Abstract

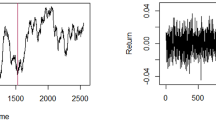

Markov-switching (MS) model is one of the most popular nonlinear time series models in the literature. However, as there are many methods for parameter estimation, the results including the plot are not similar and become more difficult for researchers to decide on the interpretation. Therefore, this study is conducted as we want to obtain a more sensitive estimation method for the MS model. This study attempts to improve the way we estimate the MS model by developing a more flexible estimator for it to be called a maximum empirical likelihood estimation (MELE). A key point of this method is that a conventional parametric likelihood is replaced by the empirical likelihood function with relatively minor modifications to existing recursive filters. To evaluate the new method’s performance, we apply the MS model to the U.S. business cycle. The estimated results from the MELE are discussed and compared to those from classical parametric estimations. It is found that the empirical likelihood could outperform the classical likelihood estimators.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Button, K.S., Ioannidis, J.P., Mokrysz, C., Nosek, B.A., Flint, J., Robinson, E.S., Munafò, M.R.: Power failure: why small sample size undermines the reliability of neuroscience. Nat. Rev. Neurosci. 14(5), 365 (2013)

Brandt, P.: MSBVAR: Markov-Switching, Bayesian, vector autoregression models. R package version 0.9-1 (2014)

Chen, S.X., Van Keilegom, I.: A review on empirical likelihood methods for regression. Test 18(3), 415–447 (2009)

Dempster, A.P., Laird, N.M., Rubin, D.B.: Maximum likelihood from incomplete data via the EM algorithm. J. R. Stat. Soc. Ser. B (Methodol.) 39(1), 1–38 (1977)

Hamilton, J.D.: A new approach to the economic analysis of nonstationary time series and the business cycle. Econ. J. Econ. Soc. 357–384(1989)

Howrey, E.P.: The role of time series analysis in econometric model evaluation. In: Evaluation of Econometric Models, pp. 275–307 (1980)

Kim, C.J., Nelson, C.R.: Has the US economy become more stable? A Bayesian approach based on a Markov-switching model of the business cycle. Rev. Econ. Stat. 81(4), 608–616 (1999)

Lourens, S., Zhang, Y., Long, J.D., Paulsen, J.S.: Bias in estimation of a mixture of normal distributions. J. Biom. Biostat. 4 (2013)

Maneejuk, P., Yamaka, W., Sriboonchitta, S.: A Markov-switching model with mixture distribution regimes. In: International Symposium on Integrated Uncertainty in Knowledge Modelling and Decision Making, pp. 312–323. Springer, Cham, March 2018

Mykland, P.A.: Bartlett identities and large deviations in likelihood theory. Ann. Stat. 27(3), 1105–1117 (1999)

Owen, A.B.: Empirical likelihood ratio confidence intervals for a single functional. Biometrika 75(2), 237–249 (1988)

Owen, A.: Empirical likelihood for linear models. Ann. Stat., 1725–1747 (1991)

Peto, R., Pike, M., Armitage, P., Breslow, N.E., Cox, D.R., Howard, S.V., Mantel, N., McPherson, K., Peto, J., Smith, P.G.: Design and analysis of randomized clinical trials requiring prolonged observation of each patient. II. analysis and examples. Br. J. Cancer 35(1), 1 (1977)

Springer, T., Urban, K.: Comparison of the EM algorithm and alternatives. Numer. Algorithms 67(2), 335–364 (2014)

Sriboochitta, S., Yamaka, W., Maneejuk, P., Pastpipatkul, P.: A generalized information theoretical approach to non-linear time series model. In: Kreinovich, V., Sriboonchitta, S., Huynh, V.N. (eds.) Robustness in Econometrics, pp. 333–348. Springer, Cham (2017)

Variyath, A.M., Chen, J., Abraham, B.: Empirical likelihood based variable selection. Journal of Statistical Planning and Inference 140(4), 971–981 (2010)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Maneejuk, P., Yamaka, W., Sriboonchitta, S. (2019). Measuring U.S. Business Cycle Using Markov-Switching Model: A Comparison Between Empirical Likelihood Estimation and Parametric Estimations. In: Kreinovich, V., Sriboonchitta, S. (eds) Structural Changes and their Econometric Modeling. TES 2019. Studies in Computational Intelligence, vol 808. Springer, Cham. https://doi.org/10.1007/978-3-030-04263-9_47

Download citation

DOI: https://doi.org/10.1007/978-3-030-04263-9_47

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-04262-2

Online ISBN: 978-3-030-04263-9

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)