Abstract

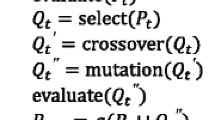

The Portfolio Selection Problem looks for a set of assets with the best trade-off between return and risk, that is, with the maximum expected return and the minimum risk (e.g., the variance of returns). As these objectives are conflicting, it is a difficult multi-objective problem. Different models and algorithms have been proposed to obtain the (optimal) Pareto front. However, exact approaches take days for a large set of points to the Pareto front. Within this perspective, we develop a basic variable neighborhood search heuristic to solve the bi-objective portfolio selection problem. The proposed heuristic considers ten neighborhood structures that are mainly based on swap moves and has a local improvement based on averaging the proportions that are invested in consecutive assets. The proposed heuristic was experimentally compared with the Mean-Variance model of Markowitz, using benchmark instances from the OR-Library. The number of assets in these instances ranges from 31 to 225. According to the experimental results, the proposed heuristic performed well in the construction of different Pareto fronts.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Anagnostopoulos, K.P., Mamanis, G.: A portfolio optimization model with three objectives and discrete variables. Comput. Oper. Res. 37(7), 1285–1297 (2010)

Anagnostopoulos, K.P., Mamanis, G.: The mean–variance cardinality constrained portfolio optimization problem: an experimental evaluation of five multiobjective evolutionary algorithms. Expert Syst. Appl. 38(11), 14208–14217 (2011)

Chang, T.J., Meade, N., Beasley, J., Sharaiha, Y.: Heuristics for cardinality constrained portfolio optimisation. Comput. Oper. Res. 27(13), 1271–1302 (2000)

Chen, C., Zhou, Y.: Robust multiobjective portfolio with higher moments. Expert Syst. Appl. 100, 165–181 (2018)

Corne, D.W., Knowles, J.D., Oates, M.J.: The pareto envelope-based selection algorithm for multiobjective optimization. In: Schoenauer, M., et al. (eds.) PPSN 2000. LNCS, vol. 1917, pp. 839–848. Springer, Heidelberg (2000). https://doi.org/10.1007/3-540-45356-3_82

De, M., Mangaraj, B.K., Das, K.B.: A fuzzy goal programming model in portfolio selection under competitive-cum-compensatory decision strategies. Appl. Soft Comput. 73, 635–646 (2018)

Deb, K., Pratap, A., Agarwal, S., Meyarivan, T.: A fast and elitist multiobjective genetic algorithm: NSGA-II. IEEE Trans. Evol. Comput. 6(2), 182–197 (2002)

Duarte, A., Pantrigo, J.J., Pardo, E.G., Mladenovic, N.: Multi-objective variable neighborhood search: an application to combinatorial optimization problems. J. Glob. Optim. 63(3), 515–536 (2014). https://doi.org/10.1007/s10898-014-0213-z

Fieldsend, J.E., Matatko, J., Peng, M.: Cardinality constrained portfolio optimisation. In: Yang, Z.R., Yin, H., Everson, R.M. (eds.) IDEAL 2004. LNCS, vol. 3177, pp. 788–793. Springer, Heidelberg (2004). https://doi.org/10.1007/978-3-540-28651-6_117

Hansen, P., Mladenović, N., Moreno Pérez, J.A.: Variable neighbourhood search: methods and applications. 4OR 6(4), 319–360 (2008)

Kalayci, C.B., Ertenlice, O., Akbay, M.A.: A comprehensive review of deterministic models and applications for mean-variance portfolio optimization. Expert Syst. Appl. 125, 345–368 (2019)

Konak, A., Coit, D.W., Smith, A.E.: Multi-objective optimization using genetic algorithms: a tutorial. Reliab. Eng. Syst. Saf. 91(9), 992–1007 (2006). Special Issue - Genetic Algorithms and Reliability

Konno, H., Yamazaki, H.: Mean-absolute deviation portfolio optimization model and its applications to tokyo stock market. Manage. Sci. 37(5), 519–531 (1991)

Kumar, D., Mishra, K.: Portfolio optimization using novel co-variance guided artificial bee colony algorithm. Swarm Evol. Comput. 33, 119–130 (2017)

Liagkouras, K., Metaxiotis, K.: A new probe guided mutation operator and its application for solving the cardinality constrained portfolio optimization problem. Expert Syst. Appl. 41(14), 6274–6290 (2014)

Macedo, L.L., Godinho, P., Alves, M.J.: Mean-semivariance portfolio optimization with multiobjective evolutionary algorithms and technical analysis rules. Expert Syst. Appl. 79, 33–43 (2017)

Markowitz, H.: Portfolio selection. J. Financ. 7(1), 77–91 (1952)

Markowitz, H.: Portfolio Selection: Efficient Diversfication of Investments, vol. 7. Wiley, New York (1959)

Mladenović, N., Hansen, P.: Variable neighborhood search. Comput. Oper. Res. 24(11), 1097–1100 (1997)

Nocedal, J., Wright, S.: Numerical Optimization. Springer, New York (2006). https://doi.org/10.1007/978-3-540-35447-5. https://www.springer.com/br/book/9780387303031

Ong, C.S., Huang, J.J., Tzeng, G.H.: A novel hybrid model for portfolio selection. Appl. Math. Comput. 169(2), 1195–1210 (2005)

Panadero, J., Doering, J., Kizys, R., Juan, A.A., Fito, A.: A variable neighborhood search simheuristic for project portfolio selection under uncertainty. J. Heuristics 1–23 (2018). https://doi.org/10.1007/s10732-018-9367-z

Schaffer, J.D.: Multiple objective optimization with vector evaluated genetic algorithms. In: Proceedings of the 1st International Conference on Genetic Algorithms, pp. 93–100. L. Erlbaum Associates Inc., Hillsdale (1985)

Skolpadungket, P., Dahal, K., Harnpornchai, N.: Portfolio optimization using multi-objective genetic algorithms. In: 2007 IEEE Congress on Evolutionary Computation, pp. 516–523, September 2007

Yitzhaki, S.: Stochastic dominance, mean variance, and Gini’s mean difference. Am. Econ. Rev. 72(1), 178–185 (1982)

Zitzler, E., Laumanns, M., Thiele, L.: SPEA2: improving the strength pareto evolutionary algorithm. Technical report, Computer Engineering and Networks Laboratory, Swiss Federation of Technology, Zurich (2001)

Acknowledgments

The authors would like to thank Intel, the National Counsel of Technological and Scientific Development (CNPq - grants 202006/2018-2 and 308312/2016-3), the State of Goiás Research Foundation (FAPEG), and the State of São Paulo Research Foundation (FAPESP - grant 2013/07375-0) for their financial support.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

de Queiroz, T.A., Mundim, L.R., de Carvalho, A.C.P.d.L.F. (2020). Multi-objective Basic Variable Neighborhood Search for Portfolio Selection. In: Benmansour, R., Sifaleras, A., Mladenović, N. (eds) Variable Neighborhood Search. ICVNS 2019. Lecture Notes in Computer Science(), vol 12010. Springer, Cham. https://doi.org/10.1007/978-3-030-44932-2_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-44932-2_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-44931-5

Online ISBN: 978-3-030-44932-2

eBook Packages: Computer ScienceComputer Science (R0)