Abstract

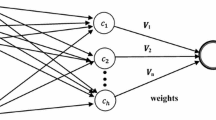

Nonparametric approaches of estimating the yield curve have been widely used as alternative approaches that supplement parametric approaches. In this paper, we propose a novel yield curve estimating algorithm based on radial basis function networks, which is a nonparametric approach. The proposed method is devised to improve accuracy and smoothness of the fitted curve. Numerical experiments are conducted for 57 U.S. Treasury securities with different maturities and demonstrate a significant performance improvement to reduce test error compared to other existing algorithms.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

James, J., Webber, N.: Interest Rate Modeling. John Wiley & Sons Ltd., London (2000)

Nelson, C.R., Siegel, A.F.: Parsimonious Modeling of Yield Curves. The Journal of Business 60, 473–489 (1987)

de Boor, C.: A Practical Guide to Splines. Springer, Heidelberg (1978)

Lee, D.-W., Choi, H.-J., Lee, J.: A Regularized Line Search Tunneling for Efficient Neural Network Learning. In: Yin, F.-L., Wang, J., Guo, C. (eds.) ISNN 2004. LNCS, vol. 3173, pp. 239–243. Springer, Heidelberg (2004)

Dierckx, P.: Curve and Surface with Splines. Oxford Science Publications, New York (1995)

Choi, H.-J., Lee, H.-S., Han, G.-S., Lee, J.: Efficient Option Pricing via a Globally Regularized Neural Network. In: Yin, F.-L., Wang, J., Guo, C. (eds.) ISNN 2004. LNCS, vol. 3174, pp. 988–993. Springer, Heidelberg (2004)

Hastie, T., Tibshirani, R., Friedman, J.: The Elements of Statistcal Learning: Data Mining, Inference, and Prediction. Springer, Heidelberg (2001)

Lee, J.: Attractor-Based Trust-Region Algorithm for Efficient Training of Multilayer Perceptrons. Electronics Letters 39, 71–72 (2003)

Haykin, S.: Neural Networks: A Comprehensive Foundation. Prentice-Hall, New York (1999)

Lee, J., Chiang, H.-D.: A Dynamical Trajectory-Based Methodology for Systematically Computing Multiple Optimal Solutions of General Nonlinear Programming Problems. IEEE Transactions on Automatic Control 49, 888–899 (2004)

Nocedal, J., Wright, S.J.: Numerical Optimization. Springer, Heidelberg (1999)

Bliss, R.R.: Testing Term Structure Estimation Methods. Advances in Futures and Options Research 9, 197–231 (1997)

McCulloch, J.H.: The Tax Adjusted Yield Curve. Journal of Finance 30, 811–830 (1975)

Fisher, M., Nychka, D., Zervos, D.: Fitting the Term Structure of Interest Rates with Smoothing Splines. Working Paper 95-1, Finance and Economics Discussion Series, Federal Reserve Board, Washington (1995)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2005 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Han, G., Lee, D., Lee, J. (2005). Estimating the Yield Curve Using Calibrated Radial Basis Function Networks. In: Wang, J., Liao, XF., Yi, Z. (eds) Advances in Neural Networks – ISNN 2005. ISNN 2005. Lecture Notes in Computer Science, vol 3497. Springer, Berlin, Heidelberg. https://doi.org/10.1007/11427445_142

Download citation

DOI: https://doi.org/10.1007/11427445_142

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-25913-8

Online ISBN: 978-3-540-32067-8

eBook Packages: Computer ScienceComputer Science (R0)