Abstract

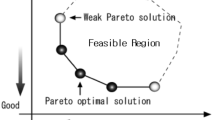

Nowadays, there are two types of financial analysis oriented to design trading systems: fundamental and technical. Fundamental analysis consists in the study of all information (both financial and nonfinancial) available on the market, with the aim of carrying out efficient investments. By contrast, technical analysis works under the assumption that when we analyze the price action in a specific market, we are (indirectly) analyzing all the factors related to the market. In this paper we propose the use of an Evolutionary Algorithm to optimize the parameters of a trading system which combines Fundamental and Technical analysis (indicators). The algorithm takes advantage of a new operator called Filling Operator which avoids problems of premature convergence and reduce the number of evaluations needed. The experimental results are promising, since when the methodology is applied to values of 100 companies in a year, they show a possible return of 830% compared with a 180% of the Buy and Hold strategy.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Allen, F., Karjalainen, R.: Using genetic algorithms to find technical trading rules. Journal of Financial Economics 51(2), 245–271 (1999)

Bali, T.G., Demirtas, O., Tehranian, H.: Aggregate earnings, firm-level earnings, and expected stock returns. JFQA 43(3), 657–684 (2008)

Basu, S.: The investment performance of common stocks in relation to their price-earnings ratios: A test of the efficient market hypothesis. Journal of Finance 32, 663–682 (1977)

Bodas-Sagi, D.J., Fernández, P., Hidalgo, J.I., Soltero, F.J., Risco-Martín, J.L.: Multiobjective optimization of technical market indicators. In: Proceedings of the GECCO 2009 Conference (Companion), pp. 1999–2004. ACM, New York (2009)

Campbell, Yogo: Efficient tests of stock return predictability. Journal of Financial Economics 81, 27–60 (2006)

Chan, L.K.C., Hamao, Y., Lakonishok, R.: Journal of finance. Fundamentals and Stock Returns in Japan, 1739–1764 (December 1991)

Contreras, I., Jiang, Y., Hidalgo, J., Núñez-Letamendia, L.: Using a gpu-cpu architecture to speed up a ga-based real-time system for trading the stock market. In: Soft Computing - A Fusion of Foundations, Methodologies and Applications, pp. 1–13 (2011)

Fama, E., French: The cross-section of expected stock returns. Journal of Finance 47(2), 427–465 (1992)

Fama, E.F., French, K.R.: Business conditions and expected returns on stocks and bonds. Journal of Financial Economics 25, 23–49 (1989)

Fernández, P., Bodas-Sagi, D.J., Soltero, F.J., Hidalgo, J.I.: Technical market indicators optimization using evolutionary algorithms. In: Proceedings of the GECCO 2008 Conference (Companion), pp. 1851–1858. ACM, New York (2008)

Jiang, Y., Núñez, L.: Efficient market hypothesis or adaptive market hypothesis? a test with the combination of technical and fundamental analysis. In: Proceedings of the 15th International Conference on Computing in Economics and Finance, University of Technology, Sydney, Australia, The Society for Computational Economics (July 2009)

Lohpetch, D., Corne, D.: Discovering effective technical trading rules with genetic programming: Towards robustly outperforming buy-and-hold. In: NaBIC, pp. 439–444. IEEE (2009)

Lohpetch, D., Corne, D.: Multiobjective algorithms for financial trading: Multiobjective out-trades single-objective. In: IEEE Congress on Evolutionary Computation, pp. 192–199. IEEE (2011)

Núñez, L.: Trading systems designed by genetic algorithms. Managerial Finance 28, 87–106 (2002)

Reinganum, M.: Selecting superior securities charlottesville. the tesearch foundation of the institute of chartered financial analysts. Technical report, The Research foundation of the institute of Chartered Financial Analysts (1988)

Sywerda, G.: Uniform crossover in genetic algorithms. In: Proceedings of the Third International Conference on Genetic Algorithms, pp. 2–9. Morgan Kaufmann Publishers Inc., San Francisco (1989)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2012 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Contreras, I., Hidalgo, J.I., Núñez-Letamendia, L. (2012). A GA Combining Technical and Fundamental Analysis for Trading the Stock Market. In: Di Chio, C., et al. Applications of Evolutionary Computation. EvoApplications 2012. Lecture Notes in Computer Science, vol 7248. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-29178-4_18

Download citation

DOI: https://doi.org/10.1007/978-3-642-29178-4_18

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-29177-7

Online ISBN: 978-3-642-29178-4

eBook Packages: Computer ScienceComputer Science (R0)