Abstract

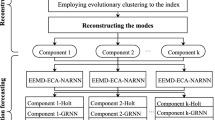

In this study, an empirical mode decomposition (EMD) based neural network ensemble learning model is proposed for world crude oil spot price modeling and forecasting. For this purpose, the original crude oil spot price series were first decomposed into a finite and often small number of intrinsic mode functions (IMFs). Then the three-layer feed-forward neural network (FNN) model was used to model each extracted IMFs so that the tendencies of these IMFs can be accurately predicted. Finally, the prediction results of each IMFs are combined with an adaptive linear neural network (ALNN) to formulate a ensemble output for the original oil series. For verification, two main crude oil price series, West Texas Intermediate (WTI) crude oil spot price and Brent crude oil spot price are used to test the effectiveness of this proposed neural network ensemble methodology.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Abosedra, S., Baghestani, H.: On the predictive accuracy of crude oil future prices. Energy Policy 32, 1389–1393 (2004)

Abramson, B., Finizza, A.: Using belief networks to forecast oil prices. International Journal of Forecasting 7(3), 299–315 (1991)

Abramson, B., Finizza, A.: Probabilistic forecasts from probabilistic models: a case study in the oil market. International Journal of Forecasting 11(1), 63–72 (1995)

Alvarez-Ramirez, J., Soriano, A., Cisneros, M., Suarez, R.: Symmetry/anti-symmetry phase transitions in crude oil markets. Physica A 322, 583–596 (2003)

Barone-Adesi, G., Bourgoin, F., Giannopoulos, K.: Don’t look back. Risk August 8, 100–103 (1998)

Hagan, M.T., Demuth, H.B., Beale, M.H.: Neural Network Design. PWS Publishing Company, Boston (1996)

Hagen, R.: How is the international price of a particular crude determined? OPEC Review 18(1), 145–158 (1994)

Hornik, K., Stinchocombe, M., White, H.: Multilayer feedforward networks are universal approximators. Neural Networks 2, 359–366 (1989)

Huang, N.E., Shen, Z., Long, S.R.: A new view of nonlinear water waves: The Hilbert spectrum. Annual Review of Fluid Mechanics 31, 417–457 (1999)

Huang, N.E., Shen, Z., Long, S.R., Wu, M.C., Shih, H.H., Zheng, Q., Yen, N.C., Tung, C.C., Liu, H.H.: The empirical mode decomposition and the Hilbert spectrum for nonlinear and nonstationary time series analysis. Proceedings of the Royal Society A: Mathematical, Physical & Engineering Sciences 454, 903–995 (1998)

Huntington, H.G.: Oil price forecasting in the 1980s: What went wrong? The Energy Journal 15(2), 1–22 (1994)

Maurice, J.: Summary of the oil price. Research Report, La Documentation Francaise (1994), http://www.agiweb.org/gap/legis106/oil_price.html

Morana, C.: A semiparametric approach to short-term oil price forecasting. Energy Economics 23(3), 325–338 (2001)

Nelson, Y., Stoner, S., Gemis, G., Nix, H.D.: Results of Delphi VIII survey of oil price forecasts. Energy report, California Energy Commission (1994)

Stevens, P.: The determination of oil prices 1945-1995. Energy Policy 23(10), 861–870 (1995)

Verleger, P.K.: Adjusting to volatile energy prices. Working paper, Institute for International Economics, Washington DC (1993)

Wang, S.Y., Yu, L., Lai, K.K.: Crude oil price forecasting with TEI@I methodology. Journal of Systems Sciences and Complexity 18(2), 145–166 (2005)

Watkins, G.C., Plourde, A.: How volatile are crude oil prices? OPEC Review 18(4), 220–245 (1994)

White, H.: Connectionist nonparametric regression: Multilayer feedforward networks can learn arbitrary mappings. Neural Networks 3, 535–549 (1990)

Xie, W., Yu, L., Xu, S.Y., Wang, S.Y.: A new method for crude oil price forecasting based on support vector machines. In: Alexandrov, V.N., van Albada, G.D., Sloot, P.M.A., Dongarra, J. (eds.) ICCS 2006. LNCS, vol. 3994, pp. 441–451. Springer, Heidelberg (2006)

Yu, L., Wang, S.Y., Lai, K.K.: A novel nonlinear ensemble forecasting model incorporating GLAR and ANN for foreign exchange rates. Computers and Operations Research 32(10), 2523–2541 (2005)

Author information

Authors and Affiliations

Editor information

Rights and permissions

Copyright information

© 2008 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Yu, L., Wang, S., Lai, K.K. (2008). An EMD-Based Neural Network Ensemble Learning Model for World Crude Oil Spot Price Forecasting. In: Prasad, B. (eds) Soft Computing Applications in Business. Studies in Fuzziness and Soft Computing, vol 230. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-79005-1_14

Download citation

DOI: https://doi.org/10.1007/978-3-540-79005-1_14

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-79004-4

Online ISBN: 978-3-540-79005-1

eBook Packages: EngineeringEngineering (R0)