Summary

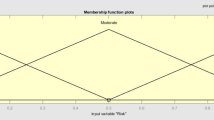

This chapter illustrates a data-mining approach to single-position day trading which uses an evolutionary algorithm to construct a fuzzy predictive model of a financial instrument. The model is expressed as a set of fuzzy IF-THEN rules. The model takes as inputs the open, high, low, and close prices, as well as the values of a number of popular technical indicators on day t and produces a go short, do nothing, go long trading signal for day t+1 based on a dataset of past observations of which actions would have been most profitable. The approach has been applied to trading several financial instruments (large-cap stocks and indices): the experimental results are presented and discussed. A method to enhance the performance of trading rules based on the approach by using ensembles of fuzzy models is finally illustrated. The results clearly indicate that, despite its simplicity, the approach may yield significant returns, outperforming a buy-and-hold strategy.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Allen F, Karjalainen R (1999) Using genetic algorithms to find technical trading rules. Journal of Financial Economics 51:245-271

Various Authors (2006) Special issue on integrating multiple learned models. Machine Learning 36(1-2)

Bacardit J, Krasnogor N (2006) Empirical evaluation of ensemble techniques for a pittsburgh learning classifier system. In Proceedings of the Ninth International Workshop on Learning Classifier Systems. Seattle, WA, USA, July 8-9 2006. ACM Press, New York

Bäck T (1996) Evolutionary algorithms in theory and practice. Oxford University Press, Oxford

Bäck T, Fogel D, Michalewicz Z (2000) Evolutionary Computation. IoP Publishing, Bristol

Beretta M, Tettamanzi A (2003) Learning fuzzy classifiers with evolutionary algorithms. In Pasi G, Bonarini A, Masulli F, (ed) Soft Computing Applications. pp 1-10, Physica Verlag, Heidelberg

Bodie Z, Kane A, Marcus A (2006) Investments (7th edn). McGraw-Hill, New York

Brabazon A, O'Neill M (2006) Biologically Inspired Algorithms for Financial Modelling. Springer, Berlin

Breiman L (1996) Bagging predictors. Machine Learning 24(2):123-140

Cantú -Paz E (1997) A survey of parallel genetic algorithms. Technical Report IlliGAL 97003, University of Illinois at Urbana-Champaign

DeJong K (2002) Evolutionary Computation: A unified approach. MIT Press, Cambridge, MA

Dempster M, Jones C (2001) A real-time adaptive trading system using genetic programming. Quantitative Finance 1:397-413

Dempster M, Jones C Romahi Y, Thompson G (2001) Computational learning techniques for intraday fx trading using popular technical indicators. IEEE Transactions on Neural Networks 12(4):744-754

Harlow H (1991) Asset allocation in a downside-risk framework. Financial Analysts Journal pp. 30-40, September/October

Hellendoorn H, Thomas C (1993) Defuzzification in fuzzy controllers. Intelligent and Fuzzy Systems 1:109-123

Hellstrom T, Holmstrom K (1999) Parameter tuning in trading algorithms using asta. Computational Finance 1:343-357

Mamdani E (1976) Advances in linguistic synthesis of fuzzy controllers. International Journal of Man Machine Studies 8:669-678

Manderick B, Spiessens P (1989) Fine-grained parallel genetic algorithms. In Schaffer J (ed) Proceedings of the Third International Conference on Genetic Algorithms, San Mateo, CA, Morgan Kaufmann

Marney J, Fyfe C, Tarbert H, Miller D (2001) Risk-adjusted returns to technical trading rules: A genetic programming approach. Computing in Economics and Finance 147, Society for Computational Economics, Yale University, USA, June 2001

Mühlenbein H (1989) Parallel genetic algorithms, population genetics and combinatorial optimization. In Schaffer J (ed) Proceedings of the Third International Conference on Genetic Algorithms, pages 416-421, San Mateo, CA, Morgan Kaufmann

Murphy J (1999) Technical Analysis of the Financial Markets. New York Institute of Finance, New York

Neely C, Weller P, Dittmar R (1997) Is technical analysis in the foreign exchange market profitable? a genetic programming approach. Journal of Financial and Quantitative Analysis 32:405-26

Potvin J-Y, Soriano P, Vallée M (2004) Generating trading rules on the stock markets with genetic programming. Computers and Operations Research 31(7):1033-1047

Tettamanzi A, Poluzzi R, Rizzotto G (1996) An evolutionary algorithm for fuzzy controller synthesis and optimization based on SGS-Thomson's W.A.R.P. fuzzy processor. In ZadehL, Sanchez E, Shibata T (ed) Genetic algorithms and fuzzy logic systems: Soft computing perspectives. World Scientific, Singapore

Ross T (1995) Fuzzy Logic with Engineering Applications. McGraw-Hill, New York

Sharpe W (1994) The Sharpe ratio. Journal of Portfolio Management 21(1):49-58

Sortino F, van der Meer R (1991) Downside risk — capturing what's at stake in investment situations. Journal of Portfolio Management 17:27-31

Subramanian H, Ramamoorthy S, Stone P, Kuipers B (2006) Designing safe, profitable automated stock trading agents using evolutionary algorithms. In CattolicoM (ed) Proceedings of Genetic and Evolutionary Computation Conference, GECCO 2006, Seattle, Washington, USA, July 8-12, 2006, pp. 1777-1784, ACM

Tettamanzi A (1995) An evolutionary algorithm for fuzzy controller synthesis and optimization. IEEE International Conference on Systems, Man and Cybernetics, volume 5/5 pp. 4021-4026, IEEE Press

Tettamanzi A, Carlesi M, Pannese L, Santalmasi M (2007) Business intelligence for strategic marketing: Predictive modelling of customer behaviour using fuzzy logic and evolutionary algorithms. In Giacobini M et al. (ed) Applications of evolutionary computing: Evoworkshops2007, volume4448 of Lecture Notes in Computer Science, pp. 233-240, Valencia, Spain, April 11-13 2007, Springer

Whitley D, Rana S, Heckendorn R (1999) The island model genetic algorithm: On separability, population size and convergence. Journal of Computing and Information Technology 7(1):33-47

Wikipedia (2007) Technical analysis — wikipedia, the free encyclopedia. Online; accessed 5 June 2007

Yao X, Xu Y (2006) Recent advances in evolutionary computation. Computer Science and Technology 21(1):1-18

Yu T, Chen S-H, Kuo T-W (2006) Discovering financial technical trading rules using genetic programming with lambda abstraction. In: O'ReillyU-M, Yu T, RioloR, Worzel B, (ed) Genetic Programming Theory and Practice II. pp 11-30, Springer, Berlin

Zadeh L (1965) Fuzzy sets. Information and Control 8:338-353

Zadeh L (1975) The concept of a linguistic variable and its application to approximate reasoning, i-ii. Information Science 8:199-249 & 301-357

Zadeh L (1992) The calculus of fuzzy if-then rules. AI Expert 7(3):22-27

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2008 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

da Costa Pereira, C., Tettamanzi, A.G.B. (2008). Fuzzy-Evolutionary Modeling for Single-Position Day Trading. In: Brabazon, A., O’Neill, M. (eds) Natural Computing in Computational Finance. Studies in Computational Intelligence, vol 100. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-77477-8_8

Download citation

DOI: https://doi.org/10.1007/978-3-540-77477-8_8

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-77476-1

Online ISBN: 978-3-540-77477-8

eBook Packages: EngineeringEngineering (R0)