Abstract

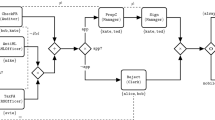

An algorithm was developed and implemented to find controllers of the stock shares for some financial institutions for the Brazilian Central Bank (BCB). The original problem is similar to a typical Sum of Subset problem that might be solved by a backtracking algorithm and the problem complexity is NP-complete. Usually BCB solves this problem manually which is time consuming and prone to errors. The heuristical approximation algorithm presented in this paper has polynomial complexity O(n3) and is based on subroutines for determining controllers at the first two levels. The paper describes the basic concepts and business rules currently employed in BCB, our algorithm and its major subroutines. It also gives a brief complexity analysis and an example at level 2. Our experimental results indicate the feasibility of an automation of the process of finding controllers. Though developed for BCB, our algorithm works equally well for other financial institutions.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Author information

Authors and Affiliations

Editor information

Rights and permissions

About this chapter

Cite this chapter

Guilherme Fracari Branco, V., Weigang, L., Pilar Estrela Abad, M. An Algorithm for Determining the Controllers of Supervised Entities: A Case Study with the Brazilian Central Bank. In: K. Halgamuge, S., Wang, L. (eds) Computational Intelligence for Modelling and Prediction. Studies in Computational Intelligence, vol 2. Springer, Berlin, Heidelberg. https://doi.org/10.1007/10966518_20

Download citation

DOI: https://doi.org/10.1007/10966518_20

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-26071-4

Online ISBN: 978-3-540-32402-7

eBook Packages: EngineeringEngineering (R0)