Abstract

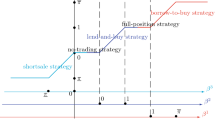

This paper considers the portfolio selection problem with different interest rates for borrowing and leading. The portfolio frontier is described under the general condition that the riskless borrowing rate is higher than the riskless lending rate.

Similar content being viewed by others

References

Black F. and Scholes M. (1973) The pricing of options and corporate liabilities. Journal of Political Economics 81, 637–659.

Chamberlain G. (1983) A characterization of the distributions that imply mean-variance utility functions. Journal of Economic Theory 29, 185–201.

Cvitanic J. and Karatzas I. (1992) Convex duality in constrained portfolio optimization. The Annals Applied Probability 2, 767–818.

Cvitanic J. and Karatzas I. (1993) Hedging contingent claims with constrained portfolios. The Annals Applied Probability 3, 652–681.

Karoui El. and Quenez M.-C. (1995) Dynamic programming and pricing of contingent claims in an incomplete market. SIAM Journal on Control and Optimization 33, 29–66.

Epstein L. (1985) Decreasing risk aversion and mean-variance analysis. Econometrica 53, 945–962.

Gonzalez-Gaverra N. (1973) Inflation and capital asset market prices: theory and tests. Unpublished Ph.D. dissertation, Stanford University.

Huang C-F. and Litzenberger R.H. (1988) Foundations for financial economics. Princeton University, California, Academic Press.

Markowitz H. (1952) Portfolio selection. Journal of Finance 7, 77–91.

Merton R.C. (1972) An analytical derivation of the efficient portfolio frontier. Journal of Financial and Quantitative Analysis 7, 1851–1872.

Merton R.C. (1973) Theory of rational option pricing. Bell Journal of Economics and Management Science 4, 141–183.

Merton R.C. (1990) Continuous-Time Finance. Blackwell Publishers, Cambridge, MA.

Munk C. (1997) No-arbitrage bounds on contingent claims prices with convex constraints on the dollar investments of the hedge portfolio. Working paper, Odense University.

Roll R. (1977) A critique of the asset pricing theory's tests. Journal of Financial Economics 4, 129–176.

Rothschild M. and Stiglitz J. (1970) Increasing risk: I. A definition. Journal of Economic Theory 2, 225–243.

Rothschild M. and Stiglitz J. (1972) Addendum to ‘Increasing risk: I. A definition’. Journal of Economic Theory 3, 66–84.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Zhang, S., Wang, S. & Deng, X. Portfolio Selection Theory with Different Interest Rates for Borrowing and Leading. Journal of Global Optimization 28, 67–95 (2004). https://doi.org/10.1023/B:JOGO.0000006719.64826.55

Issue Date:

DOI: https://doi.org/10.1023/B:JOGO.0000006719.64826.55