Abstract

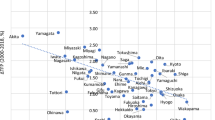

This paper applies the \(\beta \)-convergence regression model in order to assess convergence of total factor productivity among Vietnamese provinces for manufacturing industries. Specifically, we express this model in the form of a Spatial Durbin Model (SDM), which allows us to take into account the presence of omitted variables that can be spatially correlated and correlated with the initial level of productivity. We calculate the annual total factor productivity (TFP) of 63 Vietnamese provinces and 6 manufacturing industries, using the results of the structural estimation of a value-added production function from firm data over the period from 2000 to 2012. The regression of growth rates of TFP over this period on the initial levels of productivity using SDM shows that there is convergence in most industries, i.e. the gap between lower-productivity and higher-productivity provinces decreases. These results also show the importance of modeling the indirect effect of the initial level of productivity of a province on its TFP growth rate, through its effect on neighboring provinces. The inclusion of these indirect effects is made possible by SDM and increases the speed of convergence for most considered manufacturing industries, except for metal and machinery, and transportation and telecommunication.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Kokko and Thang [13] use a similar industrial classification when investigating the impact of foreign direct investment on the survival of domestic private firms in Vietnam.

- 2.

The estimation procedure is described in Appendix 2.

- 3.

Estimation of the parameters in value added production function were carried out in R using various functions including ivreg2 which allows the implementation of the instrumental variables regression proposed by Wooldridge [24].

- 4.

In a recent paper, [23] choose employment shares when aggregating foreign direct investment at the provincial level in Vietnam. We obtain similar results when using the two types of weights.

- 5.

110 km is the smallest possible value of radius such that each province has at least one neighbor.

- 6.

- 7.

Olley and Pakes [22] use the function relating investment to productivity and capital, but only for strictly positive investment. Using intermediate input as the proxy variable instead of investment avoids the problem of zero values.

- 8.

References

Abreu, M., de Groot, H.L.F., Florax, R.J.G.M.: A meta-analysis of \(\beta \)-convergence: the legendary 2%. J. Econ. Surv. 19, 389–420 (2005)

Ackerberg, D., Benkard, C.L., Berry, S., Pakes, A.: Econometric tools for analyzing market outcomes. In: Heckman, J., Leamer, E. (eds.) Handbook of Econometrics, Part A, vol. 6. Elsevier, Amsterdam (2007)

Anselin, L.: Spatial Econometrics: Methods and Models. Kluwer, Dordrecht (1988)

Anselin, L.: Estimation Methods for Spatial Autoregressive Structures. Cornell University. Regional Science Dissertation and Monograph Series, vol. 8. Ithaca Cornell University, New York (1980)

Anselin, L., Bera, A.K., Florax, R.J.G.M., Yoon, M.J.: Simple diagnostic tests for spatial dependence. Reg. Sci. Urban Econ. 26, 77–104 (1996)

Arbia, G., Basile, R., Piras, G.: Using spatial panel data in modelling regional growth and convergence. Working Paper No. 55, Istituto di Studi e Analisa Economica, Roma, Italy (2005)

Beresford, M.: Doi moi in review: the challenges of building market socialism in Vietnam. J. Contemp. Asia 38, 221–243 (2008)

Bivand, R.S., Piras, G.: Comparing implementations of estimation methods for spatial econometrics. J. Stat. Softw. 63, 1–36 (2015)

Bivand, R.S., Hauke, J., Kossowski, T.: Computing the jacobian in gaussian spatial autoregressive models: an illustrated comparison of available methods. Geogr. Anal. 45, 150–179 (2013)

Brown, J.P., Florax, R.J.G.M., McNamara, K.T.: Determinants of investment flows in U.S. manufacturing. Rev. Reg. Stud. 39, 269–286 (2009)

Burnham, K.P., Anderson, D.R.: Multimodel inference: understanding AIC and BIC in model selection. Sociol. Method Res. 33, 261–304 (2004)

Elhorst, J.P.: Applied spatial econometrics: raising the bar. Spat. Econ. Anal. 5(9), 28 (2010)

Kokko, A., Thang, T.T.: Foreign direct investment and the survival of domestic private firms in Vietnam. Asian. Dev. Rev. 31, 53–91 (2014)

Kokko, A., Tingvall, T.G.: Regional development and government support to SMEs in Vietnam. Country Economic Report 2005:5, Swedish International Development Cooperation Agency, Stockholm, Sweden (2005)

Le Gallo, J., Dall’erba, S.: Spatial and sectorial productivity convergence between European regions, 1975–2000. Pap. Reg. Sci. 87, 505–526 (2008)

LeSage, J.P., Pace, R.K.: Introduction to Spatial Econometrics. CRC Press, Boca Raton (2009)

Levinsohn, J., Petrin, A.: Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70(317), 341 (2003)

Nguyen, H.H.: Regional welfare disparities and regional economic growth in Vietnam. Ph.D. thesis, Wageningen University, Holland (2009)

Nguyen, K.M., Pham, V.K.: Forecasting the convergence state of per capita income in Vietnam. Am. J. Oper. Res. 3, 487–496 (2013)

Nguyen, K.M., Pham, V.K., Nguyen, V.H.: Using the spatial econometric approach to analyze convergence of labor productivity at the provincial level in Vietnam. J. Econ. Dev. 17, 5–19 (2015)

Nishida, M., Petrin, A., Polanec, S.: Exploring reallocation’s apparent weak contribution to growth. J. Prod. Anal. 42, 187–210 (2014)

Olley, S., Pakes, A.: The dynamics of productivity in the telecommunication equipment industry. Econometrica 64, 1263–1298 (1996)

