Abstract

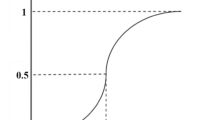

Investment portfolios are typically selected to reduce investment risk. In an economic recession or depression, investment strategies tend to be short term, subtle, and uncertain. When the economy is recovering or booming, investors should approach portfolio selection differently in response to the varying investment return and risk. Therefore, this study posits that different portfolios should be selected in different stages of the business cycle. An improved function for weighting possibilistic mean and variance is proposed, and a weighted fuzzy portfolio model for various investment conditions is then derived. Finally, a numerical example is presented to illustrate that the proposed models can obtain the optimal proportion of an investment throughout the business cycle to meet investors’ expectations.

Similar content being viewed by others

References

Best, M.J., Grauer, R.R.: The efficient set mathematics when mean–variance problems are subject to general linear constrains. J. Econ. Bus. 42, 105–120 (1990)

Best, M.J., Hlouskova, J.: The efficient frontier for bounded assets. Math. Methods Oper. Res. 52, 195–212 (2000)

Carlsson, C., Fuller, R.: On possibilistic mean value and variance of fuzzy numbers. Fuzzy Sets Syst. 122, 315–326 (2001)

Carlsson, C., Fuller, R., Majlender, P.: A possibilistic approach to selecting portfolios with highest utility score. Fuzzy Sets Syst. 131, 13–21 (2002)

Chang, B., Cheng, D., Chang, C.: Feature selection and parameter optimization of a fuzzy-based stock selection model using genetic algorithms. Int. J. Fuzzy Syst. 14(1), 65–75 (2012)

Chen, W., Tan, S.: On the possibilistic mean value and variance of multiplication of fuzzy numbers. J. Comput. Appl. Math. 232, 327–334 (2009)

Cooper, M., Chieffe, N.: Market timing and the Business cycle. J. Wealth Manage. 7(2), 81–86 (2004)

Dubois, D., Prade, H.: Possibility Theory. Plenum Press, New York (1988)

Fuller, R., Majlender, P.: On weighted possibilistic mean and variance. Fuzzy Sets Syst. 136, 364–374 (2003)

Giove, S., Funari, S., Nardelli, C.: An interval portfolio selection problems based on regret function. Eur. J. Oper. Res. 170, 253–264 (2006)

Huang, X.: Mean-semivariance models for fuzzy portfolio selection. J. Comput. Appl. Math. 217, 1–8 (2008)

Huang, X.: Risk curve and fuzzy portfolio selection. Comput. Math. Appl. 55, 1102–1112 (2008)

Huang, X.: An entropy method for diversified fuzzy portfolio selection. Int. J. Fuzzy Syst. 14(1), 160–165 (2012)

Inuiguchi, M., Tanino, T.: Portfolio selection under independent possibilistic information. Fuzzy Sets Syst. 115, 83–92 (2000)

Lacagnina, V., Pecorella, A.: A stochastic soft constraints fuzzy model for a portfolio selection problem. Fuzzy Sets Syst. 157, 1317–1327 (2006)

Lai, K.K., Wang, S.Y., Xu, J.P., Zhu, S.S., Fang, Y.: A class of linear interval programming problems and its application to portfolio selection. IEEE Trans. Fuzzy Syst. 10, 698–704 (2002)

León, T., Liem, V., Vercher, E.: Viability of infeasible portfolio selection problems: a fuzzy approach. Eur. J. Oper. Res. 139, 178–189 (2002)

Li, X., Qin, Z.F., Kar, S.: Mean-variance-skewness model for portfolio selection with fuzzy returns. Eur. J. Oper. Res. 202, 239–247 (2010)

Markowitz, H.: Portfolio selection. J. Financ. 7, 77–91 (1952)

Merton, R.C.: An analytic derivation of the efficient frontier. J. Financ. Quant. Anal. 10, 1851–1872 (1972)

Mazandarani, M., Najariyan, M.: Differentiability of type2 fuzzy number-valued functions. Commun. Nonlinear Sci. Numer. Simul. 19, 710–725 (2014)

Mazandarani, M., Najariyan, M.: Type-2 fuzzy fractional derivatives. Commun. Nonlinear Sci. Numer. Simul. 19, 2354–2372 (2014)

Nawrocki, D., Viole, F.: Behavioral finance in financial market theory, utility theory, portfolio theory and the necessary statistics: a review. J. Behav. Exp. Financ. 2, 10–17 (2014)

Pang, J.S.: A new efficient algorithm for a class of portfolio selection problems. Oper. Res. Int. J. 28, 754–767 (1980)

Perold, A.F.: Large-scale portfolio optimization. Manage. Sci. 30, 1143–1160 (1984)

Ramaswamy, S.: Portfolio Selection Using Fuzzy Decision Theory. Working Paper of Bank for International Settlements 59 (1998)

Sharpe, W.F.: Portfolio Theory and Capital Markets. McGraw-Hill, New York (1970)

Tanaka, H., Guo, P.: Portfolio selection based on upper and lower exponential possibility distributions. Eur. J. Oper. Res. 114, 115–126 (1999)

Tanaka, H., Guo, P., Türksen, I.B.: Portfolio selection based on fuzzy probabilities and possibility distributions. Fuzzy Set Syst. 111, 387–397 (2000)

Vörös, J.: Portfolio analysis—an analytic derivation of the efficient portfolio frontier. Eur. J. Oper. Res. 203, 294–300 (1986)

Watada, J.: Fuzzy portfolio selection and its applications to decision making. Tatra Mt. Math. Publ. 13, 219–248 (1997)

Xu, W., Deng, X., Li, J.: A new fuzzy portfolio model based on background risk using MCFOA. Int. J. Fuzzy Syst. 17(2), 246–255 (2015)

Zhang, W.G., Nie, Z.K.: On possibilistic variance of fuzzy numbers. Lect. Notes Artif. Intel. 2639, 398–402 (2003)

Zhang, W.G., Nie, Z.K.: On admissible efficient portfolio selection problem. Appl. Math. Comput. 159, 357–371 (2004)

Zhang, W.G.: Possibilistic mean–standard deviation models to portfolio selection for bounded assets. Appl. Math. Comput. 189, 1614–1623 (2007)

Acknowledgments

The author gratefully acknowledges financial support from National Science Foundation with Project No. NSC 101-2410-H-032-006.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, IF., Tsaur, RC. Fuzzy Portfolio Selection Using a Weighted Function of Possibilistic Mean and Variance in Business Cycles. Int. J. Fuzzy Syst. 18, 151–159 (2016). https://doi.org/10.1007/s40815-015-0073-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-015-0073-9