Abstract

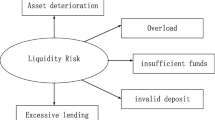

In this paper, we propose a methodology for using dynamic Bayesian networks (DBN) in the tasks of assessing the success of an investment project. The methods of constructing DBN, their parametric learning, validation and scenario analysis of “What-if” are considered. A dynamic Bayesian model has been developed for scenario analysis and forecasting the success of an investment project. The model takes into account the time component and is designed in collaboration with expert economists in the selection and quantification of input and output variables. Now, using the dynamic Bayesian model, it is possible with a certain degree of probability to assess the degree of success of the capital investment, without incurring monetary and temporary losses. This will greatly facilitate the investment forecast for identifying profitable investment sources. This is the advantage of the proposed approach.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Abramson, B., Brown, J., Edwards, W., Murphy, A., Winkler, R.: Hailfinder: a Bayesian system for forecasting severe weather. Int. J. Forecast. 12(1), 57–71 (1996). https://doi.org/10.1016/0169-2070(95)00664-8

Acid, S., Campos, L., Castellano, J.: Learning Bayesian network classifiers: searching in a space of partially directed acyclic graphs. Mach. Learn. 59(3), 213–235 (2005). https://doi.org/10.1007/s10994-005-0473-4

Barro, R.: Economic growth in a cross section of countries. Q. J. Econ. 106(2), 407 (1991). https://doi.org/10.2307/2937943

Ben-David, D.: Convergence clubs and subsistence economies. J. Dev. Econ. 55(1), 155–171 (1998). https://doi.org/10.1016/s0304-3878(97)00060-6

Bidyuk, P., Gozhyj, A., Kalinina, I.: Probabilistic inference based on LS-method modifications in decision making problems. In: Lecture Notes in Computational Intelligence and Decision Making. ISDMCI 2019, vol. 1020, pp. 422–433 (2019). https://doi.org/10.1007/978-3-030-26474-1_30

Bidyuk, P., Matsuki, Y., Gozhyj, A., Beglytsia, V., Kalinina, I.: Features of application of Monte Carlo method with Markov chain algorithms in Bayesian data analysis. In: Advances in Intelligent Systems and Computing IV. CSIT 2019, vol. 1080, pp. 361–376. Springer, Cham (2020). https://doi.org/10.1007/978-3-030-33695-0_25

Block, S.: Are real options actually used in the real world? Eng. Econ. 3(52), 255–267 (2007). https://doi.org/10.1080/00137910701503910

Brouwer, R., De-Blois, C.: Integrated modelling of risk and uncertainty underlying the cost and effectiveness of water quality measures. Environ. Model Softw. 23(7), 922–937 (2008). https://doi.org/10.1016/j.envsoft.2007.10.006

Cai, X., McKinney, D., Lasdon, L.: Integrated hydrologic-agronomic-economic model for river basin management. J. Water Resour. Plan. Manag. 129(1), 4–17 (2003). https://doi.org/10.1061/(asce)0733-9496(2003)129:1(4)

Carmona, G., Varela-Ortega, C., Bromley, J.: The use of participatory object-oriented Bayesian networks and agro-economic models for groundwater management in spain. Water Resour. Manag. 25(5), 1509–1524 (2011). https://doi.org/10.1007/s11269-010-9757-y

Castelletti, A., Soncini-Sessa, R.: Bayesian networks and participatory modelling in water resource management. Environ. Model Softw. 22(8), 1075–1088 (2007). https://doi.org/10.1016/j.envsoft.2006.06.003

Chari, V., Kehoe, P., McGrattan, E.: Sticky price models of the business cycle: can the contract multiplier solve the persis-tence problem. Econometrica 68, 1151–1179 (2000). https://doi.org/10.1111/1468-0262.00154

Cox, J., Ross, S., Rubinstein, M.: Option pricing: a simplified approach. J. Financ. Econ. 7(3), 229–263 (1979). https://doi.org/10.1016/0304-405x(79)90015-1

De Campos, L., Castellano, J.: Bayesian network learning algorithms using structural restrictions. Int. J. Approx. Reason. 45(2), 233–254 (2007). https://doi.org/10.1016/j.ijar.2006.06.009

Dean, T., Kanazawa, K.: Probabilistic temporal reasoning. In: Proceedings of the National Conference on Artificial Intelligence (AAAI - 1988), pp. 525–529. AAAI Press/The MIT Press (1988)

Dempster, A., Laird, N., Rubin, D.: Maximum likelihood from incomplete data via the EM algorithm. J. Roy. Stat. Soc. 39, 1–38 (1977)

