Abstract

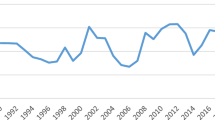

The recent incursion of Russian military forces onto Ukrainian territory has sparked global apprehension regarding the stability of stock market prices. This paper forecasts the direction that Brent spot prices will take during the year following the 2022 Ukrainian conflict, using ARFIMA parametric and semiparametric methods. According to the series’ long memory, prices will fall steeply during the next few months, reaching up to 80 or 75 dollars by the end of March 2023.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Abdallah, B., Yassin, E.: Measuring the Impact of the COVID-19 Pandemic on Oil Prices Using Long Memory Models (November 1990 to December 2020). Global J. Econo. Bus. (GJEB) 12(1), pp. 109–117 (2022). https://doi.org/10.31559/GJEB2022.12.1.6

Abdollahi, H., Ebrahimi, S.: A new hybrid model for forecasting Brent crude oil price. Energy 12, 1–13 (2020). https://doi.org/10.1016/j.energy.2020.117520

Adekoya, O.B., Oliyide, J.A., Yaya, O.S., Al-Faryan, M.A. S.: Does oil connectdifferently with prominent assets during war? Analysis of intra-day data during the Russia- Ukraine saga. Resources Policy 77 (2022). https://doi.org/10.1016/j.resourpol.2022.102728

Al Gounmeein, R., Ismail, M.: Modelling and forecasting monthly Brent crude oil prices: a long memory and volatility approach. Statistics in Transition. Statistics in Transition. New Series 22(1), 1–26 (2021). https://doi.org/10.21307/stattrans-2021-002

Álvarez-Díaz, M.: Is it possible to accurately forecast the evolution of Brent crude oil prices? An answer based on parametric and nonparametric forecasting methods. Empirical Economics 59(3), 1285–1305 (2019). https://doi.org/10.1007/s00181-019-01665-w

Amadeh, H., Amini, A., Effati, F.: ARIMA and ARFIMA Prediction of Persian Gulf Gas-Oil F.O.B. Investment Knowledge 2(7), 2–21 (2013)

Devianto, D., et al.: The hybrid model of autoregressive integrated moving average and fuzzy time series Markov chain on long-memory data. Frontiers in Applied Mathematics and Statistics 8, 1–15 (2022). https://doi.org/10.3389/fams.2022.1045241

Granger, C., Joyeux, R.: An introduction to long–memory time series and fractional differencing. Time Series Anal 1(1), 15–30 (1980). https://doi.org/10.1111/j.1467-9892.1980.tb00297.x

Hosking, J.: Fractional differencing. Biometrika 68(1), 165–176 (1981). https://doi.org/10.2307/2335817

IEA (2022) www.iea.org. [Online] Available at: https://www.iea.org/articles/energy-fact-sheet-why-does-russian-oil-and-gas-matter

Ismail, M., Al-Gounmeein, R.: Overview of long memory for economic and financial time series dataset and related time series models: a review study. Int. J. Appl. Math. 52(2), 261–269 (2022)

Jibrin, S.A., Musa, Y., Zubair, U.A., Saidu, A.S.E.: ARFIMA modelling and investigation of structural break(s) in west texas intermediate and brent series. CBN Journal of Applied Statistics 6(2), 59–79 (2015)

Liu, L., Wan, J.: A study of Shanghai fuel oil futures price volatility based on high frequency data: Long-range dependence, modeling and forecasting. Econ. Model. 29(6), 2245–2253 (2012). https://doi.org/10.1016/j.econmod.2012.06.029

Souza, F.M., Almeida, S.G., Souza, A.M., Lopes, L.F.D., Zanini, R.R.: Gasoline price forecasting to southern region of Brazil. Iberoamerican J. Indus. Eng. 3(1), 234–248 (2011)

Wang, Y., Bouri, E., Fareed, Z., Dai, Y.: Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Finance research Letters, 1–29 (2022). https://doi.org/10.1016/j.frl.2022.103066

Yu, L., Zhang, X., Wang, S.: Assessing potentiality of support vector machine method in crude oil price forecasting. EURASIA J. Math. Sci. Technol. Educ. 13(12), 7893–7904 (2017). https://doi.org/10.12973/ejmste/77926

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Davidescu, A.A., Manta, E.M., Florescu, MS., Cojocaru, M.R. (2023). A Forecast of Brent Prices in Times of Ukrainian Crisis Using ARFIMA Models. In: Jallouli, R., Bach Tobji, M.A., Belkhir, M., Soares, A.M., Casais, B. (eds) Digital Economy. Emerging Technologies and Business Innovation. ICDEc 2023. Lecture Notes in Business Information Processing, vol 485. Springer, Cham. https://doi.org/10.1007/978-3-031-42788-6_25

Download citation

DOI: https://doi.org/10.1007/978-3-031-42788-6_25

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42787-9

Online ISBN: 978-3-031-42788-6

eBook Packages: Computer ScienceComputer Science (R0)