Abstract

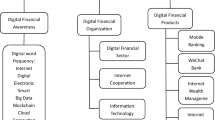

The vigorous development of digital finance has lent fresh impetus to the traditional financial market, and has also had an influence on the business situation. This article uses crawler technology to construct digital finance indicators, and based on the financial data of 42 listed commercial banks from 2011 to 2021, uses the SYS-GMM model to study the impact effect, transmission mechanisms and heterogeneity of digital finance on the operating performance from two dimensions of profitability and risk level. The results show that: First, in terms of linear relationship, digital finance reduces the profitability and increases the risk level of commercial banks; Second, as regards nonlinear relationship, there is a U-shaped relationship between digital finance and the profitability of commercial banks, and an inverted U-shaped relationship with the risk level of commercial banks; Third, digital finance inhibits the operating performance by deteriorating the deposit structure, loan structure and increasing the proportion of non-interest income. Fourth, compared with national commercial banks, the inhibitory influence on the profitability of regional banks is more pronounced, but its impact on risk level is not significantly different.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Berg, T., Burg, V., Gombović, A., Puri, M.: On the rise of FinTechs: credit scoring using digital footprints. Rev. Financ. Stud. 33(7), 2845–2897 (2020)

Cai, Y.P., Liu, Y.X.: Does fintech affect the liability structure of commercial banks. Manag. Eng. 27(5), 1007–1199 (2022). (in Chinese)

Beck, T., Pamuk, H., Ramrattan, R., Uras, R.B.: Payment instruments, finance and development. J. Dev. Econ. 133, 162–186 (2018)

Stoica, O., Mehdian, S., Sargu, A.: The impact of internet banking on the performance of Romanian banks: DEA and PCA approach. Procedia Econ. Finance 20, 610–622 (2015)

Arnold, I.J.M., van Ewijk, S.E.: Can pure play internet banking survive the credit crisis. J. Bank. Finance 35(4), 783–793 (2011)

Jia, D., Han, H.Z.: Fintech, bank liabilities and competition. J. World Econ. 46(2), 183–208 (2023). (in Chinese)

Zhang, J.C.: Financial technology, commercial bank competition and risk-taking. J. Henan Univ. Eng. (Soc. Sci. Ed.) 36(4), 34–42 (2021). (in Chinese)

Hauswald, R., Marquez, R.: Information technology and financial services competition. Rev. Financ. Stud. 16(3), 921–948 (2003)

Cheng, M.Y., Qu, Y.: Does bank FinTech reduce credit risk? Evidence from China. Pac. Basin Finance J. 63, 101398.1–101398.24 (2020)

Begenau, J., Farboodi, M., Veldkamp, L.: Big data in finance and the growth of large firms. J. Monet. Econ. 97, 71–87 (2018)

Thakor, A.V.: Fintech and banking: what do we know. J. Financ. Intermediation 41, 100858.1–100858.46 (2020)

Chen, Y., Wang, J., Liu, X.Y.: Analysis of marketing strategy of commercial banks under the background of digital finance. FinTech Time 28(6), 48–54 (2020). (in Chinese)

Sun, X.R., Wang, K.S., Wang, F.R.: FinTech, competition and bank credit structure—based on the perspective of small and medium-sized enterprises financing. J. Shanxi Univ. Finance Econ. 42(6), 59–72 (2020). (in Chinese)

Saunders, A., Schumacher, L.: The determinants of bank interest rate margins: an international study. J. Int. Money Financ. 19(6), 813–832 (2000)

Liao, W.L.: Research on the impact of internet finance on risk level of commercial banks. Am. J. Ind. Bus. Manag. 8(4), 992–1006 (2018)

Larrain, B.: Do banks affect the level and composition of industrial volatility. J. Finance 4(8), 1897–1925 (2006)

He, J.F., Zhu, A.Q., Li, J.: Research on the influence of digital finance development on the operation robustness of commercial banks. J. South China Univ. Technol. (Soc. Sci. Ed.) 24(5), 17–28 (2022). (in Chinese)

Wang, R., Yang, S.J.: Research on the impact of digital finance on commercial banks’ risk-taking: based on empirical analysis of China’s banking industry. J. Shanghai Lixin Univ. Account. Finance 34(1), 29–43 (2022). (in Chinese)

Guo, F., Wang, J.Y., Wang, F., Kong, T., Zhang, X., Cheng, Z.Y.: Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ. Q. 19(4), 1401–1418 (2020). (in Chinese)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Dai, M., Cao, H. (2023). The Impact of Digital Finance on the Operating Performance of Commercial Banks: Promotion or Inhibition?. In: Tu, Y., Chi, M. (eds) E-Business. Digital Empowerment for an Intelligent Future. WHICEB 2023. Lecture Notes in Business Information Processing, vol 481. Springer, Cham. https://doi.org/10.1007/978-3-031-32302-7_1

Download citation

DOI: https://doi.org/10.1007/978-3-031-32302-7_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-32301-0

Online ISBN: 978-3-031-32302-7

eBook Packages: Computer ScienceComputer Science (R0)