Summary

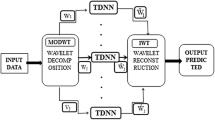

In this chapter, a new hierarchical hybrid wavelet — artificial neural network strategy for exchange rate prediction is introduced. The wavelet analysis (the Mallat’s pyramid algorithm) is utilised for separating signal components of various frequencies and then separate neural perceptrons perform prediction for each separate signal component. The strategy was tested for predicting the US dollar/Polish zloty average exchange rate. The achieved accuracy of prediction of value alterations direction is equal to 90%.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aboufadel E, Schlicker S (1999) Discovering Wavelets, Wiley, Chichester

Andreou AS, Pavlides G, Karytinos A, (2000) Nonlinear time-series analysis on the Greek exchange-rate market Int. Jour. Bifurcation and Chaos 10:1729-1758

Battle G (1987) A block spin construction of ondelettes. Part I: Lemarie functions, Commun. Math. Phys. 110:601-615

Bernhard W, Leblang D (2002) Democratic processes, political risk, and foreign exchange markets, American Journal of Political Science 46:316-333

Cheung YW, Chinn MD (2001) Currency traders and exchange rate dynamics: a survey of the US market, Journal of International Money and Finance 20:439-471

Cybenko G (1989) Approximation by Superposition of a Sigmoidal Function, Mathematics of Control, Signals and Systems 2:303-314.

Fernández-Rodriguez F, Sosvilla-Rivero S, Andrada-Félix J (1999) Exchange-rate forecasts with simultaneous nearest-neighbour methods: evidence from the EMS, Int. Jour. of Forecasting 15:383-392

Franklin P (1928) A set of continues orthogonal functions, Math. Ann. 100:522-29

Haar A (1910) Zur Theorie der orthogonalen Funktionensysteme, Math. Ann. 69:331-371

Hajto P (2002) A neural economic time series prediction with the use of the wavelet analysis, Schedae Informaticae 11:115-132

Hecht-Nielsen R (1987) Kolmogorov's Mapping Neural Network Existence Theorem, Proceedings of the International Conference on Neural Networks, Part III, IEEE, New York

Hecht-Nielsen R (1990) Neurocomputing. Addison-Wesley Publ., Reading

Hertz J, Krogh A, Palmer RG (1991) Introduction to the Theory of Neural Computation. Addison-Wesley Publ., Massachusetts

Hornik K, (1991) Approximation Capabilities of Multilayer Feedforward Networks, Neural Networks 4:251-258.

Hornik K, (1993) Some New Results on Neural Network Approximation, Neural Networks 6:1069-1072

Hornik K, Stinchcombe M, White H (1989) Mulitilayer Feedforward Networks Are Universal Approximators, Neural Networks 2:359-366

Huang W, Lai KK, Nakamori Y, Wang S (2004) Forecasting foreign exchange rates with artificial Neural networks: a review, Int. Jour. of Information Technology and Decision Making 3:145-165

Jensen A, Cour-Harbo A (2001) Ripples in Mathematics. The Discrete Wavelet Transform. Springer-Verlag, Berlin Heidelberg

Kurkova V (1992) Kolmogorov's Theorem and Multilayer Neural Networks, Neural Networks 5:501-506

Lee VCS, Wong HT (2007) A multivariate neuro-fuzzy system for foreign currency risk management decission making, Neurocomputing 70:942-951

Lemarie PG (1998) Ondelettes à localisation exponentielle, J. Math. Pures Appl 67:227-236

Lin K (1997) The ABC's of BDS, Journal of Computational Intelligence in Finance 5:23-26

Lula P (1999) Feedforeward neural networks for economic phenomena modelling. Wydawnictwo Akademii Ekonomicznej w Krakowie, Kraków (in Polish)

Mallat S (1989) Multiresolution approximation and wavelet orthonormal bases of L2 (R), Trans. Am. Math. Soc. 315:69-88

McCulloch WS, Pitts W (1943) A logical calculus for the ideas immanent in nervous activity, Bull. of Math. Biophysics 5:115-133

Mizuno T, Kurihara S, Takayasu M, Takayasu H (2003) Analysis of high-resolution foreign exchange data of USD-JPY for 13 years, Physica A 324:296-302

Muniandy SV, Lim SC, Murugan R (2001) Inhomogeneous scalling behaviors in Malaysian foreign currency exchange rates, Physica A 301:407-428

Ohira T, Sazuka N, Marumo K, Shimizu T, Takayasu M, Takayasu H (2002) cit Predictability of currency market exchange, Physica A308:368-374

Panda C, Narasimhan V (2007) Forecasting exchange rate better with artificial neural network, Jour. Policy Modeling 29:227-236

Pesaran MH, Timmermann A (1992) A simple non-parametric test of predictive performance, Jour. Business and Economic Statistics 10:461-465

Sazuka N, Ohira T, Marumo K, Shimizu T, Takayasu M, Takayasu H (2003) A dynamical stucture of high frequency currency exchange market, Physica A 324:366-371

Schauder MJ (1928) Einige Eigenschaften der Haarschen Orthogonalsysteme, Math. Zeit. 28:317-320

Shin T, Han I (2000) Optimal signal multi-resolution by genetic algorithms to support artificial neural networks for exchange-rate forecasting, Expert Systems with Applications 18:257-269

Str ömberg JO (1983) A modified Franklin system and higher order spline systems on Rn as unconditional bases for Hardy spaces, Proc. Conference in Harmonic Analysis in Honor of A. Zygmund, vol. II, Wadsworth, Belmont 475-493

Steiner M, Wittkemper HG (1995) Neural Networks as an Alternative Stock Market Model. In: Refenes APN (ed) Neural Networks in the Capital Markets. Wiley, Chichester

Tsibouris G, Zeidenberg M (1995) Testing the Efficient Markets Hypothesis with Gradient Descent Algorithm. In: Refenes APN (ed) Neural Networks in the Capital Markets. Wiley, Chichester

Walker JS (1997) Fourier analysis and wavelet analysis, Notices of the AMS 44:658-670

White H (1988) Economic Prediction Using Neural Networks: The Case of IBM Daily Stock Returns, Proceedings of the IEEE International Conference of Neural Networks, San Diego

Wojtaszczyk P (1987) A Mathematical Introduction to Wavelets. Cambridge University Press, Cambridge

Zhang G, Patuwo BE, Hu MY (1998) Forecasting with artificial neural networks: the state of the art, Int. Jour. of Forecasting 14:35-62

Zirilli JS (1966) Financial Prediction Using Neural Networks. International Thomson Computer Press, London

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2008 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Bielecki, A., Hajto, P., Schaefer, R. (2008). Hybrid Neural Systems in Exchange Rate Prediction. In: Brabazon, A., O’Neill, M. (eds) Natural Computing in Computational Finance. Studies in Computational Intelligence, vol 100. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-77477-8_12

Download citation

DOI: https://doi.org/10.1007/978-3-540-77477-8_12

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-77476-1

Online ISBN: 978-3-540-77477-8

eBook Packages: EngineeringEngineering (R0)