 (2 \alpha \lambda _2 - \gamma ^2)[D_0 - \alpha (c + a c_e)]}{[\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]} > 0\)

\(\theta _r^C - \theta _r^D = \frac{\gamma \lambda _1^2 (2 \alpha \lambda _2 - \gamma ^2)[D_0 - \alpha (c + a c_e)]}{[\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]} > 0\)

\(D^C - D^D = \frac{\alpha \lambda _1^2 \lambda _2 (2 \alpha \lambda _2 - \gamma ^2)[D_0 - \alpha (c + a c_e)]}{[\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]} > 0\).

\(\Pi ^C - \Pi ^D = \frac{\lambda _1^3 \lambda _2 (2 \alpha \lambda _2 - \gamma ^2)^2[D_0 - \alpha (c + a c_e)]^2}{2 [\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]^2} > 0\). \(\square\)

Proof of Proposition 4

First part of Proposition 4 is similar to that of Proposition 2. First, we solve the first order conditions for optimality of the retailer’s profit function (4) to obtain the values of p and \(\theta _r\) in terms of \(w,\, \theta _m\) and \(\phi\), and then putting these values in the manufacturer’s profit function (3) and solving the first order conditions for optimality of this profit function, we get the values of w and \(\theta _m\) in terms of \(\phi\). Substituting all these values in the retailer’s profit function, we get

\(\Pi _r^R = \frac{\lambda _1^2 \lambda _2 \phi [D_0 - \alpha (c + a c_e)]^2 (2 \alpha \lambda _2 - \gamma ^2 \phi )}{2 [\lambda _2\left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) + 2 \lambda _1 (\alpha \lambda _2 - \gamma ^2)\phi ]^2}.\)

Now,

\(\frac{\partial \Pi _r^{R}}{\partial \phi } = \frac{\lambda _1^2 \lambda _2^2 [D_0 + \alpha (c + a c_e)]^2 [\phi \left( 2 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2 (\beta + \alpha c_e b)^2\right) - \alpha \lambda _2 \left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) ]}{2 [\lambda _2\left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) + 2 \lambda _1 (\alpha \lambda _2 - \gamma ^2)\phi ]^3}\).

So, from \(\frac{\partial \Pi _r^{R}}{\partial \phi } = 0\), we get

\(\phi ^R = \phi = \frac{\alpha \lambda _2 [2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2]}{2 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2 (\beta + \alpha c_e b)^2}\). [\(\frac{\partial ^2\Pi _r^{R}}{\partial \phi ^2}]_{\phi = \phi ^R} = - \frac{\lambda _1^2 [D_0 - \alpha (C + a c_e)]^2 [2 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2 (\beta + \alpha c_e b)^2]^4}{\lambda _2[2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2]^3 [4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2 \left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]^3}\). Therefore, \(\phi ^R\) maximizes the retailer’s profit. Using this value of \(\phi ^R\), we can get the optimal decisions of the manufacturer and the retailer as given in Proposition 4. \(\square\)

Proof of Proposition 5

\(\theta _m^C - \theta _m^R = \frac{(\beta + \alpha c_e b)[D_0 - \alpha (c + a c_e)][(\beta + \alpha c_e b)^2\gamma ^4 + 2 \alpha \lambda _2 \gamma ^2\left( \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) + 2 \alpha ^2 \lambda _2^2 \left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) ]}{[\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(\theta _m^R - \theta _m^D = \frac{2 \lambda _1 (\alpha \lambda _2 - \gamma ^2)^2(\beta + \alpha c_e b)^3[D_0 - \alpha (c + a c_e)]}{[2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(\theta _r^D - \theta _r^R = \frac{\gamma \lambda _1 (\alpha \lambda _2 - \gamma ^2)(\beta + \alpha c_e b)^2[D_0 - \alpha (c + a c_e)]}{[2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(p^D - p^R = \frac{\lambda _1 (\alpha \lambda _2 - \gamma ^2)(\beta + \alpha c_e b)^2[D_0 - \alpha (c + a c_e)][2 \alpha \lambda _2 \left( \alpha \lambda _1 - \beta (\beta + \alpha c_e b)\right) - \gamma ^2(\beta ^2 - \alpha ^2 c_e^2 b^2)]}{\alpha [2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(p^R - p^C = \frac{\lambda _1[D_0 - \alpha (c + a c_e)]}{[2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [ \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} \times \left[ 2 \alpha \lambda _2 \left( \alpha \lambda _1 - \beta (\beta + \alpha c_e b)\right) \left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) + \gamma ^4\left( 2 \alpha \lambda _1^2 - c_e b (\beta + \alpha c_e b)^3\right) - \gamma ^2 \lambda _2 \left( 6 \alpha ^2 \lambda _1^2 - 2 \alpha \lambda _1 (\beta + \alpha c_e b)(2 \beta + \alpha c_e b) + (\beta + \alpha c_e b)^2 (\beta ^2 - \alpha ^2 c_e^2 b^2)\right) \right] > 0\)

