Abstract

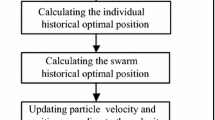

In this paper, the portfolio optimization problem is approached. It is a NP-hard problem that consists in periodically creating an instance of the problem, using the time series of the shares value of a stock exchange. The instance is solved to determine the shares set that maximize the return, minimize the risk and minimize the number of selected shares. As far as we know, only three algorithms of the state-of-the-art of the portfolio selection problem with three objectives have been assessed. In this work, we propose a Fuzzy Multi-objective Particle Swarm Optimization (FOMOPSO) that uses an auto-Tuning Fuzzy Controller. To validate our approach, a series of experiments with the realistic instances and the performance of the proposed algorithm were compared with three state-of-the-art evolutionary algorithms using six commonly used metrics. To support the conclusions, two hypothesis tests were applied. The results show that the Fuzzy Rules auto-configuration contributes to that the proposed algorithm performance clearly outperforms three of the algorithms in comparison, for four of the metrics used.

Similar content being viewed by others

References

Markowitz, H.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Zhang, J., Leung, T., Aravkin, A.Y.: A relaxed optimization approach for cardinality-constrained portfolios. ECC, 2885–2892 (2019)

Steuer, R.E., Qi, Y., Hirschberger, M.: Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Ann. OR 152(1), 297–317 (2007)

Anagnostopoulos, K.P., Mamanis, G.: A portfolio optimization model with three objectives and discrete variables. Comput. Oper. Res. 37(7), 1285–1297 (2010)

Lee, K.Y., Park, J.: Application of particle swarm optimization to economic dispatch problem: advantages and disadvantages. Published In 2006 IEEE PES Power Systems Conference and Exposition (2006). https://doi.org/10.1109/psce.2006.296295

Santiago, A., Dorronsoro, B., Nebro, A.J., Durillo, J.J., Castillo, O., Fraire, H.J.: A novel multi-objective evolutionary algorithm with fuzzy logic based adaptive selection of operators: FAME. Inf. Sci. (Ny) 471, 233–251 (2019)

Sierra, M.R., Coello, C.A.C.: Improving PSO-based multi-objective optimization using crowding, mutation and –dominance. In International Conference on Evolutionary Multi-Criterion Optimization, pp. 505–519 (2005)

Smith, J.E., Vavak, F.: Replacement strategies in steady state genetic algorithms: dynamic environments. J. Comput. Inf. Technol. 7(1), 49–59 (1999)

Agrawal, R.B., Deb, K., Agrawal, R.B.: Simulated binary crossover for continuous search space. Complex Syst. 9(2), 115–148 (1995)

Storn, R., Price, K.: Differential evolution–a simple and efficient heuristic for global optimization over continuous spaces. J. Glob. Optim. 11(4), 341–359 (1997)

Deb, K., Goyal, M.: A combined genetic adaptive search (GeneAS) for engineering design. Comput. Sci. informatics 26, 30–45 (1996)

Yoon, Y., Kim, Y.-H.: The roles of crossover and mutation in real-coded genetic algorithms. In Bio-inspired computational algorithms and their applications, InTech (2012)

González, J.A.R., Solís, J.F., Huacuja, H.J.F., Barbosa, J.J.G., Rangel, R.A.P.: Fuzzy GA-SVR for Mexican stock exchange’s financial time series forecast with online parameter tuning. Int. J. Comb. Optim. Probl. Inform. 10(1), 40–50 (2019)

Durillo, J.J., Nebro, A.J.: jMetal: a Java framework for multi-objective optimization. Adv. Eng. Softw. 42(10), 760–771 (2011)

Wilcoxon, F.: Individual comparisons by ranking methods. In Breakthroughs in statistics, Springer, pp. 196–202 (1992)

Friedman, M.: A comparison of alternative tests of significance for the problem of m rankings. Ann. Math. Stat. 11(1), 86–92 (1940)

Acknowledgments

The authors thank CONACYT for supporting the projects A1-S-11012 and 3058. Also we thank TECNM for the support to the projects 5797.19P. Javier Alberto Rangel González thanks the scholarship 429340 received from CONACYT in his PhD studies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rangel-González, J.A., Fraire, H., Solís, J.F. et al. Fuzzy Multi-objective Particle Swarm Optimization Solving the Three-Objective Portfolio Optimization Problem. Int. J. Fuzzy Syst. 22, 2760–2768 (2020). https://doi.org/10.1007/s40815-020-00928-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-020-00928-4