Abstract

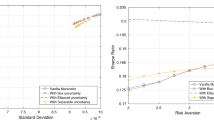

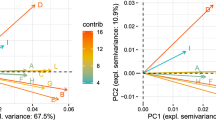

Portfolio optimization is a large area of investigation both in theoretical and practical setting since the seminal work by Markowitz where a mean-variance model was introduced. From optimization point of view, the problem of optimal portfolio in mean-variance setting can be formulated as convex quadratic optimization under uncertainty. In practice one needs to estimate parameters of the model to find an optimal portfolio. Error in the parameter estimation generates error in the optimal portfolio. It was observed that the out of sample behavior of obtained solution is not in accordance with what is expected. Main reason for this phenomena is related with the estimation of means of stock returns, estimation of covariance matrix being less important. In the present paper we study uncertainty of identification of efficient frontier (Pareto optimal portfolios) in mean-variance model. In order to avoid the estimation of means of returns we use CVaR optimization method by Rockafellar and Uryasev. First we prove, that for a large class of elliptical distributions efficient frontier in mean-variance model is identical to the trajectory of CVaR optimal portfolios with the change of the confidence level. This gives an alternative way to recover efficient frontier in mean-variance model. Next we conduct a series of numerical experiments to test the proposed approach. We show that proposed approach is competitive with existing methods.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Anderson, T.W.: An Introduction to Multivariate Statistical Analysis, 3rd edn. Wiley-Interscience, New York (2003)

Best, M.J., Grauer, R.R.: On the sensitivity of mean-variance-efficient portfolios to changes in asset means: some analytical and computational results. Rev. Financial Stud. 4(2), 315–342 (1991)

Chopra, V.K., Ziemba, W.T.: The effect of errors in means, variances, and covariances on optimal portfolio choice. J. Portfolio Manag. 19, 6–11 (1993)

DeMiguel, V., Garlappi, L., Uppal, R.: Optimal versus naive diversification: how inefficient is the 1/n portfolio strategy? Rev. Financial Stud. 22(5), 1915–1953 (2009)

Embrechts, P., McNeil, A., Straumann, D.: Correlation and dependence in risk management: properties and pitfalls. In: Dempster, M. (ed.) Risk Management Value at Risk and Beyond. Cambridge University Press, Cambridge (2002)

Guastaroba, G., Mansini, R., Speranza, M.G.: On the effectiveness of scenario generation techniques in single-period portfolio optimization. Eur. J. Oper. Res. 192(2), 500–511 (2009)

Gupta, F.K., Varga, T., Bodnar, T.: Elliptically Contoured Models in Statistics and Portfolio Theory. Springer, Heidelberg (2013). https://doi.org/10.1007/978-1-4614-8154-6

Jorion, P.: Bayes-Stein estimation for portfolio analysis. J. Financ. Quantitative Anal. 21(3), 279–292 (1986)

Kolm, P.N., Tütüncü, R., Fabozzi, F.: 60 Years of portfolio optimization: Practical Challenges Curr. Trends. Eur. J. Oper. Res. 234(2), 356–371 (2014)

Kalyagin, V.A., Slashchinin, S.V.: Impact of error in parameter estimations on large scale portfolio optimization. In: Demetriou, I.C., Pardalos, P.M. (eds.) Approximation and Optimization. SOIA, vol. 145, pp. 151–184. Springer, Cham (2019). https://doi.org/10.1007/978-3-030-12767-1_9

Ledoit, O.: Portfolio Selection: Improved Covariance Matrix Estimation (1994)

Ledoit, O., Wolf, M.: Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empirical Finance (2003)

Ledoit, O., Wolf, M.: Honey, I Shrunk the Sample Covariance Matrix (2004)

Lyuu, Y.-D.: Financial Engineering & Computation: Principles, Mathematics, Algorithms. Cambridge University Press, Cambridge (2002)

Markowitz, H.: Portfolio selection. J. Finance 7, 77–91 (1952)

Raffinot, T.: Hierarchical clustering-based asset allocation. J. Portfolio Manag. 44(2), 89–99 (2017)

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2(3), 21–40 (2000)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Finance 26(7), 1443–1471 (2002)

Sarykalin, S., Serraino, G., Uryasev, S.: Value-at-risk vs. conditional value-at-risk in risk management and optimization. In: INFORMS Tutorial (2008). https://doi.org/10.1287/educ.1080.0052. ISBN 978-1-877640-23-0

Acknowledgement

The article was prepared within the framework of the Basic Research Program at the National Research University Higher School of Economics (HSE) and is partly supported by RFFI grant 18-07-00524.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Kalygin, V.A., Slashchinin, S.V. (2020). Uncertainty of Efficient Frontier in Portfolio Optimization. In: Kotsireas, I., Pardalos, P. (eds) Learning and Intelligent Optimization. LION 2020. Lecture Notes in Computer Science(), vol 12096. Springer, Cham. https://doi.org/10.1007/978-3-030-53552-0_33

Download citation

DOI: https://doi.org/10.1007/978-3-030-53552-0_33

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-53551-3

Online ISBN: 978-3-030-53552-0

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)