Abstract

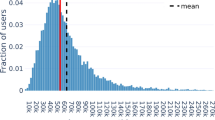

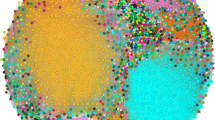

We constructed a financial network based on the relationships of the customers in our database with our other customers or other bank customers using our large-scale data set of money transactions. There are two main aims in this study. Our first aim is to identify the most profitable customers by prioritizing companies in terms of centrality based on the volume of money transfers between companies. This requires acquiring new customers, deepening existing customers and activating inactive customers. Our second aim is to determine the effect of customers on related customers as a result of the financial deterioration in this network. In this study, while creating the network, a data set was created over money transfers between companies. Here, text similarity algorithms were used while trying to match the company title in the database with the title during the transfer. For customers who are not customers of our bank, information such as IBAN numbers are assigned as unique identifiers. We showed that the average profitability of the top 30% customers in terms of centrality is five times higher than the remaining customers. Besides, the variables we created to examine the effect of financial disruptions on other customers contributed an additional 1% Gini coefficient to the model that the bank is currently using even if it is difficult to contribute to a strong model that already works with a high Gini coefficient.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bavelas, A.: A mathematical model for group structure. Appl. Anthropol. 7, 16–30 (1948)

Crucitti, P., Latora, V., Porta, S.: Centrality measures in spatial networks of urban streets. Phys. Rev. E 73, 036125 (2006)

Fletcher, J.M., Wennekers, T.: From structure to activity: Using centrality measures to predict neuronal activity. Int. J. Neural Syst. 28(2), 1750013 (2018)

Bright, D.A., Greenhill, C., Reynolds, M., Rittler, A., Morselli, C.: The use of actor-level attributes and centrality measures to identify key actors: A case study of an Australian drug trafficking network. J. Contemp. Crim. Justice 31(3), 262–278 (2015)

Inekwe, J.N., Jin, Y., Valenzuela, M.R.: Global financial network and liquidity risk. Aust. J. Manage. 43(4), 593–613 (2018)

Miller, P.R., Bobkowski, P.S., Maliniak, D., Rapoport, R.B.: Talking politics on Facebook: Network centrality and political discussion practices in social media. Polit. Res. Q. 68(2), 377–391 (2015)

Adosoglou, G., Park, S., Lombardo, G., Cagnoni, S., Pardalos, P.M.: Lazy network: a word embedding-based temporal financial network to avoid economic shocks in asset pricing models. Complexity 2022, 9430919 (2022)

Adosoglou, G., Lombardo, G., Pardalos, P.M.: Neural network embeddings on corporate annual filings for portfolio selection. Expert Syst. Appl. 164, 114053 (2021)

Hoberg, G., Phillips, G.: Text-based network industries and endogenous product differentiation. Expert Syst. Appl. 124(5), 1423–1465 (2016)

Houston, J.F., Phillips, G.: Social networks in the global banking sector. J. Account. Econ. 65(2–3), 237–269 (2018)

Newman, M.E.J: Networks: an Introduction. OUP Oxford (2010)

Schechtman, E., Schechtman, G.: The relationship between Gini methodology and the ROC curve. Available at SSRN: (2016). https://ssrn.com/abstract=2739245

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Atan, E. et al. (2023). Corporate Network Analysis Based on Graph Learning. In: Nicosia, G., et al. Machine Learning, Optimization, and Data Science. LOD 2022. Lecture Notes in Computer Science, vol 13810. Springer, Cham. https://doi.org/10.1007/978-3-031-25599-1_20

Download citation

DOI: https://doi.org/10.1007/978-3-031-25599-1_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-25598-4

Online ISBN: 978-3-031-25599-1

eBook Packages: Computer ScienceComputer Science (R0)