Abstract

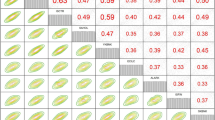

In the context of existing downside correlations, we proposed multi-dimensional elliptical and asymmetric copula with CES models to measure the dependence of G7 stock market returns and forecast their systemic risk. Our analysis firstly used several GARCH families with asymmetric distribution to fit G7 stock returns, and selected the best to our marginal distributions in terms of AIC and BIC. Second, the multivariate copulas were used to measure dependence structures of G7 stock returns. Last, the best modeling copula with CES was used to examine systemic risk of G7 stock markets. By comparison, we find the mixed C-vine copula has the best performance among all multivariate copulas. Moreover, the pre-crisis period features lower levels of risk contribution, while risk contribution increases gradually while the crisis unfolds, and the contribution of each stock market to the aggregate financial risk is not invariant.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aas, K., Czado, C., Frigessi, A., Bakken, H.: Pair-copula constructions of multiple dependence. Insurance: Mathematics and Economics 44(2), 182–198 (2009)

Acharya, V., Pedersen, L., Philippe, T., Richardson, M.: Measuring Systemic Risk. Technical Report, Department of Finance, NYU (2010)

Ba, C.: Recovering copulas from limited information and an application to asset allocation. Journal of Banking & Finance 35(7), 1824–1842 (2011)

Banulescu, G.D., Dumitrescu, E.I.: Which are the SIFIs? A Component Expected Shortfall (CES) Approach to Systemic Risk. Journal of Banking & Finance 50, 575–588 (2015)

Brownlees, T.C., Engle, R.F.: Volatility, Correlation and Tails for Systemic Risk Measurement, Working Paper, NYU-Stern (2012)

Czado, C., Schepsmeier, U., Min, A.: Maximum likelihood estimation of mixed C-vines with application to exchange rates. Statistical Modelling 12, 229–255 (2012)

Embrechts, P., McNeil, A., Straumann, D.: Correlation and dependence in risk management: properties and pitfalls. In: Dempster, M.A.H. (ed.) Risk Management: Value at Risk and Beyond. Cambridge University Press, Cambridge (2002)

Engle, R.: Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. Journal of Business and Economic Statistics 20(3), 339–350 (2002)

Engle, R.: Anticipating Correlations: A New Paradigm for Risk Management. Princeton University Press, Princeton (2009)

Ghalanos, A.: Introduction to the rugarch package (2012). http://cran.rproject.org/web/packages/rugarch Version 1.0-11

Hentschel, L.: All in the family nesting symmetric and asymmetric garch models. Journal of Financial Economics 39(1), 71–104 (1995)

Liu, J., Sriboonchitta, S.: Analysis of volatility and dependence between the tourist arrivals from China to Thailand and Singapore: a copula-based GARCH approach. In: Huynh, V.N., Kreinovich, V., Sriboonchitta, S., Suriya, K. (eds.) Uncertainty Analysis in Econometrics with Applications. AISC, vol. 200, pp. 283–294. Springer, Heidelberg (2013)

Liu, J., Sriboonchitta, S., Denoeux, T.: Economic Forecasting Based on Copula Quantile Curves and Beliefs. Thai Journal of Mathematics, 25–38 (2014)

Low, R.K.Y., Alcock, J., Faff, R., Brailsford, T.: Canonical vine copulas in the context of modern portfolio management: Are they worth it? Journal of Banking & Finance 37, 3085–3099 (2013)

Patton, A.J.: On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. Journal of Financial Econometrics 2(1), 130–168 (2004)

Sklar, M.: Fonctions de répartition à n dimensions et leurs marges, vol. 8, pp. 229–231. Publications de l’Institut de Statistique de L’Université de Paris (1959)

Sriboonchitta, S., Nguyen, H.T., Wiboonpongse, A., Liu, J.: Modeling volatility and dependency of agricultural price and production indices of Thailand: Static versus time-varying copulas. International Journal of Approximate Reasoning 54(6), 793–808 (2013)

Wu, C.C., Liang, S.S.: The economic value of range-based covariance between stock and bond returns with dynamic copulas. Journal of Empirical Finance 18, 711–727 (2011)

Yan, J.: Enjoy the Joy of Copulas: With a Package copula. Journal of Statistical Software 21(4), 1–21 (2007)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this paper

Cite this paper

Liu, J., Sriboonchitta, S., Phochanachan, P., Tang, J. (2015). Volatility and Dependence for Systemic Risk Measurement of the International Financial System. In: Huynh, VN., Inuiguchi, M., Demoeux, T. (eds) Integrated Uncertainty in Knowledge Modelling and Decision Making. IUKM 2015. Lecture Notes in Computer Science(), vol 9376. Springer, Cham. https://doi.org/10.1007/978-3-319-25135-6_37

Download citation

DOI: https://doi.org/10.1007/978-3-319-25135-6_37

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-25134-9

Online ISBN: 978-3-319-25135-6

eBook Packages: Computer ScienceComputer Science (R0)