Dixit, A.: Investment and hysteresis. J. Econ. Perspect. 6(1), 107–132 (1992). https://doi.org/10.11257/jep6.1.107

Ghanmi, N., Awal, A., Kooli, N.: Dynamic Bayesian networks for handwritten Arabic word recognition. In: 1st International Workshop on Arabic Script Analysis and Recognition (ASAR) (2017). https://doi.org/10.1016/j.ijar.2006.06.00910.1109/asar.2017.8067769

Graham, J., Harvey, C.: The theory and practice of corporate finance: evidence from the field. SSRN Electron. J. (2000). https://doi.org/10.1016/j.ijar.2006.06.00910.2139/ssrn.220251

Heckerman, D., Geiger, D., Chickering, D.: Learning Bayesian networks: the combination of knowledge and statistical data. Mach. Learn. 20(3), 197–243 (1995). https://doi.org/10.1023/a:1022623210503

Helfert Erich, A.: Financial Analysis: Tools and Techniques: A Guide for Managers. McGraw Hill, New York (2001). https://doi.org/10.1036/0071395415

Jakeman, A., Letcher, R.: Integrated assessment and modelling: features, principles and examples for catchment management. Environ. Model Softw. 18(6), 491–501 (2003). https://doi.org/10.1016/s1364-8152(03)00024-0

Lawrence, H.: Investment incentives and the discounting of depreciation allowances. In: Effects of Taxation on Capital Accumulation, pp. 296–304 (1987)

Levine, R., Renelt, D.: A sensitivity analysis of cross-country growth regressions. Am. Econ. Rev. 4(82), 942–963 (1992)

Lytvynenko, V., Savina, N., Krejci, J., Fefelov, A., Lurie, I., Voronenko, M., Lopushynskyi, I., Vorona, P.: Dynamic Bayesian networks in the problem of localizing the narcotic substances distribution. In: AISC, vol. 1080, pp. 421–438. Springer(2019)

Lytvynenko, V., Savina, N., Voronenko, M., Doroschuk, N., Smailova, S., Boskin, O., Kravchenko, T.: Development, validation and testing of the Bayesian network of educational institutions financing. In: The crossing point of Intelligent Data Acquisition and Advanced Computing Systems and East and West Scientists (IDAACS-2019) (2019). https://doi.org/10.1109/IDAACS.2019.8924307

Mbuvha, R., Jonsson, M., Ehn, N., Herman, P.: Bayesian neural networks for one-hour ahead wind power forecasting. In: IEEE 6th International Conference on Renewable Energy Research and Applications (ICRERA) (2017). https://doi.org/10.1109/icrera.2017.8191129

McDonald, R., Siegel, D.: The value of waiting to invest. Quart. J. Econ. 101, 707–728 (1986)

McKinnon, R.: Money and Capital in Economic Development. Brookings Institution, Washington (1973)

Purvis, A., Boggess, W., Moss, C., Holt, J.: Technology adoption decisions under irreversibility and uncertainty: an ex ante approach. Am. J. Agric. Econ. 77(3), 541–551 (1995). https://doi.org/10.2307/1243223

Roos, J., Bonnevay, S., Gavin, G.: Dynamic Bayesian networks with Gaussian mixture models for short-term passenger flow forecasting. In: 12th International Conference on Intelligent Systems and Knowledge Engineering (ISKE) (2017). https://doi.org/10.1109/iske.2017.8258756

Schmitt, H., Shaw, E.: Financial deepening in economic development. Am. J. Agric. Econ. 56(3), 670 (1974). https://doi.org/10.2307/1238641

Xie, H., Shi, J., Lu, W., Cui, W.: Dynamic Bayesian networks in electronic equipment health diagnosis. In: Prognostics and System Health Management Conference (PHM-Chengdu) (2016). https://doi.org/10.1109/phm.2016.7819945

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Lytvynenko, V. et al. (2021). Dynamic Bayesian Networks Application for Evaluating the Investment Projects Effectiveness. In: Babichev, S., Lytvynenko, V., Wójcik, W., Vyshemyrskaya, S. (eds) Lecture Notes in Computational Intelligence and Decision Making. ISDMCI 2020. Advances in Intelligent Systems and Computing, vol 1246. Springer, Cham. https://doi.org/10.1007/978-3-030-54215-3_20

Download citation

DOI: https://doi.org/10.1007/978-3-030-54215-3_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-54214-6

Online ISBN: 978-3-030-54215-3

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)