\(D^C - D^R = \frac{\alpha \lambda _1^2 [D_0 - \alpha (c + a c_e)][2 \alpha ^2 \lambda _2^2 \left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) - 2 \alpha \lambda _2 \gamma ^2 \left( \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) - \gamma ^4(\beta + \alpha c_e b)^2]}{[2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [ \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(D^R - D^D = \frac{2 \alpha \lambda _1^2 (\alpha \lambda _2 - \gamma ^2)^2 (\beta + \alpha c_e b)^2 [D_0 - \alpha (c + a c_e)]}{[2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\) \(\square\)

Proof of Proposition 6

\(\Pi _m^R - \Pi _m^D = \frac{ \lambda _1^2 (\alpha \lambda _2 - \gamma ^2)^2 (\beta + \alpha c_e b)^2 [D_0 - \alpha (c + a c_e)]^2}{[2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2][4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(\Pi _r^R - \Pi _r^D = \frac{ \lambda _1^2 \lambda _2 (\alpha \lambda _2 - \gamma ^2)^2 (\beta + \alpha c_e b)^4 [D_0 - \alpha (c + a c_e)]^2}{2 [2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]^2 [4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(\Pi ^R - \Pi ^D = \frac{ \lambda _1^2 (\alpha \lambda _2 - \gamma ^2)^2 (\beta + \alpha c_e b)^2 [D_0 - \alpha (c + a c_e)]^2[4 \lambda _1 (2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]}{2 [2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [2 \lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2]^2 [4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\)

\(\Pi ^C - \Pi ^R = \frac{ \lambda _1^2 [D_0 - \alpha (c + a c_e)]^2[\alpha ^2 \lambda _2^2 \left( 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2\right) - \alpha \lambda _2 \gamma ^2 \left( \alpha \lambda _1 - 2 (\beta + \alpha c_e b)^2\right) - \gamma ^4 (\beta + \alpha c_e b)^2]}{2 [2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2] [\lambda _1(2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2] [4 \alpha ^2 \lambda _1 \lambda _2 - \gamma ^2\left( 2 \alpha \lambda _1 + (\beta + \alpha c_e b)^2\right) ]} > 0\) \(\square\)

Proof for the thresholds in Assumption 4

If we look at the proof of Proposition 1, we can observe that the negative definiteness of the Hessian matrix needs \((i)\,\, 2 \alpha \lambda _1 - (\beta + \alpha c_e b)^2 > 0\), and \((ii)\,\,\lambda _1 (2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2 > 0\). If we choose \(\lambda _1\) in such a way that \(\lambda _1 > \frac{(\beta + \alpha c_e b)^2}{\alpha }\), then condition (i) will be easily satisfied. In this regard, it can be mentioned that \(\lambda _1 > \frac{(\beta + \alpha c_e b)^2}{2 \alpha }\) is sufficient for condition (i). But a lower threshold of \(\lambda _1\) may give higher greening level of the product (\(\theta _m\)) and this may cause a negative unit emission (\(a - b \theta _m\)) which is absurd. That’s why, we consider a higher threshold for \(\lambda _1\). As \(\lambda _1 (2 \alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2 = \lambda _2 [\alpha \lambda _1 - (\beta + \alpha c_e b)^2] + \lambda _1 [\alpha \lambda _2 - \gamma ^2]\), for the existence of condition (ii) we choose \(\lambda _2 > \frac{\gamma ^2}{\alpha }\). Also, the condition \(0< \phi ^R < 1\) demands \(\alpha \lambda _2 > \gamma ^2.\)

Again, positivity of the optimal selling price of the centralized model demands (\(i)\,\, \lambda _1 - c_e b (\beta + \alpha c_e b) > 0\) and (\(ii)\,\,\lambda _1 (\alpha \lambda _2 - \gamma ^2) - \lambda _2 \beta (\beta + \alpha c_e b) > 0\). As \((\beta + \alpha c_e b)^2 = (\beta + \alpha c_e b)(\beta + \alpha c_e b) > \alpha c_e b(\beta + \alpha c_e b)\), here condition (i) will be easily satisfied for the previously chosen threshold value of \(\lambda _1\). Now, as \((\beta + \alpha c_e b)^2 = (\beta + \alpha c_e b)(\beta + \alpha c_e b) > \beta (\beta + \alpha c_e b)\), if we choose \(\lambda _1 (\alpha \lambda _2 - \gamma ^2) - \lambda _2 (\beta + \alpha c_e b)^2 > 0\), then condition (ii) will also be satisfied. \(\square\)

Rights and permissions

About this article

Cite this article

Mondal, C., Giri, B.C. Analyzing a manufacturer-retailer sustainable supply chain under cap-and-trade policy and revenue sharing contract. Oper Res Int J 22, 4057–4092 (2022). https://doi.org/10.1007/s12351-021-00669-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00669-8