Abstract

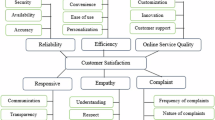

This research focuses on the digital multi-platforms of the banking sector and customer engagement behaviour. Specifically, the objective of this article is to understand how the service quality on banks’ digital platforms influences customer satisfaction, and both variables are conducive to Customer Engagement Behaviour. To this end, an empirical study was carried out through 574 online surveys of bank service users. The results of the surveys were analysed using the statistical technique of Partial Least Squares (SmartPLS 3.3.2). The findings contribute to the understanding of the importance of the quality of digital services of banking multi-platforms for the customer satisfaction and the generation of Customer Engagement Behaviour. In addition, the results allow us to expand our knowledge of the background of Customer Engagement Behaviour in the banking sector, particularly in Latin America. For the sector, the research provides the possibility of understanding how the quality service of all the digital platforms offered to its customers is related to their satisfaction and, furthermore, this influences the inclination towards Customer Engagement Behaviour.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Lovati, G., Borgo, A.: Accenture - Estudio Sobre Hábitos Y Comportamientos De Los Clientes Bancarios HSA|Accenture (2017). https://www.accenture.com/t00010101T000000__w__/pe-es/_acnmedia/PDF-44/Accenture-Consumer-Survey-HSA.pdf. Accessed 19 Aug 2020.

von Allmen, U.E., Khera, P., Ogawa, S., Sahay, R.: Digital Financial Inclusion in the Times of COVID-19, 01 July 2020. https://blogs.imf.org/2020/07/01/digital-financial-inclusion-in-the-times-of-covid-19/. Accessed 19 Aug 2020.

Brodie, R.J., Hollebeek, L.D., Jurić, B., Ilić, A.: Customer engagement: conceptual domain, fundamental propositions, and implications for research. J. Serv. Res. 14(3), 252–271 (2011). https://doi.org/10.1177/1094670511411703

Brodie, R.J., Hollebeek, L.D., Jurić, B., Ilić, A.: Customer engagement. J. Serv. Res. 14(3), 252–271 (2011). https://doi.org/10.1177/1094670511411703

Pansari, A., Kumar, V.: Customer engagement: the construct, antecedents, and consequences. J. Acad. Mark. Sci. 45(3), 294–311 (2017). https://doi.org/10.1007/s11747-016-0485-6

van Doorn, J., et al.: Customer engagement behavior: theoretical foundations and research directions. J. Serv. Res. 13(3), 253–266 (2010). https://doi.org/10.1177/1094670510375599

Abbas, M., Gao, Y., Shah, S.: CSR and customer outcomes: the mediating role of customer engagement. Sustainability 10(11), 4243 (2018). https://doi.org/10.3390/su10114243

Sondhi, N., Sharma, B.R., Kalla, S.M.: Customer engagement in the Indian retail banking sector: an exploratory study. Int. J. Bus. Innov. Res. 12(1), 41 (2017). https://doi.org/10.1504/IJBIR.2017.080710

Petzer, D.J., van Tonder, E.: Loyalty intentions and selected relationship quality constructs: the mediating effect of customer engagement. Int. J. Qual. Reliab. Manag. (2019). https://doi.org/10.1108/IJQRM-06-2018-0146

Roy, S.K., Shekhar, V., Lassar, W.M., Chen, T.: Customer engagement behaviors: the role of service convenience, fairness and quality. J. Retail. Consum. Serv. 44, 293–304 (2018). https://doi.org/10.1016/j.jretconser.2018.07.018

Bravo, R., Martínez, E., Pina, J.M.: Effects of customer perceptions in multichannel retail banking. Int. J. Bank Mark. IJBM (2019). https://doi.org/10.1108/IJBM-07-2018-0170.

Mohsin Butt, M., Aftab, M.: Incorporating attitude towards Halal banking in an integrated service quality, satisfaction, trust and loyalty model in online Islamic banking context. Int. J. Bank Mark. 31(1), 6–23 (2013. https://doi.org/10.1108/02652321311292029.

