Abstract

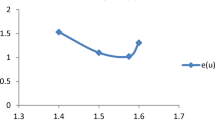

The objective of this paper is to test the forecasting performance of three nonlinear econometric prediction models, namely: Generalized Autoregressive Conditional Heteroskedasticity (GARCH), Exponential Generalized Autoregressive Con- ditional Heteroskedasticity (EGARCH), and the Smooth Transition Autoregressive (SETAR) model applied to the MASI index of the Casablanca Stock Exchange the period studied is from January 01, 2002 to September 20, 2018. Non-linearity tests are used to confirm the study’s hypotheses. The optimal delay was also chosen using Schwartz selection criteria. The Mean Absolute Error (MAE) criterion, the Root Mean Square Error (RMSE) criterion, and the Mean Absolute Percentage Error (MAPE) criterion were used to select the best prediction model. The results of using the GARCH, EGARCH and SETAR models revealed that the SETAR model is the best. These results can be beneficial for financial market traders to make good decisions regarding allocative portfolio and asset management strategies.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Maponga, L.L., Matarise, F.: Modelling non-linear time series, a dissertation submitted in partial fulfilment of the requirements for the M.Sc. In: Statistics in the Faculty of Science, University of Zimbabwe.

Xaba, D., Moroke, N.D., Arkaah, J., Pooe, C.: A comparative study of stock price forecasting using nonlinear models. Risk Gov. Control: Finan. Markets Inst. 7(2), 7–18. https://doi.org/10.22495/rgcv7i2art1

Engle, R.F.: Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. Inflation. Econometrica, 55, 987–1008

Bollerslev, T.: Generalized autoregressive conditional heteroskedasticity. J. Econometrics, 31(3), 307–327

Nilson, B.: conditional heteroskedasticity in asset returns: a new approach ‘econometrica, vol. 59, no. 2, pp. 347–370 (1991)

Franses, P.H., Dijk, D.: Non-Linear Time Series Models in Empirical Finance, Cambridge University Press, Cambridge

Tong, H.: On a Threshold Model in Pattern Recognition and Signal processing, ed. C. H. Chen, Amsterdam: Sijhoff & Noordhoff

Kassam, S., Lim, A.: An improved phase modulator with low nonlinear distortion. In: IEEE Transactions on Communications, vol. 28, no. 1, pp. 111–115 (1980). https://doi.org/10.1109/TCOM.1980.1094581

Teräsvirta, T., Anderson, H.M.: Characterizing non-linearities in business cycles using smooth transition autoregressive models. J. Appl. Econ. 7, 119–136

Hamilton, J.D.: A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57, 357–384

Tiwari, S.,Sabzehgar, R., Rasouli, M.: Short term solar irradiance forecast using numerical weather prediction (NWP) with gradient boost regression. In: 2018 9th IEEE International Symposium on Power Electronics for Distributed Generation Systems (PEDG), Charlotte, NC, USA, pp. 1–8 (2018). https://doi.org/10.1109/PEDG.2018.8447751

Ahmad, S., Latif, H.A.:Forecasting on the crude palm oil and kernel palm production: seasonal ARIMA approach. In: 2011 IEEE Colloquium on Humanities, Science and Engineering, Penang, Malaysia, pp. 939–944 (2011). https://doi.org/10.1109/CHUSER.2011.6163876

Todorova,M.: Application of machine learning methods for determining the stage of cancer. In: 2020 International Conference Automatics and Informatics (ICAI), Varna, Bulgaria, pp. 1–4 (2020). https://doi.org/10.1109/ICAI50593.2020.9311355

Zhang, F., Zhao, Y., Zhang, S., Wu, W., Tan, C.: Spacecraft equipment health condition monitoring based on augmented dickey-fuller test and gaussian mixture model. In: 2021 IEEE International Conference on Mechatronics and Automation (ICMA), Takamatsu, Japan, pp. 1379–1384 (2021). https://doi.org/10.1109/ICMA52036.2021.9512583.

Christian, F., Jean-Michel, Z.: GARCH Models (Structure, Statistical Inference and Financial Applications) GARCH (p, q) Processes.,(), pp. 17–61 (2010). https://doi.org/10.1002/9780470670057.ch2

Günay, G., Haque, M.: The effect of futures trading on spot market volatility: evidence from turkish derivative exchange. Int. J. Bus. Emerg. Markets 7(3) (2015). https://doi.org/10.1504/IJBEM.2015.070333

Laurence Watier and Sylvia Richardson Modelling of an Epidemiological Time Series by a Threshold Autoregressive Model Journal of the Royal Statistical Society. Series D (The Statisti- cian) vol. 44, no. 3, pp. 353–364 (1995)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Youness, S., Falloul, M., Smaaine, O., Ahmed, N., Hanaa, H. (2023). Forecasting Performance of GARCH, EGARCH and SETAR Non-linear Models: An Application on the MASI Index of the Casablanca Stock Exchange. In: Nguyen, N.T., et al. Recent Challenges in Intelligent Information and Database Systems. ACIIDS 2023. Communications in Computer and Information Science, vol 1863. Springer, Cham. https://doi.org/10.1007/978-3-031-42430-4_34

Download citation

DOI: https://doi.org/10.1007/978-3-031-42430-4_34

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42429-8

Online ISBN: 978-3-031-42430-4

eBook Packages: Computer ScienceComputer Science (R0)