Abstract

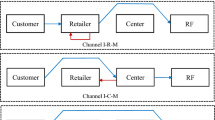

This paper analyzed how different return strategies and return rates affect dual-channel retailers' profits and channel pricings. Return can stimulate sales; however, the return has presented significant challenges to retailers. The return has long been studied to maximize profit and pricing; however, the different return strategies for dual-channel retailers affect channel both. This paper aimed to study whether or not dual-channel retailers should allow customers to return items in two channels and whether or not the retailer should contract with the manufacturers and pay extra fees to return products. This study indicated when the retailer should allow customers’ returns to maximize the profit by increasing the demand. It was discovered that when a customer's sensitivity factor for pricing is large (i.e., the demand is small) and the return rate is low, both retailer and manufacturer should object to contracting for handling returned products. However, when both the customer's sensitivity factor for pricing and the return rate are high, the retailer and the manufacturer should sign a contract to achieve maximum profit. Otherwise, the contract desire was only one-sided. The profit-maximizing retailers must balance the trade-off between the product demands, the return losses, and the return rates. This analytical work was verified with numerical simulation, and the results demonstrated implications for dual-channel retailers, return strategies, and pricing.

Similar content being viewed by others

References

Altug MS, Aydinliyim T (2016) Counteracting strategic purchase deferrals: the impact of online retailers’ return policy decisions. Manuf Serv Oper Manag 18(3):376–392

Balakrishnan A, Sundaresan S, Zhang B (2014) Browse-and-switch: retail-online competition under value uncertainty. Prod Oper Manag 23(7):1129–1145

Choi TM (2013) Optimal return service charging policy for a fashion mass customization program. Serv Sci 5(1):56–68

Cui TH, Jagmohan S, Raju Z, Zhang J (2007) Fairness and channel coordination. Manag Sci 53(08):1304–1314

Dijkstra AS, Van der Heide G, Roodbergen KJ (2019) Transshipments of cross-channel returned products. Int J Prod Econ 209:70–77

Gao F, Su X (2016) Omnichannel retail operations with buy-online-and-pick-up-in-store. Manag Sci 63(8):2478–2492

Gao F, Su XM (2017) Online and offline information for omnichannel retailing. Manuf Serv Oper Manag 19(1):84–98

Gao F, Agrawal VV, Cui S (2021) The effect of multichannel and omnichannel retailing on physical stores. Manag Sci. https://doi.org/10.1287/mnsc.2021.3968

Gümüş M, Ray S, Yin SY (2013) Returns policies between channel partners for durable products. Mark Sci 32(4):622–643

Guo L (2009) Service cancellation and competitive refund policy. Mark Sci 28(5):901–917

He Y, Xu Q Y, Wu P K (2019) Omnichannel retail operations with refurbished consumer returns. Int J Prod Res 58(1):1–20

Hu X, Wan ZX, Murthy NN (2018) Dynamic pricing of limited inventories with product returns. Manuf Serv Oper Manag 21(3):501–518

Jin D, Caliskan-Demirag O, Chen F, Huang M (2020) Omnichannel retailers′ return policy strategies in the presence of competition, Int J Prod Econ https://doi.org/10.1016/j.ijpe.2019.107595

Ketzenberg ME, Zuidwijk RA (2009) Optimal pricing, ordering and return polices for consumer goods. Prod Oper Manag 18(3):344–360

Khouja M, Ajjan H, Liu X (2019) The effect of return and price adjustment policies on a retailer’s performance. Eur J Oper Res 273:466–482

Kim E, Libaque‑Saenz C F, Park M (2019) Understanding shopping routes of offline purchasers: Selection of search-channels (online vs. offline) and search‑platforms (mobile vs. PC) based on product types. Serv Bus 13(2):305–338

Li B, Jiang YS (2019) Impacts of returns policy under supplier encroachment with risk-averse retailer. J Retail Consum Serv 47:104–115

Liu N, Choi TM, Yucn CWM (2012) Optimal pricing, modularity, and return policy under mass customization. IEEE Trans Syst Man Cybern Part A Syst Hum 42(3):604–614

Liu J, Mantin B, Wang H (2014) Supply chain coordination with customer returns and refund-dependent demand. Int J Prod Econ 148(C):81–89

Moon YM, Yao T, Friesz TL (2010) Dynamic pricing and inventory policies: a strategic analysis of dual channel supply chain design. Serv Sci 2(3):196–215

Nageswaran L, Cho S, Scheller-Wolf A (2020) Consumer return policies in omnichannel operations. Manage Sci 66(12):5558–5575

Padmanabhan V, Png IPL (1995) Manufacturer’s return policies and retail competition. Mark Sci 16(1):81–94

Radhi M, Zhang G (2019) Optimal cross-channel return policy in dual-channel retailing systems. Int J Prod Econ 210:184–198

Sahoo N, Dellarocas C, Srinivasan S (2018) The impact of online product reviews on product returns. Inf Syst Res 29(3):723–738

Samorani M, Alptekinoğlu A, Messinger PR (2019) Product return episodes in retailing. Serv Sci 11(4):263–278

Shulman JD, Coughlan AT, Savaskan RC (2010) Optimal reverse channel structure for consumer product returns. Mark Sci 29(6):1071–1085

Shulman JD, Coughlan AT, Savaskan RC (2011) Managing consumer returns in a competitive environment. Manage Sci 57(2):347–362

Su XM (2009) Consumer returns policies and supply chain performance. Manuf Serv Oper Manag 11(4):595–612

Tran T, Gurnani H, Desiraju R (2018) Optimal design of return policies. Mark Sci 37(4):649–667

Ülkü MA, Dailey LC, Yayla-Küllü HM (2013) Serving fraudulent consumers? The impact of return policies on retailer’s profitability. Serv Sci 5(4):296–309

Xu L, Li Y, Govindan K (2015) Consumer returns policies with endogenous deadline and supply chain coordination. Eur J Oper Res 242(1):88–99

Yoo SH (2014) Product quality and return policy in a supply chain under risk aversion of a supplier. Int J Prod Econ 154:146–155

Acknowledgements

This research is supported by the National Natural Science Foundation of China (Grant Nos. 71671092, 72071112). We thank the editors and several anonymous reviewers for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Liu, J., Sun, X. & Liu, Y. Products pricing and return strategies for the dual channel retailers. Oper Res Int J 22, 3841–3867 (2022). https://doi.org/10.1007/s12351-021-00670-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00670-1