Abstract

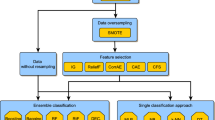

Financial institutions have been seeking ways to improve their bankruptcy prediction capabilities to mitigate the disruptive effects of future bankruptcies. One such way is using machine learning models. However, financial datasets are often imbalanced, posing a significant challenge for building effective predictive models. In this work, three resampling techniques are used to produce the datasets that were used for model building: oversampling, undersampling, and hybrid sampling. We evaluate the effectiveness of these sampling techniques on five machine learning models (Logistic Regression, Bagging, Random Forest, Support Vector Machine, Neural Networks) in predicting financial bankruptcies. We also investigate the impact of ensembling on model performance by stacking the high-performing individual models using a logistic regression meta-classifier. Our results show that hybrid sampling provides a better balance of accuracy and accountability for the minority (bankrupt) class, which makes it a suitable balancing technique for imbalanced financial datasets. Additionally, ensembling the models using stacking improved the performance of the models, resulting in a better performance for predicting bankruptcies. Remarkably, our proposed model demonstrated an outstanding accuracy of 99.75% while models from existing literature, and previous studies reported accuracies ranging from 83% to 98% for similar ensemble stacking tasks. Results from this study will be useful for practitioners in the finance sphere in making informed decisions, managing risks and choosing the right models for bankruptcy prediction.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Data Availability Statement

The data and R codes used in this work can be found in: https://drive.google.com/drive/folders/1LdK_fdKicEf8qC_iYTcffF0UoRoBBwU5?usp=share_link

References

Adamus, R.: Bankruptcy proceedings in relation to bond issuers in Poland. Soc. Polit. Sci. 1, 146–149 (2013)

Alam, T.M., et al.: Corporate bankruptcy prediction: an approach towards better corporate world. Comput. J. 64(11), 1731–1746 (2021). https://doi.org/10.1093/comjnl/bxab095

Altman, E.I.: Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 23(4), 589–609 (1968)

Altman, E.I.: Predicting financial distress of companies: revisiting the z-score and zeta® models. In: Handbook of Research Methods and Applications in Empirical Finance, pp. 428–456. Edward Elgar Publishing (2013)

Anjum, S.: Business bankruptcy prediction models: a significant study of the Altman’s z-score model. Available at SSRN 2128475 (2012)

Balcaen, S., Ooghe, H.: 35 years of studies on business failure: an overview of the classic statistical methodologies and their related problems. Br. Account. Rev. 38(1), 63–93 (2006). https://doi.org/10.1016/j.bar.2005.09.001

Barboza, F., Kimura, H., Altman, E.: Machine learning models and bankruptcy prediction. Expert Syst. Appl. 83, 405–417 (2017). https://doi.org/10.1016/j.eswa.2017.04.006

Bertsimas, D., King, A.: Logistic regression: from art to science. Stat. Sci. 32(3), 367–384 (2017)

Bondarenko, P.: Enron scandal. Encyclopedia Britannica (2019)

Butcher, B., Smith, B.J.: Feature Engineering and Selection: A Practical Approach for Predictive Models. Chapman & Hall/CRC Press, Boca Raton (2020)

Buyrukoglu, S., Savaş, S.: Stacked-based ensemble machine learning model for positioning footballer. Arab. J. Sci. Eng. 48(3), 1371–1383 (2023)

Charan, R., Useem, J., Harrington, A.: Why companies fail. Fortune 27, 36–44 (2002)

Domingos, P.: Bayesian averaging of classifiers and the overfitting problem. In: ICML, vol. 747, pp. 223–230 (2000)

Fauzi, M.A., Yuniarti, A.: Ensemble method for Indonesian twitter hate speech detection. Indones. J. Electr. Eng. Comput. Sci. 11(1), 294–299 (2018)

Fitzpatrick, P.J.: A comparison of the ratios of successful industrial enterprises with those of failed companies. The Accountants’ Magazine (1932)

Garcia, J.: Bankruptcy prediction using synthetic sampling. Mach. Learn. Appl. 9, 100343 (2022). https://doi.org/10.1016/j.mlwa.2022.100343

Horak, J., Vrbka, J., Suler, P.: Support vector machine methods and artificial neural networks used for the development of bankruptcy prediction models and their comparison. J. Risk Financ. Manag. 13(3), 60 (2020). https://doi.org/10.3390/jrfm13030060

Hosseini, S., Pourmirzaee, R., Armaghani, D.J., et al.: Prediction of ground vibration due to mine blasting in a surface lead-zinc mine using machine learning ensemble techniques. Sci. Rep. 13, 6591 (2023)

Hołda, A.: Zasada kontynuacji działalności i prognozowanie upadłości w polskich realiach gospodarczych. Zeszyty Naukowe/Akademia Ekonomiczna w Krakowie. Seria Specjalna, Monografie (174) (2006)

Jones, S.: Corporate bankruptcy prediction: a high dimensional analysis. Rev. Acc. Stud. 22, 1366–1422 (2017). https://doi.org/10.1007/s11142-017-9407-1

Khan, S.I., Hoque, A.S.M.L.: SICE: an improved missing data imputation technique. J. Big Data 7, 37 (2020). https://doi.org/10.1186/s40537-020-00313-w

Kiaupaite-Grushniene, V.: Altman z-score model for bankruptcy forecasting of the listed Lithuanian agricultural companies. In: 5th International Conference on Accounting, Auditing, and Taxation (ICAAT 2016), pp. 222–234. Atlantis Press (2016)