Tran, T.T., Pham, T.S.H.: Spatial spillovers of foreign direct investment: the case of Vietnam. DEPOCEN Working Paper Series No. 2013/12, Hanoi, Vietnam (2013)

Wooldridge, J.M.: On estimating firm-level production functions using proxy variables to control for unobservables. Econ. Lett. 104, 112–114 (2009)

Acknowledgments

This research was partially funded by Vietnam National Foundation for Science and Technology Development, grant number II 2.2-2012-18.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

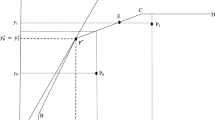

Appendix 1: Derivation of the Spatial Durbin Model

Consider a set of n spatial units whose neighborhood can be described by a proximity matrix W. The matrix W is an \(n \times n\) deterministic, non-negative spatial weight matrix. The elements of W are used to specify the spatial dependence structure among the observations. If observation unit i is related to observation j, then \(w_{ij} >0\). Otherwise, \(w_{ij} = 0\), and the diagonal elements \(w_{ii}\) are set to zero as a normalization of the model. The matrix is also standardized to have row-sums of unity. We are interested in estimating the relationship between two variables and we assume that their data generating process can be written as

where y is an \(n \times 1\) vector of observations on the continuous dependent variable, x is an \(n \times k\) matrix of observations on the explanatory variable, \(\varepsilon \) is an \(n \times 1\) vector of a spatially correlated omitted variable following a spatial autoregressive process with autoregressive coefficient \(\rho \), and v and u are \(n \times 1\) vectors of i.i.d. random error terms. The last equation shows that the omitted variable which is correlated with v, is also correlated with the explanatory variables when \(\delta \ne 0\). Using this set of equations, [16] show that the resulting model is a spatial Durbin model (see also [10]). Indeed, the first equation can be written as

by replacing \(\varepsilon \) with \((I - \rho W)^{-1} v\) from the second equation. After rearranging terms, we get

which can be expressed as

using the third equation and defining \(\gamma _1 = \beta + \delta \) and \(\gamma _2 = \rho \beta \). This last expression is known as the spatial Durbin model as Anselin [4] proposed the adaptation of the Durbin model in time series to the spatial context.

Appendix 2: Estimation Procedure of the Value Added Production Function

This appendix draws from lectures given by Jeffrey Wooldridge at the University of Wisconsin, Madison, in 2008.

Consider a value added production function for firm i in period t, i.e.

where \(y_{it}\) denotes the firm output, here measured as value added, \(l_{it}\) is the labor input, and \(k_{it}\) the observed state variable, i.e. capital input, all in logarithmic form. The sequence \(\{ \omega _{it}, t = 1,\ldots ,T \}\) is unobserved productivity, and \(\{ \varepsilon _{it}, t = 1,\ldots ,T \}\) is a sequence of shocks. The key difference between \(\omega _{it}\) and \(\varepsilon _{it}\) is that the former is a state variable and, hence, impacts on the firm’s decisions. It is not observed by the econometrician, and it can impact on the choice of inputs, leading to the well-known simultaneity problem in production function estimation (see [2]).

The demand of intermediate input as a function of the state variable and unobserved level of productivity of a firm,Footnote 7 or

where \(m_{it}\) denotes the intermediate input. For simplicity, [17] assume that the function m(., .) is time invariant and show that making mild assumptions on the firm’s production function, this demand function is monotonically increasing in \(\omega _{it}\). This allows inversion of the intermediate input demand function and allows to write unobserved level of productivity of a firm as a function of the capital and intermediate inputs, i.e.

Under the assumption

we get the following regression function

where \(h(k_{it},m_{it}) = \alpha + \gamma k_{it} + g(k_{it},m_{it})\). Since g(., .) is a general function, \(\gamma \) and \(\alpha \) are not identified from the previous regression model.

As we are interested not only by the estimation of \(\beta \) but also of \(\gamma \), we can follow the direct estimation procedure proposed by Wooldridge [24].Footnote 8 In order to identify \(\gamma \) along with \(\beta \), [24] follows [17, 22] by assuming that

The dynamic in the productivity process is also restricted such that

where the latter equivalence holds for some function f(.) because \(\omega _{it-1} = g(k_{it-1},\) \(m_{it-1})\). A consequence of this restriction is that the variable labor input \(l_{it}\) is allowed to be correlated with the innovation \(a_{it}\) in \(\omega _{it} = f(\omega _{it-1}) + a_{it}\) while \(k_{it}\), past values of \(l(_{it}, k_{it}, m_{it})\), and functions of these are uncorrelated with \(a_{it}\).

Plugging \(\omega _{it} = f\left( g(k_{it-1},m_{it-1})\right) + a_{it}\) into the expression of the value added production function gives

where \(u_{it} = a_{it} + \varepsilon _{it}\). This equation allows to identify \(\beta \) and\(\gamma \) provided we have the orthogonality condition

Effectively, \(k_{it}\), \(k_{it-1}\) and \(m_{it-1}\) act as their own instruments and \(l_{it-1}\) as an instrument for \(l_{it}\). The functions g(., .) and f(.) can be approximated by low-order polynomials and then parameters involved in the previous equation can be estimated using instrumental variable technique.

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Nguyen, P.A., Phan, T.H., Simioni, M. (2016). Productivity Convergence in Vietnamese Manufacturing Industry: Evidence Using a Spatial Durbin Model. In: Huynh, VN., Kreinovich, V., Sriboonchitta, S. (eds) Causal Inference in Econometrics. Studies in Computational Intelligence, vol 622. Springer, Cham. https://doi.org/10.1007/978-3-319-27284-9_39

Download citation

DOI: https://doi.org/10.1007/978-3-319-27284-9_39

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-27283-2

Online ISBN: 978-3-319-27284-9

eBook Packages: EngineeringEngineering (R0)