Abstract

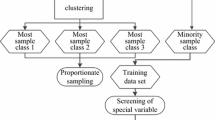

This paper applies support vector machine (SVM), decision tree C5.0, and CHAID to the detection of financial reporting frauds by establishing an effective detection model. The research data covering 2007-2016 is sourced from the Taiwan Economic Journal (TEJ). The sample consists of 28 companies engaged in financial statement frauds and 84 companies not involved in such frauds (at a ratio of 1 to 3), as listed on the Taiwan Stock Exchange and the Taipei Exchange during the research period. This paper selects key variables with SVM and C5.0 before establishing the model with CHAID and SVM. Both financial and non-financial variables are used to enhance the accuracy of the detection model for financial reporting frauds. The research suggests that the C5.0-SVM model yields the highest accuracy rate of 83.15%, followed by SVM-SVM (81.91%), the C5.0-CHAID model (80.93%), and the SVM-CHAID model (77.16%).

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Yeh, C.C., Chi, D.J., Lin, T.Y., Chiu, S.H.: A hybrid detecting fraudulent financial statements model using rough set theory and support vector machines. Cybern. Syst. 47, 261–276 (2016)

Chen, S.: Detection of fraudulent financial statements using the hybrid data mining approach. SpringerPlus 5, 89 (2016). https://doi.org/10.1186/s40064-016-1707-6

Jan, C.L.: An effective financial statements fraud detection model for the sustainable development of financial markets: evidence from Taiwan. Sustainability 10(2), 513 (2018). https://doi.org/10.3390/su10020513

Beasley, M.: An empirical analysis of the relation between the board of director composition and financial statement fraud. Account Rev. 71(4), 443–466 (1996)

Ravisankar, P., Ravi, V., Rao, G.R., Bose, I.: Detection of financial statement fraud and feature selection using data mining techniques. Decis. Support Syst. 50, 491–500 (2011)

Humpherys, S.L., Moffitt, K.C., Burns, M.B., Burgoon, J.K., Felix, W.F.: Identification of fraudulent financial statements using linguistic credibility analysis. Decis. Support Syst. 50, 585–594 (2011)

Salehi, M., Fard, F.Z.: Data mining approach to prediction of going concern using classification and regression tree (CART). Glob. J. Manag. Bus. Res. Account. Audit. 13, 25–29 (2013)

Chen, S., Goo, Y.J., Shen, Z.D.: A hybrid approach of stepwise regression, logistic regression, support vector machine, and decision tree for forecasting fraudulent financial statements. Sci. World J. (2014). https://doi.org/10.1155/2014/968712

Kotsiantis, S., Koumanakos, E., Tzelepis, D., Tampakas, V.: Forecasting fraudulent financial statements using data miming. World Enfor. Soc. 12, 283–288 (2014)

Boser, B.E., Guyon, I.M., Vapnik, V.N.: A training algorithm for optimal margin classifiers. In: Haussler D. (ed.) Proceedings of the Annual Conference on Computational Learning Theory, pp. 144–152. ACM Press, Pittsburgh (1992)

Quinlan, J.R.: C4.5–Programs for Machine Learning. Morgan Kaufmann, San Francisco (1993)

Kass, G.V.: An exploratory technique for investigating large quantities of categorical data. Appl. Statist. 29(2), 119–127 (1980)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Chi, DJ., Chu, CC., Chen, D. (2019). Applying Support Vector Machine, C5.0, and CHAID to the Detection of Financial Statements Frauds. In: Huang, DS., Huang, ZK., Hussain, A. (eds) Intelligent Computing Methodologies. ICIC 2019. Lecture Notes in Computer Science(), vol 11645. Springer, Cham. https://doi.org/10.1007/978-3-030-26766-7_30

Download citation

DOI: https://doi.org/10.1007/978-3-030-26766-7_30

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-26765-0

Online ISBN: 978-3-030-26766-7

eBook Packages: Computer ScienceComputer Science (R0)