Abstract

Proper understanding of dynamics of equity markets in long run and short run is extremely critical for investors, speculators and arbitrageurs. It is essential to delve into causal interrelationships among different financial markets in order to assess the impact of ongoing inter country trades and forecast future movements. In this paper, initially effort has been made to comprehend the nature of temporal movements and interactions among four Asian stock indices namely, Bombay Stock Exchange (BSE), Taiwan Stock Exchange (TWSE), Jakarta Stock Exchange (JSX) and Korea Composite Stock Price Exchange (KOSPI) through conventional Econometric and Statistical methods. Subsequently a granular forecasting model comprising Maximal Overlap Discrete Wavelet Transformation (MODWT) and Support Vector Regression (SVR) has been utilized to predict the future prices of the respective indices in univariate framework.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

1 Introduction

Financial markets representing developed and emerging economies largely influence intraday trading, portfolio construction and rebalancing, volatility trading in options markets, resource allocation, etc. [1,2,3]. Market is said to be inefficient if it is governed by distinct pattern consists of trend and periodic components thus enabling investors to wreak mayhem. Due to globalization, ease of investing in financial assets of other countries, trades, penetration of foreign institutional investors (FII) etc. shocks and volatility transmit from one country to other. So apart from evaluating individual markets to test random walk hypothesis and judging statistical properties, it is essential to study the interrelationships of different markets as well. The key endeavors of this research work are to present an integrated framework to critically extract the key characteristics of temporal behavior financial markets, to assess their causal interactions and to develop predictive model for forecasting future figures. Four Asian financial markets, Bombay Stock Exchange (BSE), Taiwan Stock Exchange (TWSE), Jakarta Stock Exchange (JSX) and Korea Composite Stock Price Exchange (KOSPI) have been considered in this study. To critically examine the nexus among four indices, Pearson’s correlation coefficient and cross correlation function (CCF) for checking correlations at different lags have been calculated to carry out systematic test of association. Granger causality (GC) analysis has been performed to decode the causal interactions. Next, maximal overlap discrete wavelet transformation (MODWT) is applied to decompose the stock indices into linear (detail part) and nonlinear (approximation part) components to deal with nonlinearity and presence of other erratic features in financial time series. Then support vector regression (SVR), a kernel based advanced machine learning algorithm, has been applied on decomposed components to discover the inherent patterns and make predictions. Final forecast is obtained by aggregating the obtained forecasts from individual components. As it has been well argued that the global financial markets often exhibit high volatility due to various macroeconomic and other events [4, 5]. Hence traditional forecasting models viz. autoregressive moving average (ARMA), autoregressive integrated moving average (ARIMA), autoregressive conditional heteroscedasticity (ARCH), autoregressive distributed lag (ARDL) models, etc. fail to yield good forecasts. That is why MODWT-SVR based approach has been considered in this study for predictive modelling as MODWT assists in identifying the significant nonlinear components in time series and accordingly the parameters of SVR can be well tuned to capture the pattern.

Rest of the article is planned as follows. Section 2 briefly discusses the relevant literature. Overview of the data and empirical findings are presented in Sect. 3. Causality analysis through statistical and econometric tools are narrated in Sect. 4. Section 5 elucidates the MODWT and SVR in details. Results of applied predictive modelling are highlighted and discussed in Sect. 6. Finally we conclude the paper in Sect. 7 mentioning the future research scopes.

2 Related Work

Due to its attached importance in overall economic development of a country, financial market has garnered lot of attention among academicians and practitioners worldwide. Liu and Morley [6] showed the supremacy of performance of generalized autoregressive conditional heteroscedasticity (GARCH) models in predicting the historical volatility of Hang Seng index over traditional historical average method. Sharma and Vipul [7] made a comparative research utilizing GARCH and exponential GARCH (EGARCH) models to predict conditional variance of sixteen international stock indices for a period of about fourteen years. Priyadarshini and Babu [8] utilized conventional rescaled range (R/S) analysis to estimate Hurst exponent and fractal dimensional index to investigate whether Indian stock market and mutual funds follows random walk or fractional Brownian motion. Findings strongly suggested that they followed Fractional Brownian Motion. Yin et al. [9] studied fractal nature of Chinese gold market applied both single fractal model and multi fractal detrended fluctuation analysis (MFDFA) model and identified the key responsible factors for multi fractal characteristics of the said market. Sun et al. [10] applied partition function based multifractal analysis to analyze the multifractal nature of Hang Seng Index (HSI) data for individual trading days for the timespan of January 3, 1994 to May 28, 1997. Lahmiri [11] used DWT and back propagation neural network (BPNN) that outperformed traditional ARMA model for predictive modelling of S&P 500 price index and closing prices of six different stocks during February 28, 2011 to March 11, 2011. Ramsey and Zhang [12] adopted wavelet decomposition to comprehend and model the foreign exchange rate dynamics. Study made by Gencay et al. [13] showed the effectiveness of Wavelet filtering to deal with nonstationary and time varying features of time series. Ben Ammou and Ben Mabrouk [14] carried out wavelet analysis to assess the nexus between stock returns and systematic risk in the capital asset pricing model. Jothimani et al. [15] proposed a novel framework combining MODWT and state-of-the-arts machine learning models namely, artificial neural network (ANN) and SVR to carry out predictive modelling exercise on NIFTY Index during September 2007 to July 2015.

