Abstract

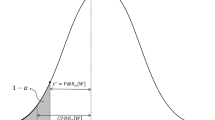

A mathematical dynamic portfolio allocation model with uncertainty is discussed. Introducing a value-at-risk under a condition, this paper formulates value-at-risks in a dynamic stochastic environment. By dynamic programming approach, an optimality condition of the optimal portfolio for dynamic value-at-risks is derived. It is shown that the optimal time-average value-at-risk is a solution of the optimality equation under a reasonable assumption, and an optimal trading strategy is obtained from the equation. A numerical example is given to illustrate our idea.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Mathematical Finance 9, 203–228 (1999)

Boot, J.C.G.: Quadratic Programming. North-Holland, Amsterdam (1964)

El Chaoui, L., Oks, M., Oustry, F.: Worst-case value at risk and robust portfolio optimization: A conic programming approach. Operations Research 51, 543–556 (2003)

Gaivoronski, A., Pflug, G.C.: Value-at-risk in portfolio optimization: Properties and computational approach. Journal of Risk 7(2), 1–31 (2005)

Jorion, P.: Value at Risk: The New Benchmark for Managing Financial Risk, 3rd edn. McGraw-Hill, New York (2007)

Korn, R., Korn, E.: Options Pricing and Portfolio Optimization Modern Models of Financial Mathematics. Amer. Math. Soc. (2001)

Kumar, P.R., Ravi, V.: Bankruptcy prediction in banks and firms via statistical and intelligent techniques - A review. European J. Oper. Res. 180, 1–28 (2007)

Kusuoka, S.: On law-invariant coherent risk measures. Advances in Mathematical Economics 3, 83–95 (2001)

Markowitz, H.: Mean-Variance Analysis in Portfolio Choice and Capital Markets. Blackwell, Oxford (1990)

Merton, R.C.: Lifetime portfolio selection under uncertainty: The continuous case. Reviews of Economical Statistics 51, 247–257 (1969)

Meucci, A.: Risk and Asset Allocation. Springer, Heidelberg (2005)

Pliska, S.R.: Introduction to Mathematical Finance: Discrete-Time Models. Blackwell Publ., New York (1997)

Rockafellar, R.T., Uryasev, S.P.: Optimization of conditional value-at-risk. Journal of Risk 2, 21–42 (2000)

Ross, S.M.: An Introduction to Mathematical Finance. Cambridge Univ. Press, Cambridge (1999)

Steinbach, M.C.: Markowitz revisited: Mean-variance model in financial portfolio analysis. SIAM Review 43, 31–85 (2001)

Tasche, D.: Expected shortfall and beyond. Journal of Banking Finance 26, 1519–1533 (2002)

Yoshida, Y.: The valuation of European options in uncertain environment. European J. Oper. Res. 145, 221–229 (2003)

Yoshida, Y.: A discrete-time model of American put option in an uncertain environment. European J. Oper. Res. 151, 153–166 (2003)

Yoshida, Y., Yasuda, M., Nakagami, J., Kurano, M.: A discrete-time portfolio selection with uncertainty of stock prices. In: De Baets, B., Kaynak, O., Bilgiç, T. (eds.) IFSA 2003. LNCS (LNAI), vol. 2715, pp. 245–252. Springer, Heidelberg (2003)

Yoshida, Y.: An estimation model of value-at-risk portfolio under uncertainty. Fuzzy Sets and Systems 160, 3250–3262 (2009)

Yoshida, Y.: A perception-based portfolio under uncertainty: Minimization of average rates of falling. In: Torra, V., Narukawa, Y., Inuiguchi, M. (eds.) MDAI 2009. LNCS (LNAI), vol. 5861, pp. 149–160. Springer, Heidelberg (2009)

Yoshida, Y.: An average value-at-risk portfolio model under uncertainty: A perception-based approach by fuzzy random variables. Journal of Advanced Computational Intelligence and Intelligent Informatics 15, 56–62 (2011)

Zmeškal, Z.: Value at risk methodology of international index portfolio under soft conditions (fuzzy-stochastic approach). International Review of Financial Analysis 14, 263–275 (2005)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2011 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Yoshida, Y. (2011). A Dynamic Value-at-Risk Portfolio Model. In: Torra, V., Narakawa, Y., Yin, J., Long, J. (eds) Modeling Decision for Artificial Intelligence. MDAI 2011. Lecture Notes in Computer Science(), vol 6820. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-22589-5_6

Download citation

DOI: https://doi.org/10.1007/978-3-642-22589-5_6

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-22588-8

Online ISBN: 978-3-642-22589-5

eBook Packages: Computer ScienceComputer Science (R0)