Abstract

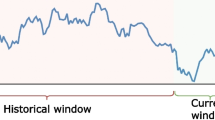

This paper proposes ε -descending support vector machines ( ε - DSVMs) to model non-stationary financial time series. The ε -DSVMs are obtained by taking into account the problem domain knowledge of non- stationarity in the financial time series. Unlike the original SVMs which use the same tube size in all the training data points, the ε -DSVMs use the tube whose value decrease from the distant training data points to the recent training data points. Three real futures which are collected from the Chicago Mercantile Market are examined in the experiment, and it is shown that the ε-DSVMs consistently forecast better than the original SVMs.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Hall, J. W.: Adaptive Selection of U.S. Socks with Neural Nets. Trading On the Edge: Neural, Genetic, and Fuzzy Systems for Chaotic Financial Markets, Wiley, New York (1994)

Yaser, S. A. M., Atiya, A. F.: Introduction to Financial Forecasting. Applied Intelligence 6 (1996) 205–213

Refenes, A. N. Bentz, Y., Bunn, D. W., Burgess, A. N., Zapranis, A. D.: Financial Time Series Modelling with Discounted Least Squares Back-propagation. Neurocomputing 14 (1997) 123–138

Vapnik, V. N.: The Nature of Statistical Learning Theory. Springer-Verlag, New York 1995

Muller, R., Smola, J. A., Scholkopf, B.: Prediction Time Series with Support Vector Machines. In Proceedings of International Conference on Artificial Neural Networks ( 1997) 999

Vapnik, V. N., Golowich, S. E., Smola, A. J.: Support Vector Method for Function Approximation, Regression Estimation, and Signal Processing. Advances in Neural Information Processing Systems 9 (1996) 281–287

Smola, A. J., Scholkopf, B.: A tutorial on Support Vector Regression. NeuroCOLT Technical Report TR, Royal Holloway College, London, UK 1998

Smola, A.J.: Learning with Kernels. PhD Thesis, GMD, Birlinghoven, Germany 1998

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2000 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Cao, L.J., Tay, F.E.H. (2000). ε-Descending Support Vector Machines for Financial Time Series Forecasting. In: Leung, K.S., Chan, LW., Meng, H. (eds) Intelligent Data Engineering and Automated Learning — IDEAL 2000. Data Mining, Financial Engineering, and Intelligent Agents. IDEAL 2000. Lecture Notes in Computer Science, vol 1983. Springer, Berlin, Heidelberg. https://doi.org/10.1007/3-540-44491-2_39

Download citation

DOI: https://doi.org/10.1007/3-540-44491-2_39

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-41450-6

Online ISBN: 978-3-540-44491-6

eBook Packages: Springer Book Archive