Abstract

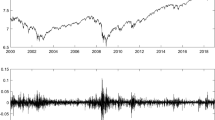

We compare the performance of competitive and collaborative strategies for mixtures of autoregressive experts with normal innovations for conditional risk analysis in financial time series. The prediction of the mixture of collaborating experts is an average of the outputs of the experts. If a competitive strategy is used the prediction is generated by a single expert. The expert that becomes activated is selected either deterministically (hard competition) or at random, with a certain probability (soft competition). The different strategies are compared in a sliding window experiment for the time series of log-returns of the Spanish stock index IBEX 35, which is preprocessed to account for the heteroskedasticity of the series. Experiments indicate that the best performance for risk analysis is obtained by mixtures with soft competition, where the experts have a probability of activation given by the output of a gating network of softmax units.

This work has been supported by the Spanish Dirección General de Investigació n, project TIN2004-07676-C02-02. J. M. Hernández-Lobato acknowledges the support of Universidad Autónoma de Madrid under an FPU grant.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Jorion, P.: Value at Risk. McGraw-Hill Professional, New York (2000)

Artzner, P., Delbaen, F., Eber, J.M., Heath, D.: Coherent measures of risk. Mathematical Finance 9(3), 203–228 (1999)

Cont, R.: Empirical properties of asset returns: stylized facts and statistical issues. Quantitative Finance 1(2), 223–236 (2001)

Kon, S.J.: Models of stock returns–a comparison. Journal of Finance 39(1), 147–165 (1984)

Mandelbrot, B.: The variation of certain speculative prices. Journal of Business 36(4), 394–419 (1963)

Fama, E.F., French, K.R.: Permanent and temporary components of stock prices. The Journal of Political Economy 96(2), 243–276 (1988)

Akgiray, V.: Conditional heteroscedasticity in time series of stock returns: Evidence and forecasts. The Journal of Business 62(1), 55–80 (1989)

Engle, R.: Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. inflation. Econometrica 50, 987–1008 (1982)

Bollerslev, T.: Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 31, 307–327 (1986)

Suárez, A.: Mixtures of autoregressive models for financial risk analysis. In: Dorronsoro, J.R. (ed.) ICANN 2002. LNCS, vol. 2415, p. 1186. Springer, Heidelberg (2002)

Vidal, C., Suárez, A.: Hierarchical mixtures of autoregressive models for time-series modeling. In: Kaynak, O., Alpaydın, E., Oja, E., Xu, L. (eds.) ICANN 2003 and ICONIP 2003. LNCS, vol. 2714, pp. 597–606. Springer, Heidelberg (2003)

Jacobs, R.A., Jordan, M.I., Nowlan, S., Hinton, G.E.: Adaptive mixtures of local experts. Neural Computation 3, 1–12 (1991)

Jordan, M.I., Jacobs, R.A.: Hierarchical mixtures of experts and the EM algorithm. Neural Computation 6, 181–214 (1994)

Sociedad de Bolsas: Histórico Cierres Índices Ibex (2006), http://www.sbolsas.es

Hamilton, J.D.: Time Series Analysis. Princeton University Press, Princeton (1994)

Bishop, C.: Neural Networks for Pattern Recognition. Oxford University Press, Oxford (1996)

Jacobs, R.A., Jordan, M.I., Barto, A.G.: Task decompostiion through competition in a modular connectionist architecture: The what and where vision tasks. Machine Learning: From Theory to Applications, 175–202 (1993)

Mathworks: Matlab Optimization toolbox 2.2. Mathworks, Inc., Natick (2002)

Hamilton, J.D.: A quasi-bayesian approach to estimating parameters for mixtures of normal distributions. Journal of Business & Economic Statistics 9(1), 27–39 (1991)

Rosenblatt, M.: Remarks on a multivariate transformation. The Annals of Mathematical Statistics 23(3), 470–472 (1952)

Kerkhof, J., Melenberg, B.: Backtesting for risk-based regulatory capital. Journal of Banking & Finance 28(8), 1845–1865 (2004)

Kupiec, H.: Techniques for verifying the accuracy of risk management models. Journal of Derivatives 3 (1995)

van der Vaart, A.W.: Asymptotic Statistics. Cambridge University Press, Cambridge (2000)

Wilcoxon, F.: Individual comparisons by ranking methods. Biometrics Bulletin 1(6), 80–83 (1945)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2006 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Hernández-Lobato, J.M., Suárez, A. (2006). Competitive and Collaborative Mixtures of Experts for Financial Risk Analysis. In: Kollias, S., Stafylopatis, A., Duch, W., Oja, E. (eds) Artificial Neural Networks – ICANN 2006. ICANN 2006. Lecture Notes in Computer Science, vol 4132. Springer, Berlin, Heidelberg. https://doi.org/10.1007/11840930_72

Download citation

DOI: https://doi.org/10.1007/11840930_72

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-38871-5

Online ISBN: 978-3-540-38873-9

eBook Packages: Computer ScienceComputer Science (R0)