Abstract

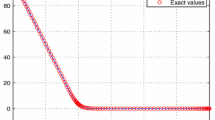

Pricing arithmetic average options continues to intrigue researchers in the field of financial engineering. Since there is no analytical solution for this problem until present, developing an efficient numerical algorithm becomes a promising alternative. One of the most famous numerical algorithms for pricing arithmetic average options is introduced by Hull and White [10]. In this paper, motivated by the common idea of reducing the nonlinearity error in the adaptive mesh model [7] and the adaptive quadrature numerical integration method [6], the logarithmically equally-spaced placement rule in the Hull and White’s model is replaced by an adaptive placement method, in which the number of representative average prices is proportional to the degree of curvature of the option value as a function of the arithmetic average price. Numerical experiments verify the superior performance of our method in terms of reducing the interpolation error. In fact, it is straightforward to apply this method to any pricing algorithm with the techniques of augmented state variables and the piece-wise linear interpolation approximation.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aingworth, D., Motwani, R., Oldham, J.D.: Accurate Approximations for Asian Options. In: Proc. 11th Annual ACM-SIAM Symposium on discrete Algorithms (2000)

Carverhill, A.P., Clewlow, L.J.: Valuing Average Rate (Asian) Options. Risk 3, 25–29 (1990)

Cho, H.Y., Lee, H.Y.: A Lattice Model for Pricing Geometric and Arithmetic Average Options. J. Financial Engrg. 6, 179–191 (1997)

Dai, T.-S., Huang, G.-S., Lyuu, Y.-D.: An Efficient Convergent Lattice Algorithm for European Asian Options. Appl. Math. and Comput. 169, 1458–1471 (2005)

Dai, T.-S., Lyuu, Y.-D.: An Exact Subexponential-Time Lattice Algorithm for Asian Options. In: Proc. ACM-SIAM Symposium on Discrete Algorithms (SODA04), New Oreleans, pp. 710–717 (2004)

Faires, J.D., Burden, R.: Numerical Methods, 3rd edn. Brooks/Cole Press, Pacific Grove (2003)

Figlewski, S., Gao, B.: The Adaptive Mesh Model: A New Approach to Efficient Option Pricing. J. Financial Econ. 53, 313–351 (1999)

Forsyth, P.A., Vetzal, K.R., Zvan, R.: Convergence of Numerical Methods for Valuing Path-Dependent Options Using Interpolation. Rev. Derivatives Res. 5, 273–314 (2002)

Geman, H., Yor, M.: Bessel Processes, Asian Options, and Perpetuities. Math. Finance 3, 349–375 (1993)

Hull, J.C., White, A.: Efficient Procedures for Valuing European and American Path-Dependent Options. J. Derivatives 1, 21–31 (1993)

Kemna, A., Vorst, T.: A Pricing Method for Option Based on Average Asset Values. J. Banking and Finance 14, 113–129 (1990)

Klassen, T.R.: Simple, Fast and Flexible Pricing of Asian Options. J. Comput. Finance 4, 89–124 (2001)

Milevsky, M.A., Posner, S.E.: Asian Option, the Sum of Lognormals and the Reciprocal Gamma Distribution. J. Financial and Quant. Anal. 33, 409–422 (1998)

Neave, E.H., Turnbull, S.M.: Quick Solutions for Arithmetic Average Options on a Recombining Random Walk. Actuarial Approach For Financial Risks 2, 717–740 (1994)

Ritchken, P., Trevor, R.: Pricing Options under Generalized GARCH and Stochastic Volatility Processes. J. Finance 54, 377–402 (1999)

Turnbull, S.M., Wakeman, L.M.: A Quick Algorithm for pricing European Average Option. J. Financial and Quant. Anal. 26, 377–389 (1991)

Author information

Authors and Affiliations

Editor information

Rights and permissions

Copyright information

© 2007 Springer Berlin Heidelberg

About this paper

Cite this paper

Dai, TS., Wang, JY., Wei, HS. (2007). An Ingenious, Piecewise Linear Interpolation Algorithm for Pricing Arithmetic Average Options. In: Kao, MY., Li, XY. (eds) Algorithmic Aspects in Information and Management. AAIM 2007. Lecture Notes in Computer Science, vol 4508. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-72870-2_25

Download citation

DOI: https://doi.org/10.1007/978-3-540-72870-2_25

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-72868-9

Online ISBN: 978-3-540-72870-2

eBook Packages: Computer ScienceComputer Science (R0)