Kingshott, R.P.J., Sharma, P., Chung, H.F.L.: The impact of relational versus technological resources on e-loyalty: a comparative study between local, national and foreign branded banks. Ind. Mark. Manag. 72, 48–58 (2018). https://doi.org/10.1016/j.indmarman.2018.02.011

Thakur, R.: The moderating role of customer engagement experiences in customer satisfaction–loyalty relationship. Eur. J. Mark. 53(7), 1278–1310 (2019). https://doi.org/10.1108/EJM-11-2017-0895

Ganguli, S., Roy, S.K.: Generic technology-based service quality dimensions in banking: generic technology-based service quality dimensions in banking: impact on customer satisfaction and loyalty. Int. J. Bank Mark. 29(2), 168–189 (2011). https://doi.org/10.1108/02652321111107648

Kosiba, J.P.B., Boateng, H., Okoe Amartey, A.F., Boakye, R.O., Hinson, R.: Examining customer engagement and brand loyalty in retail banking: the trustworthiness influence. Int. J. Retail Distrib. Manag. 46(8), 764–779 (2018). https://doi.org/10.1108/IJRDM-08-2017-0163.

Sum Chau, V., Ngai, L.W.L.C.: The youth market for internet banking services: perceptions, attitude and behaviour. J. Serv. Mark. 24(1), 42–60 (2010). https://doi.org/10.1108/08876041011017880.

Honore Petnji Yaya, L., Marimon, F., Casadesus, M.: Customer’s loyalty and perception of ISO 9001 in online banking. Ind. Manag. Data Syst. 111(8), 1194–1213 (2011). https://doi.org/10.1108/02635571111170767.

Bapat, D.: Exploring the antecedents of loyalty in the context of multi-channel banking. Int. J. Bank Mark. 35(2), 174–186 (2017). https://doi.org/10.1108/IJBM-10-2015-0155

Ladhari, R., Souiden, N., Ladhari, I.: Determinants of loyalty and recommendation: the role of perceived service quality, emotional satisfaction and image. J. Financ. Serv. Mark. 16(2), 111–124 (2011). https://doi.org/10.1057/fsm.2011.10

Hossain, M., Kim, M., Hossain, M.A., Kim, M.: Does multidimensional service quality generate sustainable use intention for Facebook? Sustainability 10(7), 2283 (2018). https://doi.org/10.3390/su10072283

Kaura, V., Durga Prasad, C.S., Sharma, S.: Service quality, service convenience, price and fairness, customer loyalty, and the mediating role of customer satisfaction. Int. J. Bank Mark. 33(4), 404–422 (2015). https://doi.org/10.1108/IJBM-04-2014-0048.

Schleyer, T.K.L., Forrest, J.L.: Methods for the design and administration of web-based surveys. J. Am. Med. Inform. Assoc. 7(4), 416–425 (2000). https://doi.org/10.1136/jamia.2000.0070416

Raziano, D.B., Jayadevappa, R., Valenzula, D., Weiner, M., Lavizzo-Mourey, R.: E-mail versus conventional postal mail survey of geriatric chiefs. Gerontologist 41(6), 799–804 (2001). https://doi.org/10.1093/geront/41.6.799

S. y A. Superintendencia de Banca, Encuesta Nacional de Demanda de Servicios Financieros y Nivel de Cultura Financiera en el Perú Resultados 2016 Encuesta Nacional de Demanda de Servicios Financieros y Nivel de Cultura Financiera en el Perú, Lima (2017). https://www.sbs.gob.pe. Accessed 18 Apr 2019

Edwards, P.J., et al.: Methods to increase response to postal and electronic questionnaires, Cochrane Database of Systematic Reviews, no. 3. John Wiley and Sons Ltd. (2009). https://doi.org/10.1002/14651858.MR000008.pub4

Hennig-Thurau, T., Gwinner, K.P., Gremler, D.D.: Understanding relationship marketing outcomes: an integration of relational benefits and relationship quality. J. Serv. Res. (2002). https://doi.org/10.1177/1094670502004003006

Makanyeza, C., Chikazhe, L.: Mediators of the relationship between service quality and customer loyalty: evidence from the banking sector in Zimbabwe. Int. J. Bank Mark. 35(3), 540–556 (2017). https://doi.org/10.1108/IJBM-11-2016-0164

Wold, H.: Soft modeling: the basic design and some extensions, in systems under indirect observation: causality. Struct. Pred. 2, 1–54 (1982)

Ringle, C., Becker, J., Wende, S.: SmartPLS3, Handb. Mark. Res. pp. 1–329, January 2014. doi: https://doi.org/10.1007/978-3-319-05542-8_15-1.

