Abstract

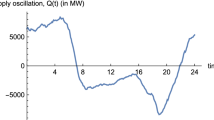

This paper introduces a mean field modeling framework for consumption-accumulation optimization. The production dynamics are generalized from stochastic growth theory by addressing the collective impact of a large population of similar agents on efficiency. This gives rise to a stochastic dynamic game with mean field coupling in the dynamics, where we adopt a hyperbolic absolute risk aversion (HARA) utility functional for the agents. A set of decentralized strategies is obtained by using the Nash certainty equivalence approach. To examine the long-term behavior we introduce a notion called the relaxed stationary mean field solution. The simple strategy computed from this solution is used to investigate the out-of-equilibrium behavior of the mean field system. Interesting nonlinear phenomena can emerge, including stable equilibria, limit cycles and chaos, which are related to the agent’s sensitivity to the mean field.

Similar content being viewed by others

References

Achdou Y, Capuzzo-Dolcetta I (2010) Mean field games: numerical methods. SIAM J Numer Anal 48(3):1136–1162

Adlakha S, Johari R, Weintraub G, Goldsmith A (2008) Oblivious equilibrium for large-scale stochastic games with unbounded costs. In: Proc 47th IEEE CDC, Cancun, Mexico, pp 5531–5538

Amir R (1996) Continuous stochastic games of capital accumulation with convex transitions. Games Econ Behav 15:111–131

Andersson D, Djehiche B (2011) A maximum principle for SDEs of mean-field type. Appl Math Optim 63(3):341–356

Arthur WB (1999) Complexity and the economy. Science 284:107–109

Askenazy P, Le Van C (1999) A model of optimal growth strategy. J Econ Theory 85:24–51

Balbus L, Nowak AS (2004) Construction of Nash equilibria in symmetric stochastic games of capital accumulation. Math Methods Oper Res 60:267–277

Bardi M (2012) Explicit solutions of some linear-quadratic mean field games. Netw Heterog Media 7(2):243–261

Barro RJ, Sala-I-Martin X (1992) Public finance in models of economic growth. Rev Econ Stud 59(4):645–661

Benhabib J (ed) (1992) Cycles and chaos in economic equilibrium. Princeton University Press, Princeton

Bensoussan A, Frehse J, Yam P (2012) Overview on mean field games and mean field type control theory. Preprint

Bensoussan A, Sung KCJ, Yam SCP, Yung SP (2011) Linear-quadratic mean-field games. Preprint

Brock WA, Mirman LJ (1972) Optimal economic growth and uncertainty: the discounted case. J Econ Theory 4:479–513

Buckdahn R, Cardaliaguet P, Quincampoix M (2011) Some recent aspects of differential game theory. Dyn Games Appl 1(1):74–114

Cardaliaguet P (2012) Notes on mean field games

Carmona R, Delarue F (2012) A probabilistic analysis of mean field games. Preprint

Cass D (1965) Optimum growth in an aggregative model of capital accumulation. Rev Econ Stud 32(3):233–240

Chow YS, Teicher H (1997) Probability theory: independence, interchangeability, martingales, 3rd edn. Springer, New York

Day RH (1982) Irregular growth cycles. Am Econ Rev 72(3):406–414

Dockner EJ, Nishimura K (2005) Capital accumulation games with a non-concave production function. J Econ Behav Organ 57:408–420

Duffie D, Fleming W, Soner HM, Zariphopoulou T (1997) Hedging in incomplete markets with HARA utility. J Econ Dyn Control 21:753–782

Gomes DA, Mohr J, Souza RR (2010) Discrete time, finite state space mean field games. J Math Pures Appl 93:308–328

Gast N, Gaujal B, Le Boudec J-Y (2012) Mean field for Markov decision processes: from discrete to continuous optimization. IEEE Trans Autom Control 57(9):2266–2280

Guéant O, Lasry J-M, Lions P-L (2011) Mean field games and applications. In: Carmona AR et al. (eds) Paris-Princeton lectures on mathematical finance 2010. Springer, Berlin, pp 205–266

Hart S (1973) Values of mixed games. Int J Game Theory 2:69–86

Hernández-Lerma O, Lasserre JB (1996) Discrete-time Markov control processes: basic optimality criteria. Springer, New York

Huang M (2010) Large-population LQG games involving a major player: the Nash certainty equivalence principle. SIAM J Control Optim 48(5):3318–3353

Huang M, Caines PE, Malhamé RP (2003) Individual and mass behaviour in large population stochastic wireless power control problems: centralized and Nash equilibrium solutions. In: Proc 42nd IEEE CDC, Maui, HI, pp 98–103

