Abstract

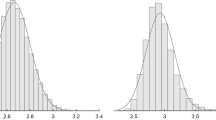

Coherent distortion risk measure is needed in the actuarial and financial fields in order to provide incentive for active risk management. The purpose of this study is to propose extended versions of Wang transform using skew normal distribution functions. The main results show that the extended version of skew normal distortion risk measure is coherent and its transform satisfies the classic capital asset pricing model. Properties of the stock price model under log-skewnormal and its transform are also studied. A simulation based on the skew normal transforms is given for a insurance payoff function.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J.M., Heath, D.: Thinking coherently: generalised scenarios rather than var should be used when calculating regulatory capital. Risk-Lond.-Risk Mag. Ltd. 10, 68–71 (1997)

Artzner, P., Delbaen, F., Eber, J.M., Heath, D.: Coherent measures of risk. Math. Financ. 9(3), 203–228 (1999)

Azzalini, A.: A class of distributions which includes the normal ones. Scand. J. Stat. 12, 171–178 (1985)

Basak, S., Shapiro, A.: Value-at-risk-based risk management: optimal policies and asset prices. Rev. Financ. stud. 14(2), 371–405 (2001)

Butsic, R.P.: Capital Allocation for property-liability insurers: a catastrophe reinsurance application. In: Casualty Actuarial Society Forum, pp. 1–70 (1999)

Fernández, C., Steel, M.F.: On Bayesian modeling of fat tails and skewness. J. Am. Stat. Assoc. 93(441), 359–371 (1998)

Gupta, A.K., Chang, F.C., Huang, W.J.: Some skew-symmetric models. Random Oper. Stoc. Equ. 10, 133–140 (2002)

Hull, J.C.: Options, Futures and Other Derivatives. Pearson Education, New York (1999)

Hürlimann, W.: On stop-loss order and the distortion pricing principle. Astin Bull. 28, 119–134 (1998)

Hürlimann, W.: Distortion risk measures and economic capital. N. Am. Actuar. J. 8(1), 86–95 (2004)

Hürlimann, W.: Conditional value-at-risk bounds for compound Poisson risks and a normal approximation. J. Appl. Math. 2003(3), 141–153 (2003)

Jones, M.C., Faddy, M.J.: A skew extension of the t-distribution, with applications. J. R. Stat. Soc.: Ser. B (Stat. Methodol.) 65(1), 159–174 (2003)

Kijima, M.: A multivariate extension of equilibrium pricing transforms: the multivariate Esscher and Wang transforms for pricing financial and insurance risks. Astin Bull. 36(1), 269 (2006)

Lee, Y.S.: The mathematics of excess of loss coverages and retrospective rating-a graphical approach. PCAS LXXV 49 (1988)

Lin, G.D., Stoyanov, J.: The logarithmic skew-normal distributions are moment-indeterminate. J. Appl. Probab. 46(3), 909–916 (2009)

Li, B., Wang, T., Tian, W.: Risk measures and asset pricing models with new versions of Wang transform. In: Uncertainty Analysis in Econometrics with Applications, pp. 155–167. Springer, Berlin (2013)

Ma, Y., Genton, M.G.: Flexible class of skew-symmetric distributions. Scand. J. Stat. 31(3), 459–468 (2004)

Merton, R.C.: An intertemporal capital asset pricing model. Econom.: J. Econom. Soc. 41, 867–887 (1973)

Nekoukhou, V., Alamatsaz, M.H., Aghajani, A.H.: A flexible skew-generalized normal distribution. Commun. Stat.-Theory Methods 42(13), 2324–2334 (2013)

Sharpe, W.F.: The sharpe ratio. J. Portf. Manag. 21(1), 4958 (1994)

Venter, G.G.: Premium calculation implications of reinsurance without arbitrage. Astin Bull. 21(2), 223–230 (1991)

Wang, S.S.: Premium calculation by transforming the layer premium density. Astin Bull. 26, 71–92 (1996)

Wang, S.S.: A class of distortion operators for pricing financial and insurance risks. J. Risk Insur. 67, 15–36 (2000)

Wang, S.S.: A universal framework for pricing financial and insurance risks. Astin Bull. 32(2), 213–234 (2002)

Wang, S.S.: Cat bond pricing using probability transforms. Geneva Papers: Etudes et Dossiers, special issue on Insurance and the State of the Art in Cat Bond Pricing 278, 19–29 (2004)

Wang, T., Li, B., Gupta, A.K.: Distribution of quadratic forms under skew normal settings. J. Multivar. Anal. 100(3), 533–545 (2009)

Wirch, J.L., Hardy, M.R.: A synthesis of risk measures for capital adequacy. Insur.: Math. Econ. 25(3), 337–347 (1999)

Wirch, J.L., Hardy, M.R.: Distortion risk measures. Coherence and stochastic dominance. In: International Congress on Insurance: Mathematics and Economics, pp. 15–17 (2001)

Acknowledgments

The authors would like to thank Ying Wang for proofreading of this paper and anonymous referees for their valuable comments which let the improvement of this paper.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Tian, W., Wang, T., Hu, L., Tran, H.D. (2015). Distortion Risk Measures Under Skew Normal Settings. In: Huynh, VN., Kreinovich, V., Sriboonchitta, S., Suriya, K. (eds) Econometrics of Risk. Studies in Computational Intelligence, vol 583. Springer, Cham. https://doi.org/10.1007/978-3-319-13449-9_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-13449-9_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-13448-2

Online ISBN: 978-3-319-13449-9

eBook Packages: EngineeringEngineering (R0)