Abstract

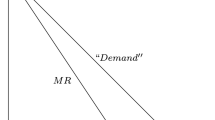

One variant of the Dutch auction roughly corresponds to a multi-unit, progressively ascending, uniform price, lowest winning bid, open auction. The overall revenue realized by the auctioneer in such an auction is given by R = Q × pw where, Q is the number of units of the item being auctioned, and pw is the lowest winning bid price at the end of the auction. R is only dependent on pw(Q being fixed) and an interesting question is whether it is possible to increase R.

Proposed in this paper is a method for increasing pw (and consequently R). Given that the maximum bid that a bidder places reflects his or her valuation, our method relies on increasing the valuation of those bidders whose valuations are in close proximity to the lowest winning bid price. We propose achieving this objective through the use of a coupon, which is introduced at an algorithmically determined time during the auction, and which, if introduced, assumes a non-decreasing face value. The coupon can be used by all participants—the price paid by participants with winning bids utilizing the coupon is discounted by the face value of the coupon at the end of the auction process. Assuming other things are equal, participants with bids at or near the lowest winning bid price during the auction are more likely to use the coupon and increase their bids by an amount in excess of their valuation (the excess being recovered through the use of the coupon) thereby creating additional competition and potentially increasing pw.

We present an algorithm that determines, based on present auction dynamics, if a coupon should be introduced, the initial face value of it, and possible subsequent revisions of the coupon face value. We also present a simple example to illustrate the algorithmic steps and illustrate the increase in R that results as a consequence of the proposed methodology.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

R. Bapna, P. Goes, and A. Gupta, “A theoretical and empirical investigation of multi-item online auctions,” Information Technology and Management, Vol. 1, pp. 1–23, 2000.

R. Bapna, P. Goes, and A. Gupta, “Compartive analysis of multi-item online auctions: evidence from the laboratory,” Decision Support Systems, Vol. 32, pp. 135–153, 2001.

P. K. Kopalle, C. F. Mela, and L. Marsh, “The dynamic effect of discounting on sales: empirical analysis and normative pricing,” Marketing Science, Vol. 18, No. 3, 1999.

P. Alsemgeest, C. Noussair, and M. Olson, “Experimental comparison of auction under single and multi-unit demand,” Economic Inquiry, Vol. 36, pp. 87–98, 1998.

W. Vickrey, “Conter-speculation, auctions, and competetive sealed tenders,” Journal of Finance, Vol. 41, pp. 8–37, 1961.

P. Milogram, “Auctions and bidding: a primer,” Journal of Economic Perspectives, Vol. 3, pp. 3–22, 1989.

J.C. Cox, V. L. Smith, and J. M. Walker, “Expected revenue in discriminative and uniform price sealed-bid auctions,” Research in Experimental Economics, Vol. 3, pp. 183–232, 1985.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2002 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Kothari, R., Mohania, M., Kambayashi, Y. (2002). Increasing Realized Revenue in a Web Based Dutch Auction. In: Bauknecht, K., Tjoa, A.M., Quirchmayr, G. (eds) E-Commerce and Web Technologies. EC-Web 2002. Lecture Notes in Computer Science, vol 2455. Springer, Berlin, Heidelberg. https://doi.org/10.1007/3-540-45705-4_2

Download citation

DOI: https://doi.org/10.1007/3-540-45705-4_2

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-44137-3

Online ISBN: 978-3-540-45705-3

eBook Packages: Springer Book Archive