3 Data and Empirical Results

We have collected the daily closing prices of BSE, TWSE, JSX and KOSPI during April 20, 2010 to April 20, 2017 from Yahoo Finance data repository for analysis. Before proceeding with the causal association analysis and predictive modelling some key statistical properties have been estimated to get deeper insights about the nature of temporal movements of the considered indices as shown in Table 1.

Jarque-Bera and Shapiro-Wilk test statistic reveal that none of the indices adhere to normal distribution. Augmented-Dickey-Fuller (ADF) and Philips-Peron (PP) tests confirm that except KOSPI, other three induces are not stationary. ARCH-Lagrange multiplier (LM) test suggests the presence of conditional heteroscedasticity in BSE, TWSE and JSX. As the estimated values of Hurst Exponent for all four indices are well above 0.5, inferences can be drawn that the indices are governed by biased random walk or fractional Brownian motion.

4 Test of Associations and Causal Interactions

To identify and determine the impact of nexus among the four stock indices Pearson’s correlation and GC tests have been performed to execute systematic check of association and causality. Results of bivariate pointwise correlation to measure association are tabulated below (Table 2).

It is quite evident that significant high positive associations exist between BSE-TWSE, BSE-JSX, TWSE-JSX and TWSE-KOSPI pairs. However mere study of association cannot provide insights related to existing causal influence among each other. To examine causal interactions, GC test in pair wise manner has been conducted. It is well known that outcome of GC test is highly sensitive to the lag order of the variables which also termed as structural instability. To overcome this problem, lag order selection criteria in vector auto regression (VAR) framework is utilized to find appropriate leg length. Table 3 portrays the results.

Minimum AIC value corresponds to lag order of 8. Hence GC test has been performed keeping lag order of 8. Table 4 narrates the findings of causality analysis.

It can be observed that there exists a bidirectional causal interaction between the pairs TWSE-BSE and JSX-BSE at 5% level of significance. KOSPI is found to have significant unidirectional causal influence on BSE. Similarly TWSE is significantly influenced by KOSPI. Only JSX is observed to possess significant causal influence over KOSPI.

5 Methodology for Predictive Modelling

5.1 Maximal Overlap Discrete Wavelet Transform (MODWT)

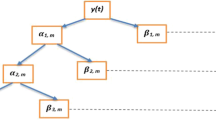

It is a novel filtering technique that segregates a time series observations into coefficients related to variation over a set of scales while preserving orthogonality to carry out multiresolution analysis. Basically it decomposes any time series data into a nonlinear (approximation) component and a series of linear components (details). In the wavelet analysis, the original function is translated and dilated onto father and mother wavelets at different scales. The mother wavelets account for the details part having unit energy and zero mean while the father wavelet defines the approximations part with mean value of one. There are several advantages of MODWT over DWT for decomposition of time series. First of all, unlike DWT, MODWT does not require the dataset to be dyadic. Secondly it is also invariant to circular shift.

5.2 Support Vector Regression

It is a kernel based machine learning model which has been widely used in various predictive modelling problems. Originated by Vapnik [16], it performs regression tasks [17, 18] to analyze the nonlinear patterns by projecting the original data set into high dimensional feature space and finding linear separation boundary in high dimensional space via quadratic optimization process. The input data xi \( {\epsilon}\,R^{p} \) is first mapped onto a high dimensional feature space using a nonlinear mapping function \( \phi \left( x \right) \) and then a linear model is constructed in this space with a weight w and bias b given by Eq. 1.

6 Results and Analysis

In this research, ‘haar’ wavelets are used for six levels of decomposition in MODWT framework for individual stock indices. The following figures graphically illustrate the MODWT decomposition of BSE, TWSE, JSX and KOSPI (Figs. 1, 2, 3 and 4).

To evaluate the performance of predictive modelling, three quantitative measures namely, Nash Schutcliffe Coefficients (NSE), Index of Agreement (IA) and Theil Inequality (TI) are computed. The value of NSE range between −∞ to 1. Essentially closer the value of NSE to 1, better is the predictive performance. The range of IA lies between 0 (no fit) and 1 (perfect fit). TI value should be close to 0 for good prediction while a value close to 1 implies no prediction at all. Parameters of the SVR algorithm have been varied to perform ten experimental trials. Average values of the performance measures have been reported here. Table 5 summarizes the predictive performance of univariate MODWT-SVR framework considering one day lagged, two days lagged, three days lagged and four days lagged values as predictors.

