Abstract

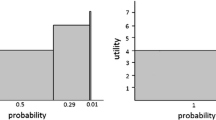

In this paper, we aim at obtaining, from an experimental design in decision makingunder risk, richer and more appropriate information for management scientists involved indecision7dash;aiding. We design a method of direct elicitation of individual indifference curvesin the Marschak Machina triangle (i.e., the set of all probability distributions over threefixed outcomes). Our results show that indifference curves clearly take quite different typesof shape according to their location within the triangle, i.e. that preferences under risk fundamentallydepend on the risk-structure (as defined in the paper) faced by the decision maker.Furthermore, the risk-structure dependence effect explains the indecisive results of previousexperimental/econometric studies trying to rank different models according to theirdescriptive power.

Similar content being viewed by others

References

M. Abdellaoui and B. Munier, The “closing-in” method: An experimental tool to investigate individual choice patterns under risk, in: Models and Experiments in Risk and Rationality, eds. B. Munier and M.J. Machina, Kluwer Academic, Dordrecht/Boston, 1994, pp. 141 – 155.

M. Abdellaoui and B. Munier, On the fundamental risk-structure dependence of individual preferences under risk, Working Paper GRID 94-07, 1994.

M. Abdellaoui and B. Munier, Rank dependent utility vs. expected utility: An experimental comparison, Working Paper GRID 96-01, 1996.

M. Abdellaoui, Is the probability transformation function in RDU models sensitive to the magnitude of losses?, Working Paper GRID 96-03, 1996.

M. Allais, The so-called Allais paradox and rational decisions under uncertainty, in: Expected Utility Hypotheses and the Allais Paradox, eds. M. Allais and O. Hagen, Reidel, Dordrecht/Boston, 1979, pp. 473 – 681.

R.C. Battalio, J.H. Kagel and R. Jiranyakul, Testing between alternative models of choice under uncertainty: Some initial results, Journal of Risk and Uncertainty 3(1990)25 – 50.

C.F. Camerer, An experimental test of several generalized utility theories, Journal of Risk and Uncertainty 2(1989)61 –104.

C.F. Camerer and T-H. Ho, Violations of the betweenness axiom and nonlinearity in probability, Journal of Risk and Uncertainty 8(1994)167 – 196.

E. Carbone and J.D. Hey, Discriminating between preference functionals: A preliminary Monte Carlo study, Journal of Risk and Uncertainty 8 (1994)223 – 242.

E. Carbone and J.D. Hey, A comparison of the estimates of expected utility and non-expected utility preference functionals, Geneva Papers on Risk and Insurance Theory 20(1995)111 – 133.

S.H. Chew and W.S. Waller, Empirical tests of weighted utility theory, Journal of Mathematical Psychology 30(1986)55 – 72.

M. Cohen, J.-Y. Jaffray and T. Said, Experimental comparison of individual behavior under risk and under uncertainty for gains and for losses, Organizational Behavior and Human Decision Processes 39 (1987)1– 22.

D. Harless, Predictions about indifference curves inside the unit triangle, a test of variants of expected utility theory, Journal of Economic Behavior and Organization 18(1992)391– 414.

D. Harless and C.F. Camerer, The utility of generalized expected utility theories, Econometrica 62(1994)1251–1289.

J. Hey and Ch. Orme, Investigating generalizations of expected utility theory using experimental data, Econometrica 62(1994)1251 – 1289.

J. Hey and E. Strazzera, Estimation of indifference curves in the Marschak – Machina triangle, Journal of Behavioral Decision Making 2(1989)239 – 260.

R.L. Keeney and H. Raiffa, Decisions with Multiple Objectives, Wiley, New York, 1976.

M. J. Machina, Expected utility analysis without the independence axiom, Econometrica 50(1982) 277 – 323.

M.J. Machina, Generalized expected utility analysis and the nature of observed violations of the independence axiom, in: Foundations of Utility and Risk Theory with Applications, eds. B.P. Stigum and F. Wenstøp, Reidel, Dordrecht, 1983.

M. McCord and R. de Neufville, Empirical demonstration that expected utility decision analysis is not operational, in: Foundations of Utility and Risk Theory, eds. B.P. Stigum and F. Wenstøp, Reidel, DordrechtyBoston, 1983, pp. 181 – 199.

B. Munier and M.J. Machina, Models and Experiments in Risk and Rationality, Kluwer Academic, Dordrechty/Boston, 1994.

B. Sopher and G. Gigliotti, A Test of generalized expected utility theory, Theory and Decision 35(1993)75 – 106.

B.J. Winer, Statistical Principles in Experimental Design, McGraw-Hill, New York, 1971.

Rights and permissions

About this article

Cite this article

Abdellaoui, M., Munier, B. The risk-structure dependence effect:Experimenting with an eye to decision-aiding. Annals of Operations Research 80, 237–252 (1998). https://doi.org/10.1023/A:1018916031387

Issue Date:

DOI: https://doi.org/10.1023/A:1018916031387