Abstract

Decisions to grant credit to customer is the most crucial part in credit business. In the recent years, advances in information technology have lessened the costs of acquiring, managing and analyzing data in an effort to build more efficient and powerful models for credit rating in credit risk management.

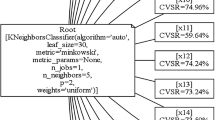

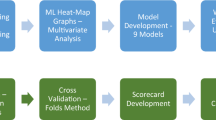

By using common methods as statistical and learning methods, credit scoring models are built to evaluate credit risk for real Vietnamese corporate data. We found that the logistic model give promising results compare with multivariate discrimination analysis, probit and neural network.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Tri Thuc Tre: http://ttvn.vn/kinh-doanh.htm.

- 2.

IMF: 2016 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Vietnam.

- 3.

In simplest case, we consider that a firm is either default or non-default. In the general case, we can divide firms into groups based on discriminant score.

- 4.

We also use these model to classify customers to different groups.

- 5.

Gini, C. (1912).

- 6.

Basel Committee on Banking Supervision - Revisions to the Standardized Approach for credit risk.

References

Rencher, A.C.: Methods of Multivariate Analysis, 2nd edn. Brigham Young University, Brigham (2002)

Altman, E.: Iltman : Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Finance, XXII I(4), 589–609 (1968)

Altman, E.I., Marco, G., Varetto, F.: Corporate distress diagnosis; Comparisons using linear discriminant analysis and neural networks (the Italian experience). J. Banking Finance 18, 505–529 (1994)

Bierman, H., Hausman, W.H.: The credit granting decision. Manage. Sci. 16, 519–532 (1970)

Buckley, J., James, I.: Linear regression with censored data. Biometrika 66, 429–436 (1979)

Powers, D.M.W.: Evaluation: From precision, recall and F-measure to ROC, informedness, markedness correlation. J. Mach. Learn. Technol. 2, 37–63 (2011)

Spackman, K.A.: Signal detection theory: Valuable tools for evaluating inductive learning. In: Proceedings of the Sixth International Workshop on Machine Learning, pp. 160–163. Morgan Kaufmann, San Mateo, CA (1989)

Marsland, Stephen: Learning, Machine: An Algorithmic Perspective. Massey University, Palmerston North, New Zealand (2009)

Ganganwar, V.: An overview of classification algorithms for imbalanced datasets. Int. J. Emerg. Technol. Adv. Eng. 4, 42–47 (2012)

Further Reading

Lahsasna, A., Ainon, R.N., Wah, T.Y.: Credit scoring models using soft computing methods: a survey. Int. Arab J. Inf. Technol. 7(2), 115–123 (2010)

Boyle, M., Crook, J.N., Hamilton, R., Thomas, L.C.: Methods for credit scoring applied to slow payers. In: Thomas, L.C., Crook, J.N., Edelman, D.B. (eds.) Credit Scoring and Credit Control, pp. 75–90. Oxford University Press, Oxford (1992)

Banasik, J., Crook, J.N., Thomas, L.C.: Does scoring a subpopulation make a difference? Int. Rev. Retail Distrib. Consum. Res. 6, 180–195 (1996)

Banasik, J., Crook, J.N., Thomas, L.C.: Not if but when borrowers default. J. Oper. Res. Soc. 50, 1185–1190 (1999)

Carter, C., Catlett, J.: Assessing credit card applications using machine learning. IEEE Expert 2, 71–79 (1987)

Angelini, E., Tollo, G., Roli, A.: A neural network approach for credit risk evaluation. Q. Rev. Econ. Finance 48(4), 733–755 (2008)

Hammer, P.L., Kogan, A., Lejeune, M.A.: A logical analysis of banks’ financial strength ratings. Expert Syst. Appl. 39(9), 7808–7821 (2012)

Ahn, H., Kim, K.-J.: Corporate credit rating using multi-class classification models with order information. World Acad. Sci. Eng. Technol. 5, 161–177 (2011)

Majer, I.: Application scoring: Logit model approach and the divergence method compared, Working Paper No. 10, Warsaw School of Economics, Poland (2006)

De Andrés, J., Lorca, P., de Cos Juez, F.J.: Bankruptcy forecasting: a hybrid approach using fuzzy c-means clustering and multivariate adaptive regression splines (MARS). Expert Syst. Appl. 38, 1866–1875 (2011)

Galindo, J., Tamayo, P.: Credit risk assessment using statistical and machine learning: Basic methodology and risk modeling applications. Comput. Econ. 15(1–2), 107–143 (2000)

Narain, B.: Survival analysis and the credit granting decision. In: Thomas, L.C., Crook, J.N., Edelman, D.B. (eds.) Credit scoring and credit control, pp. 109–122. Oxford University Press, Oxford (1992)

Sheskin, D.: Handbook of Parametric and Nonparametric Statistical Procedures. CRC Press, Boca Raton (2004)

Pacelli, Vincenzo: Michele, A.: An artificial neural network approach for credit risk management. J. Intell. Learn. Syst. Appl. 3, 103–112 (2011)

Huang, Z., Chen, H., Hsu, C.-J., Chen, W.-H., Wu, S.: Credit rating analysis with support vector machines and neural networks: A market comparative study. Decis. Support Syst. 37, 543–558 (2004)

Acknowledgment

We are immensely grateful to 3 anonymous reviewers for their comments on an earlier version of the manuscript, although any errors are our own and should not tarnish the reputations of these esteemed persons.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing AG

About this paper

Cite this paper

Nguyen, H., Nguyen, T. (2016). Statistical and ANN Approaches in Credit Rating for Vietnamese Corporate: A Comparative Empirical Study. In: Huynh, VN., Inuiguchi, M., Le, B., Le, B., Denoeux, T. (eds) Integrated Uncertainty in Knowledge Modelling and Decision Making. IUKM 2016. Lecture Notes in Computer Science(), vol 9978. Springer, Cham. https://doi.org/10.1007/978-3-319-49046-5_60

Download citation

DOI: https://doi.org/10.1007/978-3-319-49046-5_60

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-49045-8

Online ISBN: 978-3-319-49046-5

eBook Packages: Computer ScienceComputer Science (R0)