As the values of NSE and IA are very close to 1 and TI values are substantially low for MODWT-SVR framework on both train and test data set, it is evident that the future prices of BSE, TWSE, JSX and KOSPI can be predicted with high degree of precision.

7 Conclusion and Future Scope

In this paper, an integrated research framework is presented to study the temporal dynamics, causal interrelationships and to perform predictive modelling in financial markets of selected countries in Asia. The MODWT-SVR based univariate framework can effectively be applied to predict future movements. Causality analysis assists heavily to understand nature of influence of one stock market to another which eventually can lead into proper construction of portfolios. Long run co-movements of the stock indices can be analyzed using Johansen’s co-integration test. Also other advanced Machine Learning algorithms such as random forest (RF), multiple adaptive regression splines (MARS), elastic net (EN), adaptive boosting (AdaBoost), etc. can be utilized in conjugation with MODWT for forecasting performance and comparative performance study can be made.

References

Cajueiro, D.O., Tabak, B.M.: Evidence of long-range dependence in Asian equity markets: the role of liquidity and market restrictions. Phys. A Stat. Mech. Appl. 342, 656–664 (2004)

Fallahpour, S., Zadeh, M.H., Lakvan, E.N.: Use of clustering approach for portfolio management. Int. SAMANM J. Finan. Account. 2, 115–136 (2014)

Guhathakurta, K.: Investigating the nonlinear dynamics of emerging and developed stock markets. J. Eng. Sci. Technol. Rev. 8, 65–71 (2015)

Wang, J., Ma, J.-H.: Gold markets price analysis and application studies based on complexity theories. Complex Syst. Complex. Sci. 5, 54–59 (2011)

Srinivasan, P.: Modelling and forecasting time-varying conditional volatility of Indian stock market. IUP J. Finan. Risk Manag. 12, 49–64 (2015)

Liu, W., Morley, B.: Volatility forecasting in the Hang Seng index using the GARCH approach. Asia-Pacific Finan. Market 16, 51–63 (2009)

Sharma, P., Vipul: Forecasting stock market volatility using realized GARCH model: international evidence. Q. Rev. Econ. Finan. 59, 222–230 (2016)

Priyadarshini, E., Chandra Babu, A.: Fractal analysis of Indian financial markets: an empirical approach. Asia-Pacific J. Manag. Res. Innov. 8, 271–281 (2012)

Yin, K., Zhang, H., Zhang, W., Wei, Q.: Fractal analysis of gold market in China. Rom. J. Econ. Forecast. 16, 144–163 (2013)

Sun, X., Chen, H.P., Yuan, Y.Z., Wu, Z.Q.: Predictability of multifractal analysis of Hang Seng stock index in Hong Kong. Phys. A Stat. Mech. Appl. 301, 473–482 (2001)

Lahmiri, S.: Wavelet low- and high-frequency components as features for predicting stock prices with backpropagation neural networks. J. King Saud Univ. Comput. Inf. Sci. 26, 218–227 (2014)

Ramsey, J.B., Zhang, Z.: The analysis of Foreign exchange data using waveform dictionaries. J. Empirical Finan. 4, 341–372 (1997)

Gençay, R., Selçuk, F., Whitcher, B.: Multiscale systematic risk. J. Int. Money Finan. 24, 55–70 (2005)

Abounoori, E., Elmi, Z., Nademi, Y.: Forecasting Tehran stock exchange volatility; Markov switching GARCH approach. Phys. A Stat. Mech. Appl. 445, 264–282 (2016)

Jothimoni, D., Shankar, R., Yadac, S.S.: Discrete wavelet transformation-based prediction of stock index: a study on national stock exchange fifty index. J. Finan. Manag. Anal. 28, 35–49 (2015)

Vapnik, V.: The Nature of Statistical Learning Theory. Springer, New York (1995)

Aich, U., Banerjee, S.: Modeling of EDM responses by support vector machine regression with parameters selected by particle swarm optimization. Appl. Math. Model. 38, 2800–2818 (2014)

Markovic, N., Milinkovic, S., Tikhonov, K.S., Schonfeld, P.: Analyzing passenger train arrival delays with support vector regression. Transp. Res. Part C 56, 251–262 (2015)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Ghosh, I., Sanyal, M.K., Jana, R.K. (2017). Analysis of Causal Interactions and Predictive Modelling of Financial Markets Using Econometric Methods, Maximal Overlap Discrete Wavelet Transformation and Machine Learning: A Study in Asian Context. In: Shankar, B., Ghosh, K., Mandal, D., Ray, S., Zhang, D., Pal, S. (eds) Pattern Recognition and Machine Intelligence. PReMI 2017. Lecture Notes in Computer Science(), vol 10597. Springer, Cham. https://doi.org/10.1007/978-3-319-69900-4_84

Download citation

DOI: https://doi.org/10.1007/978-3-319-69900-4_84

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-69899-1

Online ISBN: 978-3-319-69900-4

eBook Packages: Computer ScienceComputer Science (R0)