Dijkstra T.K., Henseler, J.: Consistent and asymptotically normal PLS estimators for linear structural equations (2012). https://www.rug.nl/staff/t.k.dijkstra/Dijkstra-Henseler-PLSc-linear.pdf. Accessed 13 Aug 2020

Sarstedt, M., Ringle, C.M., Hair, J.F.: Partial Least Squares Structural Equation Modeling. Springer, Cham (2017)

Van Riel, A.C.R., Henseler, J., Kemény, I., Sasovova, Z.: Estimating hierarchical constructs using consistent partial least squares: the case of second-order composites of common factors. Ind. Manag. Data Syst. 117(3), 459–477 (2017). https://doi.org/10.1108/IMDS-07-2016-0286

Anderson, J.C., Gerbing, D.W.: Structural equation modeling in practice: a review and recommended two-step approach. Psychol. Bull. 103(3), 411–423 (1988). https://doi.org/10.1037/0033-2909.103.3.411

Marin-Garcia, J.A., Alfalla-Luque, R.: Key issues on Partial Least Squares (PLS) in operations management research: a guide to submissions. J. Ind. Eng. Manag. 12(2), 219–240 (2019). https://doi.org/10.3926/jiem.2944

Hair, J.F., Risher, J.J., Sarstedt, M., Ringle, C.M.: When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 31(1) 24 (2019). https://doi.org/10.1108/EBR-11-2018-0203.

Marín-García, J.A., Alfalla-Luque, R.: Protocol: how to deal with Partial Least Squares (PLS) research in operations management. a guide for sending papers to academic journals. WPOM-Work. Pap. Oper. Manag. 10(1), 29–69 (2019). https://doi.org/10.4995/wpom.v10i1.10802

Hulland, J.: Use of partial least squares (PLS) in strategic management research: a review of four recent studies. Strateg. Manag. J. 20(2), 195–204 (1999). https://doi.org/10.1002/(sici)1097-0266(199902)20:2%3c195::aid-smj13%3e3.0.co;2-7

Bagozzi, R.P., Yi, Y.: On the evaluation of structural equation models. J. Acad. Mark. Sci. 16(1), 74–94 (1988). https://doi.org/10.1007/BF02723327

Henseler, J., Ringle, C.M., Sarstedt, M.: A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 43(1), 115–135 (2014). https://doi.org/10.1007/s11747-014-0403-8

Cohen, J.: Statistical Power Analysis for the Behavioral Sciences. Routledge (2013)

Dijkstra, T.K., Henseler, J.: Consistent partial least squares path modeling. MIS Q.: Manag. Inf. Syst. 39(2) 297–316 (2015). https://doi.org/10.25300/MISQ/2015/39.2.02

Nitzl, C., Roldan, J.L., Cepeda, G.: Mediation analysis in partial least squares path modelling, helping researchers discuss more sophisticated models. Ind. Manag. Data Syst. 116(9), 1849–1864 (2016). https://doi.org/10.1108/IMDS-07-2015-0302

Monferrer, D., Moliner, M.A., Estrada, M.: Increasing customer loyalty through customer engagement in the retail banking industry. Spanish J. Mark. - ESIC 23(3), 461–484 (2019). https://doi.org/10.1108/SJME-07-2019-0042

Itani, O.S., Kassar, A.N., Loureiro, S.M.C.: Value get, value give: the relationships among perceived value, relationship quality, customer engagement, and value consciousness. Int. J. Hosp. Manag. (2019). https://doi.org/10.1016/j.ijhm.2019.01.014

Kumar, V., Pansari, A.: Competitive advantage through engagement. J. Mark. Res. 53(4), 497–514 (2016). https://doi.org/10.1509/jmr.15.0044

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Lodeiros-Zubiria, M.L. (2021). Customer Engagement Behaviour Through Satisfaction and Service Quality in Digital Multi-platform Banking: A Proposal from Peru. In: Rocha, Á., Ferrás, C., López-López, P.C., Guarda, T. (eds) Information Technology and Systems. ICITS 2021. Advances in Intelligent Systems and Computing, vol 1331. Springer, Cham. https://doi.org/10.1007/978-3-030-68418-1_20

Download citation

DOI: https://doi.org/10.1007/978-3-030-68418-1_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-68417-4

Online ISBN: 978-3-030-68418-1

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)