Huang M, Caines PE, Malhamé RP (2007) Large-population cost-coupled LQG problems with nonuniform agents: individual-mass behavior and decentralized ε-Nash equilibria. IEEE Trans Autom Control 52(9):1560–1571

Huang M, Caines PE, Malhamé RP (2012) Social optima in mean field LQG control: centralized and decentralized strategies. IEEE Trans Autom Control 57(7):1736–1751

Huang M, Malhamé RP, Caines PE (2006) Large population stochastic dynamic games: closed-loop McKean–Vlasov systems and the Nash certainty equivalence principle. Commun Inf Syst 6(3):221–251

Jovanovic B, Rosenthal RW (1988) Anonymous sequential games. J Math Econ 17:77–87

Kizilkale AC, Caines PE (2013) Mean field stochastic adaptive control. IEEE Trans Autom Control 58(4):905–920

Kolokoltsov VN, Li J, Yang W (2011) Mean field games and nonlinear Markov processes. Preprint

Lambson VE (1984) Self-enforcing collusion in large dynamic markets. J Econ Theory 34:282–291

Lasry J-M, Lions P-L (2007) Mean field games. Jpn J Math 2(1):229–260

Levhari D, Srinivasan TN (1969) Optimal savings under uncertainty. Rev Econ Stud 36(2):153–163

Li T, Zhang J-F (2008) Asymptotically optimal decentralized control for large population stochastic multiagent systems. IEEE Trans Autom Control 53(7):1643–1660

Li TY, Yorke JA (1975) Period three implies chaos. Am Math Mon 82(10):985–992

Liu W-F, Turnovsky SJ (2005) Consumption externalities, production externalities, and long-run macroeconomic efficiency. J Public Econ 89:1097–1129

Ma Z, Callaway D, Hiskens I (2013) Decentralized charging control for large populations of plug-in electric vehicles. IEEE Trans Control Syst Technol 21(1):67–78

Mendelssohn R, Sobel MJ (1980) Capital accumulation and the optimization of renewable resource models. J Econ Theory 23:243–260

Merton R (1969) Lifetime portfolio selection under uncertainty: the continuous time case. Rev Econ Stat 51(3):247–257

Nguyen SL, Huang M (2012) Linear-quadratic-Gaussian mixed games with continuum-parameterized minor players. SIAM J Control Optim 50(5):2907–2937

Nourian M, Caines PE (2012) ε-Nash mean field game theory for nonlinear stochastic dynamical systems with mixed agents. In: Proc 51st IEEE CDC, Maui, HI, pp 2090–2095

Nourian M, Caines PE, Malhamé RP, Huang M (2012) Mean field control in leader-follower stochastic multi-agent systems: likelihood ratio based adaptation. IEEE Trans Autom Control 57(11):2801–2816

Olson LJ, Roy S (2006) Theory of stochastic optimal economic growth. In: Dana R-A, Le Van C, Mitra T, Nishimura K (eds) Handbook on optimal growth I. Springer, Berlin, pp 297–335

Olson LJ, Roy S (2000) Dynamic efficiency of conservation of renewable resources under uncertainty. J Econ Theory 95:186–214

Ramsey FP (1928) A mathematical theory of saving. Econ J 38(152):543–559

Saari D (1995) Mathematical complexity of simple economics. Not Am Math Soc 42(2):222–230

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Stokey NL, Lucas RE Jr., Prescott EC (1989) Recursive methods in economic dynamics. Harvard University Press, Cambridge

Tembine H, Le Boudec J-Y, El-Azouzi R, Altman E (2009) Mean field asymptotics of Markov decision evolutionary games and teams. In: Proc GameNets, Istanbul, Turkey, pp 140–150

Tembine H, Zhu Q, Basar T (2011) Risk-sensitive mean-field stochastic differential games. In: Proc 18th IFAC world congress, Milan, Italy

Wang B-C, Zhang J-F (2012) Distributed control of multi-agent systems with random parameters and a major agent. Automatica 48(9):2093–2106

Weintraub GY, Benkard CL, Van Roy B (2008) Markov perfect industry dynamics with many firms. Econometrica 76(6):1375–1411

Yin H, Mehta PG, Meyn SP, Shanbhag UV (2012) Synchronization of coupled oscillators is a game. IEEE Trans Autom Control 57(4):920–935

Yong J (2011) A linear-quadratic optimal control problem with mean-field stochastic differential equations. Preprint

Acknowledgements

This work was partially supported by Natural Sciences and Engineering Research Council (NSERC) of Canada.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, M. A Mean Field Capital Accumulation Game with HARA Utility. Dyn Games Appl 3, 446–472 (2013). https://doi.org/10.1007/s13235-013-0092-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-013-0092-9