Abstract

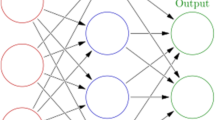

Accurate prediction of energy products future price is required for effective reduction of future price uncertainty as well as risk management. Neural Networks (NNs) are alternative to statistical and mathematical methods of predicting energy product prices. The daily prices of Propane (PPN), Kerosene Type Jet fuel (KTJF), Heating oil (HTO), New York Gasoline (NYGSL), and US Coast Gasoline (USCGSL) interrelated energy products are predicted. The energy products prices are found to be significantly correlated at 0.01 level (2-tailed). In this study, NNs learning algorithms are used to build a model for the accurate prediction of the five (5) energy product price. The aptitudes of the five (5) NNs learning algorithms in the prediction of PPN, KTJF, HTO, NYGSL, and USCGSL are examined and their performances are compared. The five (5) NNs learning algorithms are Gradient Decent with Adaptive learning rate backpropagation (GDANN), Bayesian Regularization (BRNN), Scale Conjugate Gradient backpropagation (SCGNN), Batch training with weight and bias learning rules (BNN), and Levenberg-Marquardt (LMNN). Results suggest that the LMNN and BRNN can be viewed as the best NNs learning algorithms in terms of R2 and MSE whereas GDANN was found to be the fastest. Results of the research can be use as a guide to reduce the high level of uncertainty about energy products prices, thereby provide a platform for developmental planning that can result in the improvement economic standard.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

US Department of Energy, Annual Energy Outlook 2004 with Projections to 2025 (2004), http://www.eia.doe.gov/oiaf/archive/aeo04/index.html

Malliaris, M.E., Malliaris, S.G.: Forecasting energy product prices. Eur. J. Financ. 14(6), 453–468 (2008)

Sato, A., Pichl, L., Kaizoji, T.: Using Neural Networks for Forecasting of Commodity Time Series Trends. In: Madaan, A., Kikuchi, S., Bhalla, S. (eds.) DNIS 2013. LNCS, vol. 7813, pp. 95–102. Springer, Heidelberg (2013)

Su, F., Wu, W.: Design and testing of a genetic algorithm neural network in the assessment of gait patterns. Med. Eng. Phys. 22, 67–74 (2000)

Barunik, J., Křehlík, T.: Coupling High-Frequency Data with Nonlinear Models in Multiple-Step-Ahead Forecasting of Energy Markets’ Volatility (2014), http://dx.doi.org/10.2139/ssrn.2429487

Wang, T., Yang, J.: Nonlinearity and intraday efficiency test on energy future markets. Energ. Econ. 32, 496–503 (2010)

Shambora, W.E., Rossiter, R.: Are there exploitable inefficiencies in the futures market for oil? Energ. Econ. 29, 18–27 (2007)

Panella, M., Barcellona, F., D’Ecclesia, R.L.: Forecasting Energy Commodity Prices Using Neural Networks. Advances in Decision Sciences 2012, Article ID 289810, 26 pages (2012), doi:10.1155/2012/289810

Moshiri, S., Foroutan, F.: Forecasting nonlinear crude oil futures prices. Energ. J. 27, 81–95 (2006)

Quek, C.M., Kumar, P.N.: Novel recurrent neural network-based prediction system for option trading and hedging. Appl. Intell. 29, 138–151 (2008)

Haykin, S.: Neural networks, 2nd edn. Prentice Hall, New Jersey (1999)

Jammazi, R., Aloui, C.: Crude oil forecasting: Experimental evidence from wavelet decomposition and neural network modeling. Energ. Econ. 34, 828–841 (2012)

Hair, F.J., Black, W.C., Babin, B.J., Anderson, R.E.: Multivariate data analysis. Pearson Prentice Hall, New Jersey (2010)

Hornik, K.: Approximation capabilities of multilayer feedforward networks. Neural Netw. 4, 251–257 (1991)

Berry, M.J.A., Linoff, G.: Data mining techniques. Willey, New York (1997)

Azar, A.T.: Fast neural network learning algorithms for medical applications. Neural Comp. Appl. 23(3-4), 1019–1034 (2013)

Chiroma, H., Gital, A.Y.U., Abubakar, A., Usman, M.J., Waziri, U.: Optimization of neural network through genetic algorithm searches for the prediction of international crude oil price based on energy products prices. In: Proceedings of the 11th ACM Conference on Computing Frontiers, p. 27. ACM (2014)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this paper

Cite this paper

Chiroma, H., Abdul-Kareem, S., Abdullahi Muaz, S., Khan, A., Sari, E.N., Herawan, T. (2014). Neural Network Intelligent Learning Algorithm for Inter-related Energy Products Applications. In: Tan, Y., Shi, Y., Coello, C.A.C. (eds) Advances in Swarm Intelligence. ICSI 2014. Lecture Notes in Computer Science, vol 8794. Springer, Cham. https://doi.org/10.1007/978-3-319-11857-4_32

Download citation

DOI: https://doi.org/10.1007/978-3-319-11857-4_32

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-11856-7

Online ISBN: 978-3-319-11857-4

eBook Packages: Computer ScienceComputer Science (R0)