Abstract

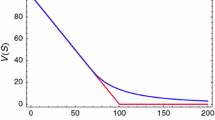

This paper deals with American put options, which is modelled by a free boundary problem for a nonhomogeneous generalized Black-Scholes equation. We present a parameter estimation technique to compute the put option price as well as the optimal exercise curve. The forward problem of computing the put option price with a given parameter of the function space for the free boundary employs the upwind finite difference scheme. The inverse problem of minimizing the cost functional over that function space uses the Levenberg-Marquardt method. Numerical experiments show that the approximation scheme satisfies appropriate convergence properties. Our method can be applied to the case that the volatility is a function of time and asset variables.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Banks, H.T., Kunisch, K.: Estimation Techniques for Distributed Parameter Systems. Birkhäuser, Boston (1989)

Cox, J.C., Ross, S.A., Rubinstein, M.: Option pricing: A simplified approach. Journal of Financial Economics 7, 229–264 (1979)

Hull, J.C.: Introduction to Futures and Options Markets, 3rd edn. Prentice-Hall, New Jersey (1998)

Jamshidian, F.: An analysis of American options. Review of Futures Markets 11, 72–80 (1992)

Kholodnyi, V.A.: A nonlinear partial differential equation for American options in the entire domain of the state variable. Nonlinear Analysis, TMA 30, 5059–5070 (1997)

Kuske, R.A., Keller, J.B.: Optimal exercise boundary for an American put option. Appl. Math. Finance 5, 107–116 (1998)

Lindberg, P., Marcusson, G., Nordman, G.: Numerical analysis of the optimal exercise boundary of an American put option, Internal Report 2002:7, Uppsala University (2002)

Mckean Jr., H.P.: Appendix: a free boundary problem for the heat equation arising from a problem in mathematical economics. Industrial Management Review 6, 32–39 (1965)

Merton, R.C.: Theory of rational option pricing. Bell Journal of Economics and Management Science 4, 141–183 (1973)

Roos, H.G., Stynes, M., Tobiska, L.: Numerical Methods for Singularly Perturbed Differential Equations. Springer, Berlin (1996)

Press, W.H., Teukolsky, S.A., Vettering, W.T., Flannery, B.P.: Numerical Recipes in C. Cambridge University Press, Cambridge (1992)

Ševčoviç, D.: Analysis of the free boundary for the pricing of an American call option. European J. Appl. Math. 12, 25–37 (2001)

Shu, J., Gu, Y., Zheng, W.: A novel numerical approach of computing American option. Int. J. Found. Comut. Sci. 13, 685–693 (2002)

Wilmott, P., Dewynne, J., Howision, S.: Option Pricing: Mathematical Models and Computation. Oxford Financial Press, Oxford (1995)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2004 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Cho, CK., Kang, S., Kim, T., Kwon, Y. (2004). A New Approach for Numerical Identification of Optimal Exercise Curve. In: Laganá, A., Gavrilova, M.L., Kumar, V., Mun, Y., Tan, C.J.K., Gervasi, O. (eds) Computational Science and Its Applications – ICCSA 2004. ICCSA 2004. Lecture Notes in Computer Science, vol 3045. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-24767-8_97

Download citation

DOI: https://doi.org/10.1007/978-3-540-24767-8_97

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-22057-2

Online ISBN: 978-3-540-24767-8

eBook Packages: Springer Book Archive