Abstract

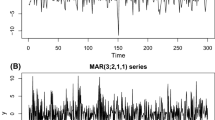

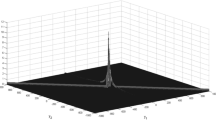

The structure of the time-series of returns for the IBEX35 stock index is analyzed by means of a class of non-linear models that involve probabilistic mixtures of autoregressive processes. In particular, a specification and implementation of probabilistic mixtures of GARCH processes is presented. These mixture models assume that the time series is generated by one of a set of alternative autoregressive models whose probabilities are produced by a gating network. The ultimate goal is to provide an adequate framework for the estimation of conditional risk measures, which can account for non-linearities, heteroskedastic structure and extreme events in financial time series. Mixture models are sufficiently flexible to provide an adequate description of these features and can be used as an effective tool in financial risk analysis.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

R. Jacobs and M. Tanner. Mixtures of X. In A. J. C. Sharkey, editor, Combining Artificial Neural Nets, pages 267–296, London, 1999. Springer.

A. S. Weigend, M. Mangeas, and A. N. Srivastava. Nonlinear gated experts for time series: Discovering regimes and avoiding overfitting. International Journal of Neural Systems, 6(4):373–399, 1995.

A. J. Zeevi, R. Meir, and R. J. Adler. Non-linear models for time series using mixtures of autorregressive models. Preprint, 1999.

C. S. Wong and W. K. Li. On a mixture autoregressive model. Journal of the Royal Statistical Society B, 62:95–115, 2000.

G. González-Rivera. Smooth transition GARCH models. Studies in Nonlinear Dynamics and Econometrics, 3:61–78, 1998.

S. Lundbergh and T. Tersvirta. Modelling economic high-frequency time series with STAR-GARCH models. Working Paper, No. 291, Stockholm School of Economics, 1998.

J. D. Hamilton. Time Series Analysis. Princeton University Press, Princeton, NJ, 1994.

M. I. Jordan and R. A. Jacobs. Hierarchical mixtures of experts and the EM algorithm. Neural Computation, 6:181–214, 1994.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2002 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Suárez, A. (2002). Mixtures of Autoregressive Models for Financial Risk Analysis. In: Dorronsoro, J.R. (eds) Artificial Neural Networks — ICANN 2002. ICANN 2002. Lecture Notes in Computer Science, vol 2415. Springer, Berlin, Heidelberg. https://doi.org/10.1007/3-540-46084-5_192

Download citation

DOI: https://doi.org/10.1007/3-540-46084-5_192

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-44074-1

Online ISBN: 978-3-540-46084-8

eBook Packages: Springer Book Archive