Abstract

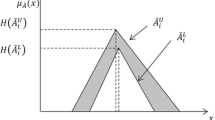

This paper presents an alternative approach to capital budgeting, named fuzzy modified net present value (fuzzy MNPV) method, for evaluation of investment projects under uncertainty. Triangular fuzzy numbers are used to represent uncertainty of cash flows and of reinvestment, financing and risk-adjusted discount rates. Due to the complexity of the calculations involved, a new financial function for MS-Excel has been developed (MNPVfuzzy). To illustrate the use of the model and of the function, numerical examples are supplied. Results show that the proposed method is more advantageous and simpler to use than other methods for evaluation of investment under uncertainty.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Graham, J.R., Harvey, C.R.: The Theory and Practice of Corporate Finance: Evidence from the Field. Journal of Financial Economics 60, 187–243 (2001)

Plath, D.A., Kennedy, W.F.: Teaching Return-Based Measures of Project Evaluation. Financial Practice & Education 4, 77–86 (1994)

Biondi, Y.: The Double Emergence of the Modified Internal Rate of Return: The Neglected Financial Work of Duvillard (1755-1832) in a Comparative Perspective. European Journal of the History of Economic Thought 13, 311–335 (2006)

Kierulff, H.: MIRR: A Better Measure. Business Horizons 51, 321–329 (2008)

McClure, K.G., Girma, P.B.: Modified Net Present Value (MNPV): A New Technique for Capital Budgeting. Zagreb International Review of Economics and Business 7, 67–82 (2004)

Chandra, P.: Projects: Planning, Analysis, Selection, Financing, Implementation, and Review, 7th edn. Tata McGraw-Hill, New Delhi (2009)

Solomon, E.: The Arithmetic of Capital-Budgeting Decisions. The Journal of Business 29(2), 124–129 (1956)

Zadeh, L.A.: Fuzzy Sets. Information and Control 8, 338–353 (1965)

Kahraman, C. (ed.): Fuzzy Engineering Economics with Applications. Springer, Heidelberg (2008)

Ulukan, Z., Ucuncuoglu, C.: Economic Analyses for the Evaluation of IS Projects. Journal of Information Systems and Technology Management 7(2), 233–260 (2010)

Gutiérrez, I.: Fuzzy Numbers and Net Present Value. Scandinavian Journal of Management 5, 149–159 (1989)

Chiu, C.Y., Park, C.S.: Fuzzy Cash Flow Analysis Using Present Worth Criterion. The Engineering Economist 39(2), 113–137 (1994)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2012 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Sampaio Filho, A.C., Vellasco, M., Tanscheit, R. (2012). Modified Net Present Value under Uncertainties: An Approach Based on Fuzzy Numbers and Interval Arithmetic. In: Greco, S., Bouchon-Meunier, B., Coletti, G., Fedrizzi, M., Matarazzo, B., Yager, R.R. (eds) Advances in Computational Intelligence. IPMU 2012. Communications in Computer and Information Science, vol 300. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-31724-8_2

Download citation

DOI: https://doi.org/10.1007/978-3-642-31724-8_2

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-31723-1

Online ISBN: 978-3-642-31724-8

eBook Packages: Computer ScienceComputer Science (R0)