Abstract

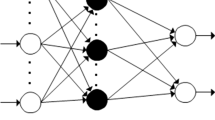

Various models and methods for analyzing the risk of enterprises bankruptcy using discriminant analysis, artificial neural networks and statistical approaches are presented. The specific problems of the Ukrainian economy are described - the lack of a large number of enterprises in the stock market, the inaccessibility of information about the real financial condition of some enterprises, the vagueness of the definition of bankruptcy. The possibility of using foreign models for Ukrainian enterprises is considered. The advantages, disadvantages and practical significance of the considered models in modern economic conditions are determined. Experimental studies have been carried out to compare statistical models, artificial neural networks of the perceptron type, regression models and binary trees in bankruptcy risk problems. A comparative analysis of the effectiveness of the use of these approaches to assess the financial stability of Ukrainian enterprises has been carried out. The most adequate methods were determined by the example of a specific enterprise actually functioning in Ukraine.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Altman E (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609

Altman E, Hotchkiss E (2005) Corporate financial distress and bankruptcy: predict and avoid bankruptcy, analyze and invest in distressed debt, 3rd edn. Wiley, New York

Tereshchenko O (2009) Management of financial rehabilitation of enterprises, 2nd edn. KNEU, Kyiv (in Ukrainian)

Matviychuk A (2013) Fuzzy, neural network and discriminant models for diagnosing the possibility of bankruptcy of enterprises. Neuro-Fuzzy Simul Technol Econ 2:71–118 (in Ukrainian)

Kaidanovich D (2010) Estimation of the risk of bankruptcy of enterprises with the use of counterproliferation neural networks. Sci Notes Natl Univ Ostroh Acad Ser Econ 15:468–474 (in Ukrainian)

Debunov L (2017) Application of artificial neural networks in modeling financial sustainability of an enterprise. Bus Inform 9:112–119 (in Ukrainian)

Tymoshchuk O, Dorundiak K (2018) Estimation of the probability of bankruptcy of enterprises through discriminant analysis and neural networks. Syst Res Inf Technol 2:22–33 (in Ukrainian)

Baek J, Cho S (2003) Bankruptcy prediction for credit risk using an auto-associative neural network in Korean firms. In: Proceedings of the IEEE international conference on computational intelligence for financial engineering, pp 25–29

Ostrovska G, Kvasovsky O (2011) Analysis of the practice of using foreign methods (models) for predicting the probability of bankruptcy of enterprises. Galician Econ J 2(31):99–111 (in Ukrainian)

Hastie T, Tibshirani R, Friedman J (2009) Random forests. In: The elements of statistical learning: data mining, inference, and prediction, 2nd edn. Springer, Heidelberg. Chap 15

Zhang Y, Wu L (2011) Bankruptcy prediction by genetic ant colony algorithm. Adv Mater Res 186:459–463

Korol T (2013) Early warning models against bankruptcy risk for Central European and Latin American enterprises. Econ Model 31:22–30

Khaykin S (2006) Neural networks: full course, 2nd edn. Publishing House Williams, Montreal Translation from English

Nielsen A (2015) Neural networks and deep learning. Determination Press, San Francisco

Ohlson J (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Acc Res 18(1):109–131

Breiman L (2001) Random forests. Mach Learn 45:1

Ho T (1995) Random decision forests. In: Proceedings of the third international conference on document analysis and recognition, vol 1, pp 278–282

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Tymoshchuk, O., Kirik, O., Dorundiak, K. (2020). Comparative Analysis of the Methods for Assessing the Probability of Bankruptcy for Ukrainian Enterprises. In: Lytvynenko, V., Babichev, S., Wójcik, W., Vynokurova, O., Vyshemyrskaya, S., Radetskaya, S. (eds) Lecture Notes in Computational Intelligence and Decision Making. ISDMCI 2019. Advances in Intelligent Systems and Computing, vol 1020. Springer, Cham. https://doi.org/10.1007/978-3-030-26474-1_20

Download citation

DOI: https://doi.org/10.1007/978-3-030-26474-1_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-26473-4

Online ISBN: 978-3-030-26474-1

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)