Abstract

Decentralized Finance (DeFi) promises to transform the traditional financial systems into fair and transparent protocols that do not require trusted third parties. To circumvent the high volatility of crypto-assets, DeFi protocols advocate collateralizing their assets against conventional financial instruments. To do so, these protocols require access to external or off-chain data, such as asset exchange rates. DeFi protocols rely on oracles to access such information. Importing external data onto the chain via oracles consists of multiple data processing and aggregation stages. Thus, it is critical to minimize errors or deviations while the ground truth data moves through these stages. In this paper, we investigate the degree of price deviations at different levels between the data source and the final output rendered to an on-chain requester. In particular, we focus on Chainlink’s oracle network for ETH-USD pricing. Our results show that despite checks and balances, the output rendered to the requester considerably deviates from data reported by the sources.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

- 2.

- 3.

- 4.

- 5.

- 6.

- 7.

- 8.

- 9.

- 10.

- 11.

- 12.

- 13.

- 14.

- 15.

- 16.

0x37bc7498f4ff12c19678ee8fe19d713b87f6a9e6.

References

Adler, J., Berryhill, R., Veneris, A., Poulos, Z., Veira, N., Kastania, A.: Astraea: a decentralized blockchain oracle. In: IEEE International Conference on iThings, GreenCom, CPSCom, SmartData, pp. 1145–1152 (2018)

Al-Breiki, H., Rehman, M.H.U., Salah, K., Svetinovic, D.: Trustworthy blockchain oracles: review, comparison, and open research challenges. IEEE Access 8, 85675–85685 (2020)

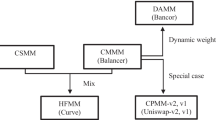

Angeris, G., Chitra, T.: Improved price oracles: constant function market makers. In: ACM Conference on Advances in Financial Technologies, pp. 80–91 (2020)

Beniiche, A.: A study of blockchain oracles. arXiv preprint:2004.07140 (2020)

Berger, B., Huber, S., Pfeifhofer, S.: OraclesLink: an architecture for secure oracle usage. In: IEEE International Conference on Blockchain Computing and Applications, pp. 66–72 (2020)

Biryukov, A., Khovratovich, D., Tikhomirov, S.: Findel: secure derivative contracts for ethereum. In: International Conference on Financial Cryptography and Data Security, pp. 453–467 (2017)

Breidenbach, L., et al.: Chainlink 2.0: next steps in the evolution of decentralized oracle networks. White Paper, pp. 1–136 (2021)

Chainlink: 16 Ways to Create Dynamic Non-Fungible Tokens (NFT) Using Chainlink Oracles (2020). https://blog.chain.link/create-dynamic-nfts-using-chainlink-oracles/

Chainlink: ETH-USD data feeds (2022). https://data.chain.link/ethereum/mainnet/crypto-usd/eth-usd

CoinMarketCap: Top DeFi Tokens by Market Capitalization (2022). https://coinmarketcap.com/view/defi/

Egberts, A.: The Oracle Problem - An Analysis of How Blockchain Oracles Undermine the Advantages of Decentralized Ledger Systems. Available at SSRN 3382343 (2017)

Ellis, S., Juels, A., Nazarov, S.: Chainlink: a decentralized oracle network. White Paper, pp. 1–38 (2017)

Eskandari, S., Salehi, M., Gu, W.C., Clark, J.: SoK: oracles from the ground truth to market manipulation. In: 3rd ACM Conference on Advances in Financial Technologies, pp. 127–141 (2021)

Finance Magnates: DeFi Startup Acala to Restructure Oracle Network - For the Better (2020). https://www.financemagnates.com/thought-leadership/defi-startup-acala-to-restructure-oracle-network-for-the-better/

Kaleem, M., Shi, W.: Demystifying pythia: a survey of chainlink oracles usage on ethereum. In: International Conference on Financial Cryptography and Data Security, pp. 115–123 (2021)

Liu, B., Szalachowski, P., Zhou, J.: A first look into DeFi oracles. In: IEEE International Conference on Decentralized Applications and Infrastructures, pp. 39–48 (2021)

Lo, S.K., Xu, X., Staples, M., Yao, L.: Reliability analysis for blockchain oracles. Comput. Electr. Eng. 83, 1–10 (2020)

Mühlberger, R., et al.: Foundational oracle patterns: connecting blockchain to the off-chain world. In: International Conference on Business Process Management, pp. 35–51 (2020)

Pasdar, A., Dong, Z., Lee, Y.C.: Blockchain Oracle Design Patterns. arXiv preprint:2106.09349 (2021)

Peaster, W.M.: Biggest DeFi hacks in 2020 (2021). https://defiprime.com/hacks2020

Salehi, M., Clark, J., Mannan, M.: Red-black coins: dai without liquidations. In: International Conference on Financial Cryptography and Data Security, pp. 136–145 (2021)

samczsun: So You Want to Use a Price Oracle (2020). https://samczsun.com/so-you-want-to-use-a-price-oracle/

Werner, S.M., Perez, D., Gudgeon, L., Klages Mundt, A., Harz, D., Knottenbelt, W.J.: SoK: decentralized finance. arXiv preprint:2101.08778 (2021)

Williams, A.K., Peterson, J.: Decentralized common knowledge oracles. arXiv preprint:1912.01215 (2019)

Zaugust: CoFiX: A Computable Trading System (2020). https://github.com/Computable-Finance/Doc

Zhao, Y., Kang, X., Li, T., Chu, C.K., Wang, H.: Towards trustworthy DeFi oracles: past, present, and future. arXiv preprint:2201.02358 (2022)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Gangwal, A., Valluri, R., Conti, M. (2022). Analyzing Price Deviations in DeFi Oracles. In: Beresford, A.R., Patra, A., Bellini, E. (eds) Cryptology and Network Security. CANS 2022. Lecture Notes in Computer Science, vol 13641. Springer, Cham. https://doi.org/10.1007/978-3-031-20974-1_17

Download citation

DOI: https://doi.org/10.1007/978-3-031-20974-1_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-20973-4

Online ISBN: 978-3-031-20974-1

eBook Packages: Computer ScienceComputer Science (R0)