Abstract

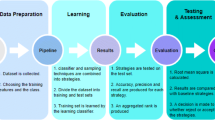

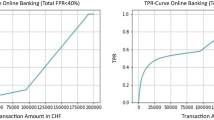

Machine Learning is one of the leading technologies in this generation with unique techniques and problem-solving algorithms which are very helpful to predict the models accurately with higher positivity rates as compare to the less or false positives prediction of any given projects. In this chapter, we can assure that all of the proposed approaches are almost valid and able to detect fraud transactions. Through this chapter, our aim is to show and determine the possibility of balancing the ratio between fraudulent and non-fraudulent transactions. The methods and parameters which have been used to study the project has anticipated after a thorough research and every requirement have been fulfilled to obtain the desired output. Payment fraud detection is the solid example of classification. The datasets have been modelled after analyzing and pre-processing the existing datasets later to differentiate between fraudulent and non-fraudulent transactions. Such predictions can only be determined with the help of Machine Learning as we used along with the relevant algorithms and techniques which was required for the respective chapter. Numerous interpretations have been done, but acquiring 100% accuracy is still cannot be accomplished due to class imbalanced data related to the transactions. To monitor the usual transactions of people is a vast task and so is to track the fare and fraudulent transactions among billion of people. The main goal of this research is to prevent users from performing unusual transactions through unverified sources and to obtain the positive results in terms of data accuracy and data visualization.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

“Credit Card Fraud Detection Based on Transaction Behaviour –by John Richard D. Kho, Larry A. Vea” published by Proc. of the 2017 IEEE Region 10 Conference (TENCON), Malaysia, November 5–8 (2017)

“Survey Paper on Credit Card Fraud Detection by Suman” , Research Scholar, GJUS&T Hisar HCE, Sonepat published by International Journal of Advanced Research in Computer Engineering & Technology (IJARCET) Volume 3 Issue 3 (2014)

https://towardsdatascience.com/understanding-confusion-matrix-a9ad42dcfd62

https://towardsdatascience.com/fraud-detection-with-graph-analytics-2678e817b69e

Lakshmi, S.V.S.S., Kavilla , S.D.: Machine Learning for Credit Card. Fraud Detection System. unpublished [7] N. Malini, Dr. M. Pushpa,“Analysis on Credit Card Fraud Identification Techniques on the basis of KNN and Outlier Detection“, Advances in Electrical, Electronics, Information, Communication and Bio-Informatics (AEEICB), 2017 Third International Conference, pp. 255- 258. IEEE

Malsa, N., Vyas, V., Gautam, J., Shaw, R.N., Ghosh, A.: Framework and smart contract for blockchain enabled certificate verification system using robotics. In: Bianchini, M., Simic, M., Ghosh, A., Shaw, R.N. (eds.) Machine Learning for Robotics Applications. SCI, vol. 960, pp. 125–138. Springer, Singapore (2021). https://doi.org/10.1007/978-981-16-0598-7_10

“Credit Card Fraud Detection Based on Transaction Behavior –by John Richard D. Kho, Larry A. Vea” published by Proc. of the 2017.IEEE Region 10 Conference (TENCON), Malaysia, November 5–8 (2017)

Machine Learning For Credit Card Fraud Detection System, Lakshmi S V S , Selvani Deepthi Kavila (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Surpam, N., Sakhare, A. (2023). Data Analysis on ERP System of Easy-Pay Payment Services. In: Shaw, R.N., Paprzycki, M., Ghosh, A. (eds) Advanced Communication and Intelligent Systems. ICACIS 2022. Communications in Computer and Information Science, vol 1749. Springer, Cham. https://doi.org/10.1007/978-3-031-25088-0_48

Download citation

DOI: https://doi.org/10.1007/978-3-031-25088-0_48

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-25087-3

Online ISBN: 978-3-031-25088-0

eBook Packages: Computer ScienceComputer Science (R0)