Kim, M.J., Kang, D.K.: Ensemble with neural networks for bankruptcy prediction. Expert Syst. Appl. 37(4), 3373–3379 (2010). https://doi.org/10.1016/j.eswa.2009.10.012

Kitowski, J., Kowal-Pawul, A., Lichota, W.: Identifying symptoms of bankruptcy risk based on bankruptcy prediction models-a case study of Poland. Sustainability 14(3), 1416 (2022)

Kou, G., et al.: Bankruptcy prediction for SMEs using transactional data and two-stage multiobjective feature selection. Decis. Support Syst. 140, 113429 (2021). https://doi.org/10.1016/j.dss.2020.113429

Kufeoglu, S.: SDG-9: industry, innovation and infrastructure. In: Emerging Technologies (Sustainable Development Goals Series). Springer (2022). https://doi.org/10.1007/978-3-031-07127-0-11

Learning, S.M.: Hybrid model for twitter data sentiment analysis based on ensemble of dictionary-based classifier and stacked machine learning classifiers-SVM, KNN and c5.0. J. Theoret. Appl. Inf. Technol. 98(04), 624–635 (2020)

Lian, W., Nie, G., Jia, B., et al.: An intrusion detection method based on decision tree-recursive feature elimination in ensemble learning. Math. Probl. Eng. 2020, 1–15 (2020)

Lombardo, G., Pellegrino, M., Adosoglou, G., Cagnoni, S., Pardalos, P.M., Poggi, A.: Machine learning for bankruptcy prediction in the American stock market: dataset and benchmarks. Future Internet 14(8), 244 (2022). https://doi.org/10.3390/fi14080244

Maddikonda, S.S.T., Matta, S.K.: Bankruptcy prediction: mining the Polish bankruptcy data (2018)

Malek, N.H.A., Yaacob, W.F.W., Wah, Y.B., et al.: Comparison of ensemble hybrid sampling with bagging and boosting machine learning approach for imbalanced data. Indones. J. Electr. Eng. Comput. Sci. 29(1), 598–608 (2023)

Misankova, M., Bartosova, V.: Comparison of selected statistical methods for the prediction of bankruptcy. In: Conference Proceedings of 10th International Days of Statistics and Economics, Melandrium, Prague, pp. 895–899 (2016)

Muller, D., Soto-Rey, I., Kramer, F.: An analysis on ensemble learning optimized medical image classification with deep convolutional neural networks. IEEE Access 10, 66467–66480 (2022)

Qu, Y., Quan, P., Lei, M., Shi, Y.: Review of bankruptcy prediction using machine learning and deep learning techniques. Procedia Comput. Sci. 162, 895–899 (2019). https://doi.org/10.1016/j.procs.2019.12.065

Rodrigues, P.C., Awe, O.O., Pimentel, J.S., Mahmoudvand, R.: Modelling the behaviour of currency exchange rates with singular spectrum analysis and artificial neural networks. Stats 3(2), 137–157 (2020)

Shekhar, S., Schrater, P.R., Vatsavai, R.R., Wu, W., Chawla, S.: Spatial contextual classification and prediction models for mining geospatial data. IEEE Trans. Multimedia 4(2), 174–188 (2002)

Shetty, S., Musa, M., Brédart, X.: Bankruptcy prediction using machine learning techniques. J. Risk Financ. Manag. 15(1), 35 (2022). https://doi.org/10.3390/jrfm15010035

Son, H., Hyun, C., Phan, D., Hwang, H.J.: Data analytic approach for bankruptcy prediction. Expert Syst. Appl. 138, 112816 (2019). https://doi.org/10.1016/j.eswa.2019.06.050

Thilakarathna, C., Dawson, C., Edirisinghe, E.: Using financial ratios with artificial neural networks for bankruptcy prediction. In: 2022 IEEE International Conference on Artificial Intelligence and Computer Applications (ICAICA), Dalian, China, pp. 55–58. IEEE (2022). https://doi.org/10.1109/ICAICA54878.2022.9844640

Xu, Y., Klein, B., Li, G., Gopaluni, B.: Evaluation of logistic regression and support vector machine approaches for XRF based particle sorting for a copper ore. Miner. Eng. 192, 108003 (2023)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Ethics declarations

CRediT Authorship Contribution Statement

Anthonia Oluchukwu Njoku: Conceptualization, Methodology, Validation, Formal analysis, Investigation, Software, Writing & editing, Visualization.

Berthine Nyunga Mpinda: Validation, Formal analysis, Review & editing.

Olushina Olawale Awe: Conceptualization, Methodology, Validation, Review & editing, Supervision, Project administration.

Declaration of Competing Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Oluchukwu Njoku, A., Nyunga Mpinda, B., Olawale Awe, O. (2024). Improving the Accuracy of Financial Bankruptcy Prediction Using Ensemble Learning Techniques. In: Debelee, T.G., Ibenthal, A., Schwenker, F., Megersa Ayano, Y. (eds) Pan-African Conference on Artificial Intelligence. PanAfriConAI 2023. Communications in Computer and Information Science, vol 2069. Springer, Cham. https://doi.org/10.1007/978-3-031-57639-3_1

Download citation

DOI: https://doi.org/10.1007/978-3-031-57639-3_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-57638-6

Online ISBN: 978-3-031-57639-3

eBook Packages: Computer ScienceComputer Science (R0)