Abstract

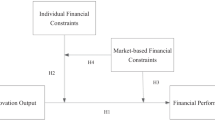

This paper uses a large and original data set of Catalan firms in all the economic branches to analyse the effects of size, industry and degree of ICT uses on financial constraints for innovative firms. We have conducted a micro econometric analysis following Henry et al. (1999) investment model to empirically contrast the relationship between firms’ investment spread over time and their financial structure, and we have used von Kalckreuth (2004) methodology, based on an original survey with data on financial issues. Our results show that it exits a positive and significant relationship between investment shift and financial structure, emerging financial constraints for more innovative firms. Furthermore, these constraints are higher for micro companies and firms within the knowledge-advanced services’ industry. Finally, we have also found that advanced ICT uses by more innovative firms allow them to reduce constraints of access to sources of finance.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aghion, P., Bond, S., Klemm, A., Marinescu, I.: Technology and Financial Structure: Are Innovative Firms Different?. Paper presented at the 6th Bundesbank Spring Conference Financing Innovation, Eltville, Germany, April 30 – May 1 (2004)

Arrow, K.J.: Economic welfare and the allocation of resources for invention. In: Nelson, R.R. (ed.) The Rate and Direction of Invention Activity: Economic and Social Factors. Princeton University Press, Princeton (1962)

Bond, S., Elston, J.A., Mairesse, J., Mulkay, B.: Financial Factors and Investment in Belgium, France, Germany and the United Kingdom: A Comparison Using Company Panel Data. The Review of Economics and Statistics 85, 153–165 (2003)

Bond, S., Harhoff, D., van Reenen, J.: Investment, Financial Constraints and R&D in Britain and Germany. In: Working Paper W99/05. The Institute for Fiscal Studies, London (1999)

Brealy, R., Myers, S.: Principles of Corporate Finance. McGraw-Hill, Irwin (2003)

Bresnahan, T.F., Brynjolfsson, E., Hitt, L.M.: Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-level Evidence. Quarterly Journal of Economics 117(1), 339–376 (2002)

Chirinko, R.S., von Kalckreuth, U.: Further Evidence on the Relationship between Firm Investment and Financial Status. Discussion Paper 28/02. Economic Research Centre of the Deutsche Bank (November 2002)

Chirinko, R.S., von Kalckreuth, U.: On the German Monetary Transmission Mechanism: Interest Rate and Credit Channel for Investment Spending. In: CESifo Working Paper 838 (January 2003)

Fazzari, S.M., Hubbard, R.G., Petersen, B.C.: Financing Constraints and Corporate Investment. Brookings Papers on Economic Activity 1, 141–206 (1988)

Goodacre, A., Tonks, I.: Finance and Technological Change. In: Handbook of the Economics of Innovation and Technological Change, pp. 298–341. P. Stoneman. Blackwell Handbooks in Economics, Oxford (1995)

Hart, O.: Firms, Contracts and Financial Structure. Oxford University Press, Oxford (1995)

Henry, B., Sentance, A., Urga, G.: Finance, profitability and investment in manufacturing. In: Driver, C., Temple, P. (eds.) Investment, Growth and Employment. Perspectives for policy, pp. 29–50. Routledge, London (1999)

Holmstrom, B., Ricart i Costa, J.E.: Managerial incentives and capital management. Quarterly Journal of Economics, 835–860 (November 1986)

Holmstrom, B., Weiss, L.: Managerial incentives, investment and aggregate implications: scale effects. Review of Economic Studies 52, 403–425 (1985)

Innovation Advisory Board. Innovation: City Attitudes and Practice. Department of Trade and Industry (1990)

Laffont, J.J., Maskin, E.: The theory of incentives: an overview. In: Hildenbrand, W. (ed.) Advances in Economic Theory, pp. 31–94. Cambridge University Press, Cambridge (1980)

Miller, M.H., Rock, K.: Dividend policy under asymmetric information. Journal of Finance 40, 1031–1051 (1985)

Modiglliani, F., Miller, M.H.: The cost of capital, corporation finance and the theory of investment. American Economic Review 48, 261–297 (1958)

Myers, S.C.: The capital structure puzzle. Journal of Finance 39, 575–592 (1984)

Myers, S.C., Majluf, N.S.: Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13, 187–221 (1984)

Ricart i Costa, J.E.: On managerial contracting with asymmetric information. European Economic Review 33(9), 1805–1830 (1989)

Stein, J.C.: Efficient capital markets, inefficient firms: a model of myopic corporate behaviour. Quarterly Journal of Economics, 656–669 (November 1989)

Von Kalckreuth, U.: Investment and Monetary Transmission in Germany: A Microeconometric Investigation. In: Angeloni, I., Kashyap, A., Mojon, B. (eds.) Monetary Policy Transmission in the Euro Area. Cambridge University Press, Cambridge (2003)

Von Kalckreuth, U.: Financial constraints for investors and the speed of adaptation: Are innovators special? Deutsche Bundesbank Discussion Papers. Series 1: Studies of the Economic Research Centre. Nº 20/2004 (2004)

Von Kalckreuth, U.: Financial Constraints and Capacity Adjustment: Evidence from a Large Panel of Survey Data. Economica 73, 691–724 (2006)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2010 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Castillo-Merino, D., Vilaseca-Requena, J., Plana-Erta, D. (2010). Financial Constrains for Innovative Firms: The Role of Size, Industry and ICT Uses as Determinants of Firms’ Financial Structure. In: Lytras, M.D., Ordonez de Pablos, P., Ziderman, A., Roulstone, A., Maurer, H., Imber, J.B. (eds) Organizational, Business, and Technological Aspects of the Knowledge Society. WSKS 2010. Communications in Computer and Information Science, vol 112. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-16324-1_5

Download citation

DOI: https://doi.org/10.1007/978-3-642-16324-1_5

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-16323-4

Online ISBN: 978-3-642-16324-1

eBook Packages: Computer ScienceComputer Science (R0)