Abstract

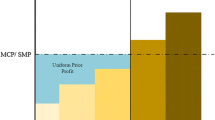

Investigate how the level of rationality of power suppliers impacts on equilibrium. First fictitious play was established to electricity market. Then a leaning model Price-deviation-adjust (PD-adjust) was proposed, which inherits main characters of the fictitious play but in a lower rationality because of poor information. An interesting phenomenon is observed in numerical simulations: the errors coming from lower rationality of the agents can be reinforced and often bring the agents extra profits rather than loss, and eventually drive the market to enter an unstable state from the stable equilibrium one. The conclusion is a set of game models identified by a rationality variable should be introduced to understand the electricity market better.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Xiaohong, G., Yuchi, H., David, L.P.: Gaming and Price Spikes in Electric Power Markets. IEEE Transactions on Power Systems 16, 402–408 (2001)

Aleksandr, R., Tabors, C.: Supply Function Equilibrium: Theory and Applications. In: 36th Annual Hawaii International Conference on System Sciences (HICSS 2003), Track 2, Big Island, Hawaii (2003)

Drew, F., David, K.L.: The Theory of Learning in Games. MIT Press, Cambridge (1998)

Camerer, C.F.: Behavioral Game Theory: Experiments in Strategic Interaction. Princeton University Press, Princeton (2003)

Martin, D.: Review of Ariel Rubinstein’s Modeling Bounded Rationality. Economics & Philosophy 17, 134–140 (2001)

Ido, E., Alvin, E.R.: Predicting How People Play Games: Reinforcement Learning Experimental Games with Unique, Mixed Strategy Equilibria. The American Economic Review 88, 847–880 (1998)

Sarin, R., Vahid, F.: Predicting How People Play Games: A Simple Dynamic Model of Choice. Games and Economic Behavior 34, 104–122 (2001)

Sarin, R., Vahid, F.: Payoff Assessments without Probabilities: A Simple Dynamic Model of Choice. Games and Economic Behavior 28, 294–309 (1999)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2005 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Zhou, X., Feng, L., Dong, X., Shang, J. (2005). Fictitious Play and Price-Deviation-Adjust Learning in Electricity Market. In: Wang, L., Chen, K., Ong, Y.S. (eds) Advances in Natural Computation. ICNC 2005. Lecture Notes in Computer Science, vol 3612. Springer, Berlin, Heidelberg. https://doi.org/10.1007/11539902_45

Download citation

DOI: https://doi.org/10.1007/11539902_45

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-28320-1

Online ISBN: 978-3-540-31863-7

eBook Packages: Computer ScienceComputer Science (R0)