Abstract

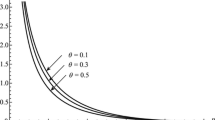

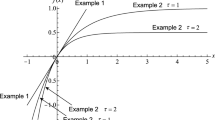

A perception-based portfolio model under uncertainty is discussed. In the proposed model, randomness and fuzziness are evaluated respectively by the probabilistic expectation and the mean values with evaluation weights and λ-mean functions. The means, the variances and the covariances fuzzy numbers/fuzzy random variables are evaluated in the possibility case and the necessity case, and the rate of return with portfolios is estimated by the both random factors and imprecise factors. In the portfolio model, the average rate of falling is minimized using average value-at-risks as a coherent risk measure. By analytical approach, we derive a solution of the portfolio problem to minimize the average rate of falling. A numerical example is given to illustrate our idea.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Mathematical Finance 9, 203–228 (1999)

Campos, L., Munoz, A.: A subjective approach for ranking fuzzy numbers. Fuzzy Sets and Systems 29, 145–153 (1989)

El Chaoui, L., Oks, M., Oustry, F.: Worst-case value at risk and robust portfolio optimization: A conic programming approach. Operations Research 51, 543–556 (2003)

Fortemps, P., Roubens, M.: Ranking and defuzzification methods based on area compensation. Fuzzy Sets and Systems 82, 319–330 (1996)

Inuiguchi, M., Tanino, T.: Portfolio selection under independent possibilistic information. Fuzzy Sets and Systems 115, 83–92 (2000)

Jorion, P.: Value at Risk: The New Benchmark for Managing Financial Risk, 3rd edn. McGraw-Hill, New York (2007)

Kruse, R., Meyer, K.D.: Statistics with Vague Data. Riedel Publ. Co., Dortrecht (1987)

Kwakernaak, H.: Fuzzy random variables – I. Definitions and theorem. Inform. Sci. 15, 1–29 (1978)

Markowitz, H.: Mean-Variance Analysis in Portfolio Choice and Capital Markets. Blackwell, Oxford (1990)

Pliska, S.R.: Introduction to Mathematical Finance: Discrete-Time Models. Blackwell Publ., New York (1997)

Puri, M.L., Ralescu, D.A.: Fuzzy random variables. J. Math. Anal. Appl. 114, 409–422 (1986)

Rockafellar, R.T., Uryasev, S.P.: Optimization of conditional value-at-risk. Journal of Risk 2, 21–42 (2000)

Steinbach, M.C.: Markowitz revisited: Mean-variance model in financial portfolio analysis. SIAM Review 43, 31–85 (2001)

Tanaka, H., Guo, P., Türksen, L.B.: Portfolio selection based on fuzzy probabilities and possibilistic distribution. Fuzzy Sets and Systems 111, 397 (2000)

Yoshida, Y.: Mean values, measurement of fuzziness and variance of fuzzy random variables for fuzzy optimization. In: Proceedings of SCIS & ISIS 2006, September 2006, pp. 2277–2282 (2006)

Yoshida, Y.: A risk-minimizing model under uncertainty in portfolio. In: Melin, P., Castillo, O., Aguilar, L.T., Kacprzyk, J., Pedrycz, W. (eds.) IFSA 2007. LNCS (LNAI), vol. 4529, pp. 381–391. Springer, Heidelberg (2007)

Yoshida, Y.: Fuzzy extension of estimations with randomness: The perception-based approach. In: Torra, V., Narukawa, Y., Yoshida, Y. (eds.) MDAI 2007. LNCS (LNAI), vol. 4617, pp. 295–306. Springer, Heidelberg (2007)

Yoshida, Y.: An estimation model of value-at-risk portfolio under uncertainty. Fuzzy Sets and Systems (to appear) doi:10.1016/j.fss2009.02.007

Zmeškal, Z.: Value at risk methodology of international index portfolio under soft conditions (fuzzy-stochastic approach). International Review of Financial Analysis 14, 263–275 (2005)

Zadeh, L.A.: Fuzzy sets. Inform. and Control 8, 338–353 (1965)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2009 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Yoshida, Y. (2009). A Perception-Based Portfolio Under Uncertainty: Minimization of Average Rates of Falling. In: Torra, V., Narukawa, Y., Inuiguchi, M. (eds) Modeling Decisions for Artificial Intelligence. MDAI 2009. Lecture Notes in Computer Science(), vol 5861. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-04820-3_14

Download citation

DOI: https://doi.org/10.1007/978-3-642-04820-3_14

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-04819-7

Online ISBN: 978-3-642-04820-3

eBook Packages: Computer ScienceComputer Science (R0)