Abstract

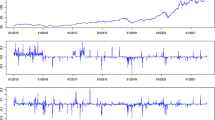

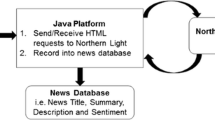

This paper explores the relation between the sentiment of the media and IPOs underpricing which means whether the media were responsible for the phenomenal rise and fall in the market value of IPOs shares from 2010 to 2014. We focus on the effect of pre-IPOs media on the first day’s return and we use sentiment analysis to calculate the media sentiment and use the sentimental words to classify the news. We found that the sentiment of media is significantly related to initial return. This paper also indicates significantly results that initial return is related to market return than sentiment of media in non-electronics industry. Furthermore, as our expected, the number of positive (negative) news has a positive (negative) influence on the initial return in the electronics industry.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

- 2.

Knowledge Management Winner, http://kmw.chinatimes.com/.

- 3.

Biotechnology & medical care, optoelectronic, electronic parts & components, semiconductor, communications & Internet, electric machinery, electronics & peripheral equipment, information service, tourism, other electronic, trading and consumers’ goods, shipping & transportation, chemical, cultural & creative, textiles, building material & construction, plastics, electrical & cable, iron & steel, automobile, glass & ceramics, foods, electronic products distribution, other.

- 4.

News that is considered to have a positive (negative) impact on IPO firms. News is considered to have a trivial impact is classified as neutral news.

- 5.

Electronics: 106 and Non-electronics: 133.

- 6.

TW1: pre-IPO period, TW2: one month prior to the issue day.

References

Allen, F., Faulhaber, G.R.: Signaling by underpricing in the IPO Market. J. Financ. Econ. 23(2), 303–323 (1989)

Arbel, A., Strebel, P.: Pay attention to neglected firms!*. J. Portfolio Manag. 9(2), 37–42 (1983)

Azar, P.D.: Sentiment Analysis in Financial News, Harvard University (2009)

Baker, M., Stein, J.C., Wurgler, J.: When does the market matter? stock prices and the investment of equity-dependent firms. Q. J. Econ. 118(3), 969–1005 (2002)

Barber, B.M., Odean, T.: All that glitters: the effect of attention and news on the buying behavior of individual and institutional investors. Rev. Financ. Stud. 21(2), 785–818 (2008)

Baron, D.P.: A model of the demand for investment banking advising and distribution services for new issues. J. Finan. 37(4), 955–976 (1982)

Bautin, M., Vijayarenu, L., Skiena, S.: International sentiment analysis for news and blogs. In: Proceedings of the International Conference on Weblogs and Social Media (2008)

Beatty, R.P., Ritter, J.R.: Investment banking, reputation, and the underpricing of initial public offerings. J. Finan. Econ. 15(1), 213–232 (1986)

Benveniste, L.M., Spindt, P.A.: How investment bankers determine the offer price and allocation of new issues. J. Financ. Econ. 24(2), 343–361 (1989)

Benveniste, L.M., Wilhelm, W.J.: A comparative analysis of IPO proceeds under alternative regulatory environments. J. Financ. Econ. 28(1), 173–207 (1990)

Cook, D.O., Kieschnick, R., Van Ness, R.A.: On the marketing of IPOs. J. Financ. Econ. 82(1), 35–61 (2006)

Davis, A.K., Piger, J.M., Sedor, L.M.: Beyond the Numbers: An Analysis of Optimistic and Pessimistic Language in Earnings Press Releases (2006)

Degeorge, F., Derrien, F., Womack, K.L.: Quid Pro Quo in IPOs: Why Book-Building is Dominating Auctions (2004)

Derrien, F.: IPO pricing in “Hot” market conditions: Who leaves money on the table? J. Finan. 60(1), 487–521 (2005)

Frieder, L., Subrahmanyam, A.: Brand perceptions and the market for common stock. J. Finan. Quant. Anal. 40(1), 57–85 (2005)

Godbole, N., Srinivasaiah, M., Skiena, S.: Large-scale sentiment analysis for news and blogs. In: International Conference on Weblogs and Social Media (ICWSM 2007), Denver CO, 26-28 March 2007 (2007)

Grinblatt, M., Hwang, C.Y.: Signalling and the pricing of new issues. J. Finan. 44(2), 393–420 (1989)

Henry, E.: Are investors influenced by how earnings press releases are written? J. Bus. Commun. 45(4), 363–407 (2008)

Lin, I.H., Chen, K.T.: Creating and Verifying Sentiment Dictionary of Finance and Economics via Financial News (2013)

Liu, L.X., Sherman, A.E., Zhang, Y.: Media Coverage and IPO Underpricing (2009)

Ljungqvist, A., Nanda, V., Singh, R.: Hot markets, investor sentiment, and IPO pricing. J. Bus. 79(4), 1667–1702 (2006)

Logue, D.E.: On the pricing of unseasoned equity issues: 1965–1969. J. Finan. Quant. Anal. 8(1), 91–103 (1973)

Lowry, M., Schwert, G.W.: Is the IPO pricing process efficient? J. Finan. Econ. 71(1), 3–26 (2004)

Miller, G.A., Beckwith, R., Fellbum, C., Gross, D., Miller, K.J.: Introduction to WordNet: an On-line lexical database. Int. J. Lexicography 3(4), 235–312 (1990)

Morck, R., Yeung, B., Yu, W.: The information content of stock markets: Why do emerging markets have synchronous stock price movements? J. Finan. Econ. 58(1), 215–260 (2000)

Nasukawa, T., Yi, J.: Sentiment analysis: Capturing favorability using natural language processing. In: Proceedings of the 2nd International Conference on Knowledge Capture, pp. 70–77 (2003)

Neal, R., Wheatley, S.M.: Do measures of investor sentiment predict returns? J. Finan. Quant. Anal. 33(4), 523–547 (1998)

Rock, K.: Why new issues are underpriced. J. Finan. Econ. 15(1–2), 187–212 (1986)

Sherman, A.E., Titman, S.: Building the IPO order book: underpricing and participation limits with costly information. J. Finan. Econ. 65(1), 3–29 (2002)

Tetlock, P.C.: Giving content to investor sentiment: the role of media in the stock market. J. Finan. 62(3), 1139–1168 (2007)

Trauten, A., Langer, T.: Information production and bidding in IPOs: an experimental analysis of auctions and fixed-price offerings. Zeitschrift für Betriebswirtschaft 82(4), 361–388 (2012)

Welch, I.: Seasoned offerings, imitation costs, and the underpricing of initial public offerings. J. Finan. 44(2), 421–449 (1989)

Yi, J., Nasukawa, T., Bunescu, R., Niblack, W.: Sentiment analyzer: extracting sentiments about a given topic using natural language processing techniques. In: Third IEEE International Conference on Data Mining (ICDM), pp. 427–434 (2003)

Acknowledgement

This research is supported by NSC 102-2627-E-004 -001, MOST 103-2627-E-004 -001, MOST 104-2627-E-004-001.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Seng, JL., Yang, PH., Yang, HF. (2016). IPO and Financial News. In: Nguyen, N.T., Trawiński, B., Fujita, H., Hong, TP. (eds) Intelligent Information and Database Systems. ACIIDS 2016. Lecture Notes in Computer Science(), vol 9622. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-49390-8_34

Download citation

DOI: https://doi.org/10.1007/978-3-662-49390-8_34

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-49389-2

Online ISBN: 978-3-662-49390-8

eBook Packages: Computer ScienceComputer Science (R0)